Subscribe

Subscribe today to receive CGD’s latest newsletters and topic updates.

All Commentary

Filters:

Topics

Facet Toggle

Content Type

Facet Toggle

Time Frame

Facet Toggle

Blog Post

April 16, 2024

Last month The Gambia’s National Assembly advanced a bill that, if ratified, would make it the first country to overturn a ban on female genital mutilation. These moves—supported by the predominantly male legislature—reflect the precarious nature of gains made in gender equality and have implication...

Blog Post

April 15, 2024

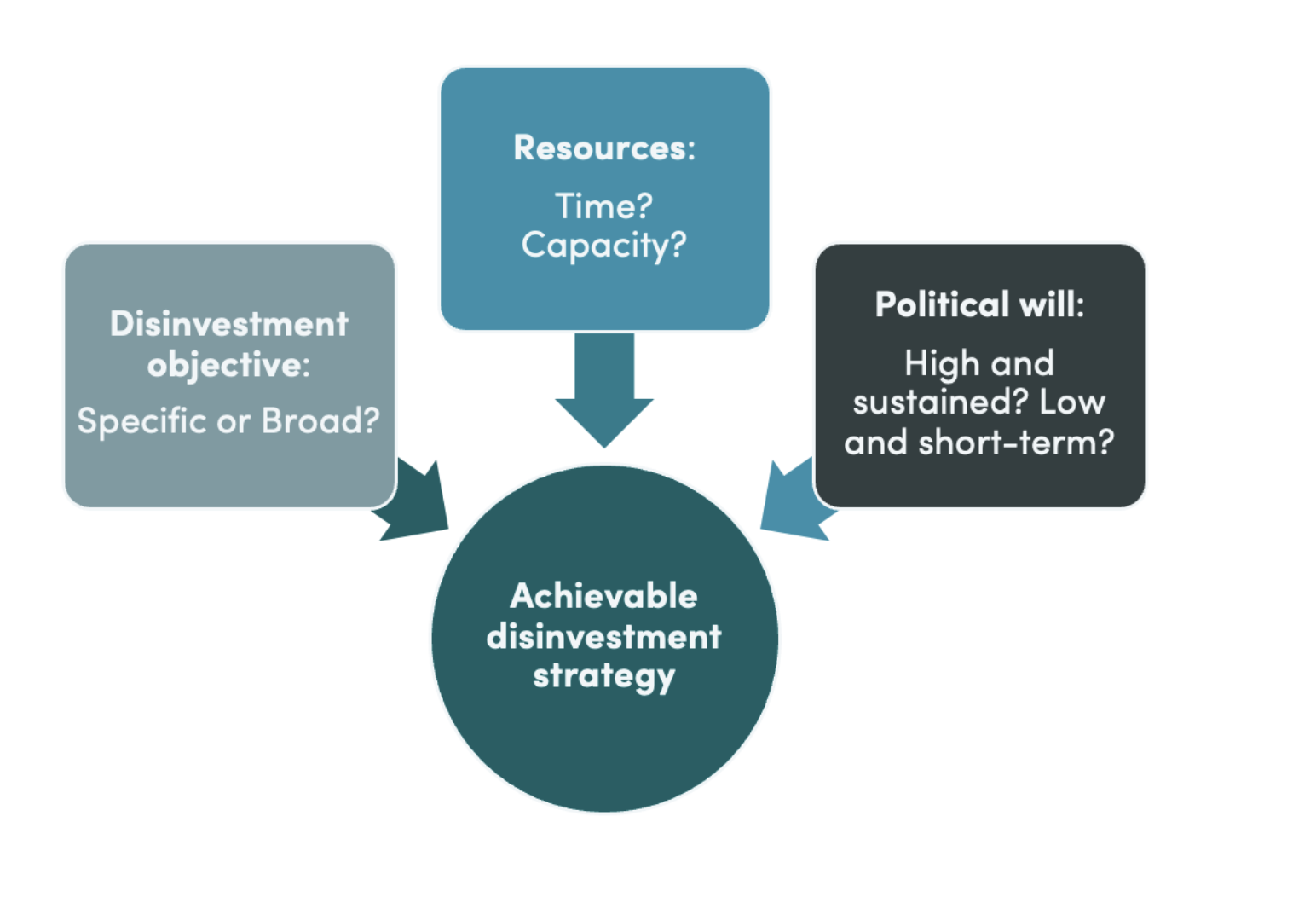

In theory, disinvestment offers the potential to release resources for achieving UHC during challenging fiscal times. However, in practice, it is time- and resource-consuming and results in less benefit than expected at the outset. The opportunity cost of launching an initiative needs to be weighed ...

Blog Post

April 11, 2024

There are currently two prevailing methodologies for calculating PCM—the MDB approach and the OECD approach. Both approaches have developed over time and contributed significantly to better understanding of the ways in which private capital is mobilised for development. However, they have key defici...

Blog Post

April 11, 2024

How schools are managed––things like budgets, staffing, and planning––matters for school effectiveness and children’s learning. But how easy is it to improve this (at scale) in poor countries? In a new CGD working paper we evaluate the impact of a large-scale school leader training programme impleme...

Blog Post

April 10, 2024

The UK Government has committed to producing a strategy on how the UK will support local leadership on development, climate, nature and humanitarian action; and its Foreign, Commonwealth and Development Office has endorsed a Donor Statement on Supporting Locally Led Development. Lisa Nandy, Labour’s...

Blog Post

April 09, 2024

It's spring in DC, which means it's time once again for the IMF-World Bank Spring Meetings. Finance ministers, central bank governors, and other top officials from around the world gather to discuss the state of the world economy and the international financial architecture, and CGD's researchers ar...

Blog Post

April 08, 2024

When Gavi, the Vaccine Alliance, was founded in 2001, it logically targeted its support to the poorest countries—with GNI per capita under a pre-defined eligibility threshold—that also had the highest shares of the world’s undervaccinated children. Fast-forward almost 25 years, and the situation has...