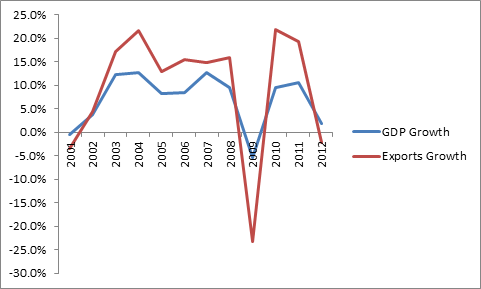

When the financial crisis hit in 2008, many people feared that countries would respond as they had during the Great Depression and restrict imports. And as shown in the chart below, trade plunged even more deeply than economic output, but then it rebounded just as quickly. It seemed the system built after World War II to avoid beggar-thy-neighbor trade policies had worked pretty well. Certainly there was nothing like the Smoot-Hawley tariff bill of 1930 that raised the average US tariff by a third — to almost 60 percent! But more recently, trade growth slowed dramatically again and the question is why?

Protectionist measures are creeping up…

Simon Evenett, founder and coordinator of the Global Trade Alert (GTA) project, thinks we should not be too sanguine that the world avoided broad, new across-the-board trade barriers. The project monitors and reports on trade measures around the world, classifying them into those that are liberalizing and those that are discriminatory (and likely to harm other countries). In the project’s latest report, titled “The Global Trade Disorder,” Evenett points to disturbing trends in the data. He concludes that there have been three phases since the early days of the economic crisis. There was an initial upsurge in protectionist measures during the crisis, followed by a modest decline as economies recovered in 2010-11. But more recently, as economic growth has slowed in many parts of the world, the number of new protectionist measures ticked up again.

And, because many of the previous measures have not gone away, the cumulative number of beggar-thy-neighbor measures in place is higher now than at the peak of the crisis. The European Union and India have imposed the most measures affecting the greatest number of trading partners, while China is the most frequent target (pp. 4, 66 of the report). The most recent data indicate that metals and chemicals are the sectors most frequently hit, surpassing agriculture.

Most of the measures identified in the GTA are ad hoc duties imposed against allegedly unfair (dumped or subsidized) imports, or bailouts and other financial incentives for domestic industries, and not increases in old-fashioned tariffs. In that sense, the international trade rules are working; it’s just that the rules have weak spots. And trade growth, which was outpacing output growth before the crisis, slowed dramatically during Evenett’s third phase of crisis-era protectionism.

But how much do these protectionist policies really matter for trade?

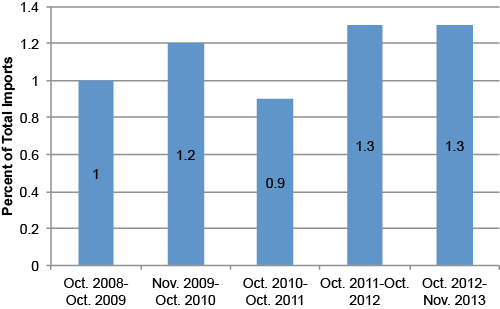

Of course, some of the decline in trade growth is due to the lack of growth in key parts of the world. A recent VoxEU article concluded that about half the slowdown was due to cyclical factors, particularly economic stagnation in the European Union. The other half they concluded was due to structural factors, including modest increases in protection around the world. However, the article suggests this is only a small part of the problem, citing data from the World Trade Organization which shows that just over 1 percent of global imports are covered by restrictive measures:

Figure 8. Trade covered by new import restrictive measures

Source: WTO.

While Chapter 4 of the new Global Trade Alert report argues that the WTO count of new restrictive measures is too low, it is hard to believe that the “murky” protection measures captured by the GTA would change the order of magnitude of trade affected.

What are other explanations for slower trade growth?

Paul Krugman argued on his New York Times blog last year that the rapid growth of trade in the post-World War II era was due to sharply declining costs of trade. In his story, both sources of declining trade costs—post-war trade policy liberalization and the spread of shipping container technology—have largely run their course and a slowdown in trade growth is not surprising.

In an intriguing new analysis, Cristina Constantinescu and Michele Ruta, and Aaditya Mattoo, economists at the IMF and World Bank, respectively, argue that changes in supply chain trade in China and the United States are the key factors explaining the slowdown in trade growth. Notably, as China’s industrial sector matured, the share of imported inputs in China’s total exports was nearly halved from its peak of 60 percent in the mid-1990s. And in the United States, the authors conclude that the pace of offshoring and supply chain fragmentation by US companies seems to be declining.

Should developing countries be concerned?

Even if the pace of supply chain fragmentation is slowing, we are unlikely to see it reverse. So, if the slowdown in China’s trade is paired with economic reforms that shift the focus in China to domestic consumption and public goods, such as clean air, and improved health and other services, new trade opportunities could open up for other developing countries. But the growth in discriminatory trade measures documented in the Global Trade Alert is worrying. Even if the trade impact is not yet large, it comes in addition to the proliferation of regional trade arrangements that contribute to erosion in the international rules-based trade system.

So, having read the latest GTA report, I’m even more grateful that US and Indian negotiators were able to work out a compromise on food security that will let the WTO get back to work. It should never have gotten to this point, and the road ahead is by no means smooth, but willingness to reach a deal at least indicates that these two major players still do value the multilateral system.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.