Subscribe

Subscribe today to receive CGD’s latest newsletters and topic updates.

All Commentary

Filters:

Topics

Facet Toggle

Content Type

Facet Toggle

Time Frame

Facet Toggle

Blog Post

February 23, 2024

The Re-thinking Development Cooperation (RDC) Working Group has established itself as a novel informal forum for building partnerships and strengthening learning both from, and about, participating agencies. We reflect on the first year of this new initiative; highlight key lessons from the group’s ...

Blog Post

February 22, 2024

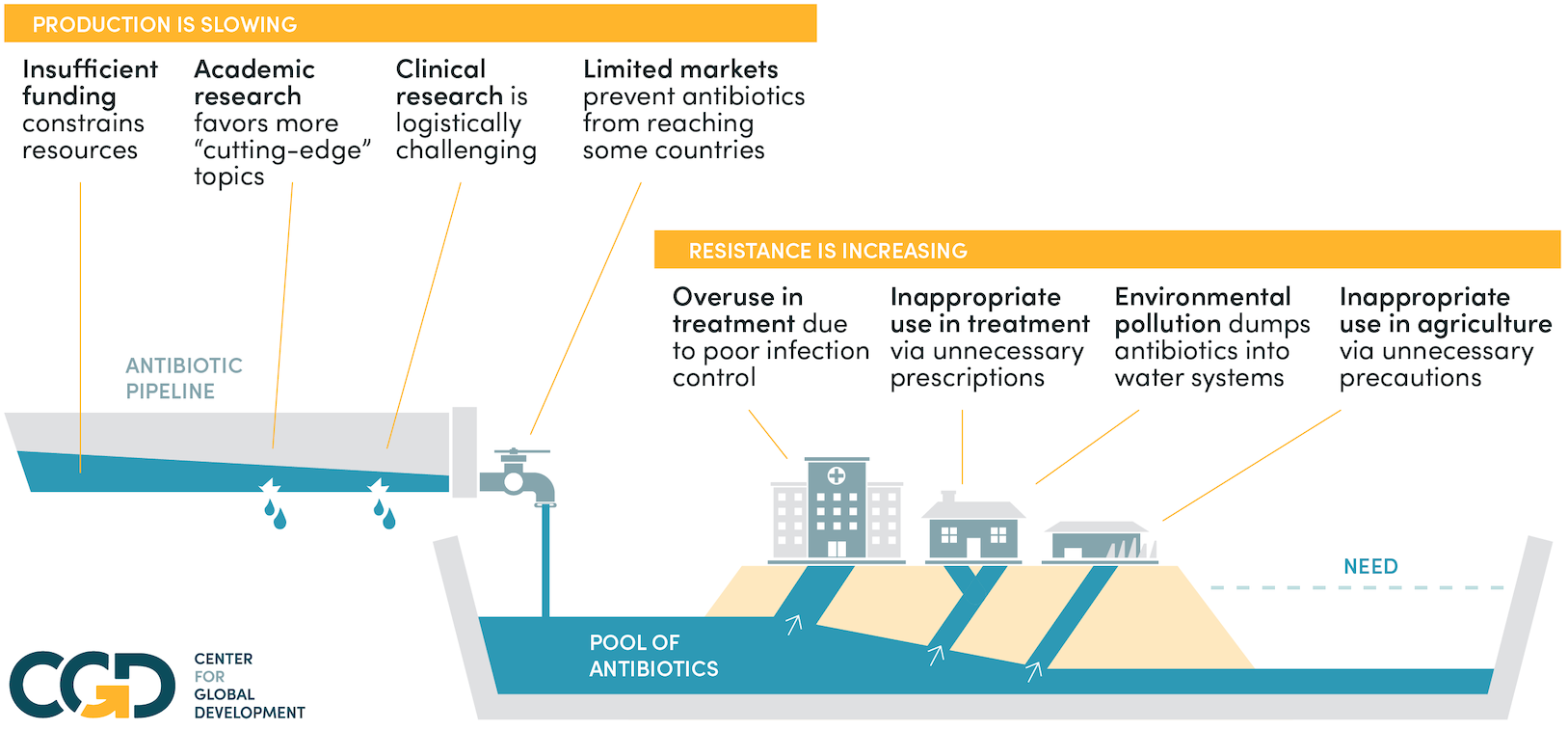

The process of discovering, producing, buying, and consuming antibiotics is riddled with market and government failures. To solve antibiotic resistance, it’s not enough to solve just some of these. If we fix the market failures that reduce the number of new antibiotics that are discovered, but not t...

Blog Post

February 22, 2024

Is there a relationship between climate change and conflict? Gyude speaks to Dr. Edward (Ted) Miguel of University of California Berkley about the impact of rising temperatures, extreme droughts, and floods on competition for resources, and how governments can respond to climate change’s compounding...

Blog Post

February 21, 2024

So: how do donor governments actually use their subsidies to the private sector to support mitigation and development projects around the world? The process usually starts with a private company (the project sponsor) asking a development finance institution (DFI) like the World Bank Group’s Internat...

Blog Post

February 20, 2024

There is some good news on global climate change. The International Energy Agency suggests we are “at the beginning of the end” of the fossil fuel era, with ‘peak fossil’ likely this decade. And the consensus amongst climate modelers appears to be that the worse scenarios historically used by the IP...

Blog Post

February 20, 2024

In a new note, I suggest there’s little evidence that aid (official development assistance, or ODA) spent on climate mitigation is actually reducing emissions. That’s not to say the finance is wasted: much will have been spent on projects with considerable development impact and some, surely, reduce...