CGD has been following Advanced Market Commitment (AMC) for vaccines for a while now: from its groundwork in the CGD report Making Markets for Vaccines, to its launch and the delivery of its first vaccines in 2010 (GAVI also offers a nice timeline of events here). This innovative financing mechanism aims to increase investment in vaccines for use in lower-middle income countries (LMIC)by guaranteeing a market for appropriate health products and services, reducing unpredictability or volatility that can discourage private investment, and increasing competition and innovation between companies and organizations (read more here).

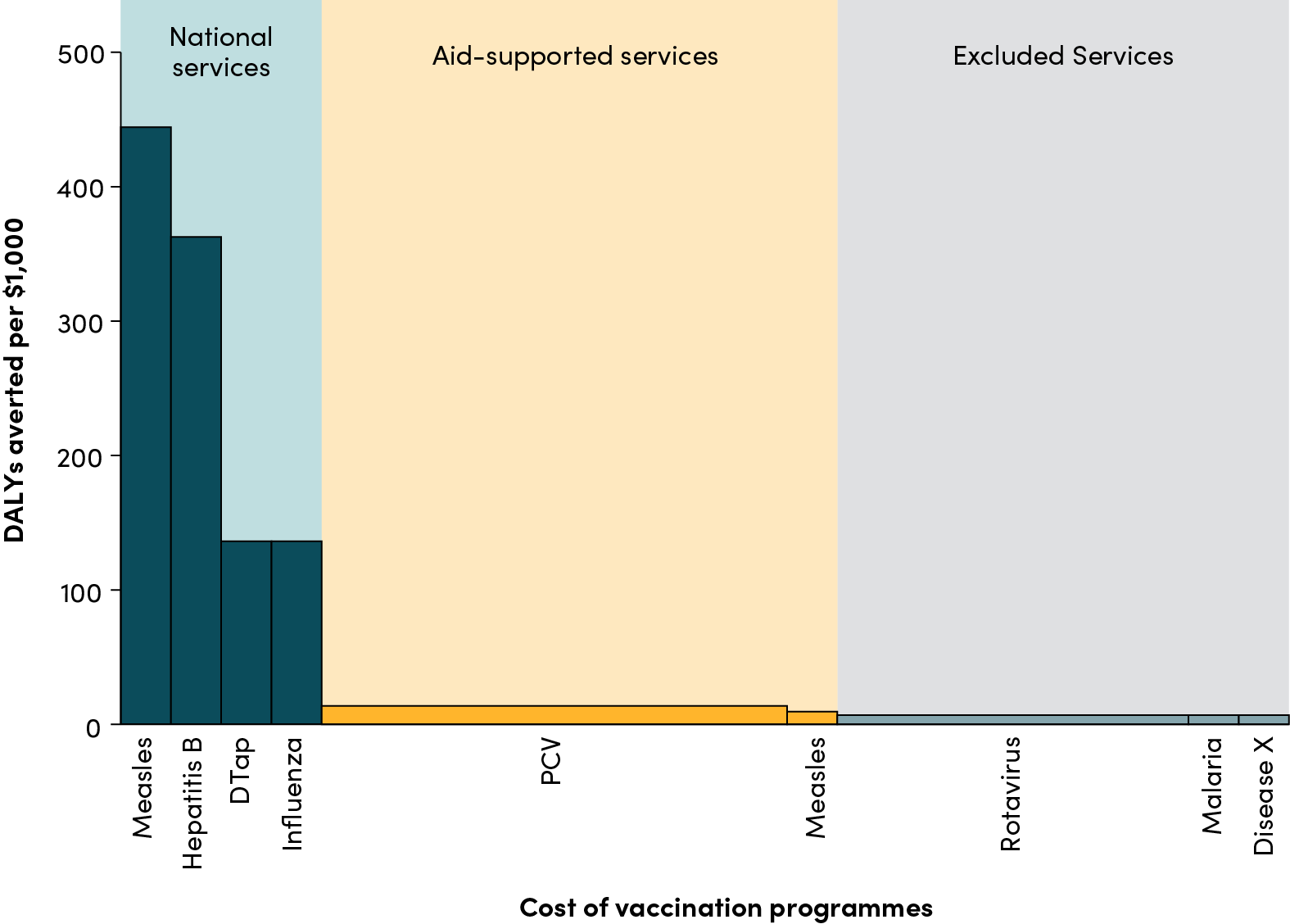

The pilot AMC -- launched in 2009 -- incentivized the development of pneumococcal vaccines (PNV) and attracted 1.5 billion in commitments from a variety of donors. Since then, both GlaxoSmithKline and Pfizer have produced PNV at the $3.50/dose cost threshold established, and the vaccine has since been rolled out in 25 countries. But was the $3.50/dose threshold the right place to draw the line? A recent evaluation from Dalberg (contracted by the GAVI Alliance) sought to answer this question among others.

There have been a few previous evaluations of the AMC, but this most recent evaluation of the pneumococcal AMC focuses on the AMC’s strategic decision making processes and how well the pilot fulfilled its objectives to accelerate the development of pneumococcal vaccines and increase their availability and affordability. The methodology of the report included interviews, data analysis, and secondary research and built on previous models—however, the Dalberg report does note a lack of suitable counterfactuals or control scenarios with which to compare the AMC.

In particular, the report explores the processes for determining prices for vaccines funded by the AMC, which is is one of the most difficult steps in the design process. For the PNV pilot, AMC designers established the price ceiling to maximize the number of existing or potential PNV manufacturer participants. Participating pharmaceutical companies obtained an estimated internal rate of return between 10-20%, suggesting that the target price point did provide a sufficient incentive. But not all PNV manufacturers participated, and generally higher cost firms opted out. Thus, lower cost vaccine manufactures might have made similar returns without the AMC subsidy, but whether the demand component would have been the same without the AMC momentum isn’t clear. Also, while other bidders are set to enter the market with potentially lower prices, the interviews that informed the report suggested that new entrants won’t join until 2017, at which point more than two-thirds of the AMC-funded PNV will have already been purchased and delivered.

Another key takeaway from the report is that GAVI’s “learning by doing” strategy, which allowed for the AMC experiment, was successful in pioneering a route for other AMCs. The authors recommend that future AMCs be developed in an iterative process, “intentionally build[ing] flexibility and space for iteration into the design and implementation processes,” including predetermined checks (such as revaluations prompted by price estimates, country co-payments reaching particular levels, or manufacturer interest), and reviews of baseline assumptions. While adjustments should only be marginal—reducing volatility is one of the main attractions of the AMC—self-feedback loops might increase buy-in from stakeholders while maintaining the credibility of commitments.

Getting the price right on AMCs is a delicate balance, but the lessons learned from the PNV AMC will be instrumental in informing the design of future efforts. What’s next? Malaria? Climate Change?

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.