Recommended

Just before the yuletide of 2018, I arrived in my native Ghana after one of my long spells away.

I flipped out my phone, opened Uber, and tried to flag a ride from inside the shiny new terminal of Accra’s international airport. After a couple of false starts I gave up, walked out, and headed for the taxi stand.

In the many days that followed, this ritual repeated itself with remarkable regularity. Sometimes I got the Uber, but on as many occasions, I couldn’t.

The reasons for the frequent failure ranged from curious to bizarre. The “partner-drivers” would accept the request. Then they would begin to go around in circles. Sometimes they would start heading in the opposite direction. On a few occasions they would call and announce that they were “far away,” even though their registered location was visible to me on the app and their estimated time of arrival had factored into my decision to wait.

It would take me a whole week to figure out that the problem wasn’t always that many Ghanaian Uber drivers couldn’t use GPS all that well, or that they were displeased with fares. There were other issues that I’d left out of my calculation, such as my payment preference, which was set to “bank card” instead of “cash.” The drivers want cash because it allows them to unofficially “borrow” from Uber and remit Uber’s money when it suits their cashflow.

Though Uber offers two tiers of service, the difference in quality appeared negligible. Even on the upper tier, it was a constant struggle to find an Uber whose air conditioner hadn’t “just stopped working earlier today.” As something of a globetrotter used to seamless Uber services in European and American cities, I found the costs of onboarding onto Uber as my main means of mobility in Accra onerous.

Why is a powerful corporation like Uber, reportedly valued by shrewd investment bankers at $120 billion, with $24 billion in capital raised, unable to maintain even a relative semblance of quality in its product in Ghana? And in other African cities I have visited?

It may seem bleedingly obvious why heavily digitalised Facebook, Twitter, Microsoft, and Google manage to deliver fairly uniform standards of product quality regardless of where their customers are based, whilst Uber, because of its greater “embeddedness in local ecosystems” and lower digitalisation of its value chain, fails. But in that seemingly redundant observation enfolds many explanations for why the innovation-based leapfrogging narrative in frontier markets, especially in Africa, unravels at close quarters.

Co-innovation: A missing ingredient in frontier markets

There are two big questions about modern innovation: Why does it tend to confine itself to only a narrow “vanguard” of the economy in every part of the world? And why does it not provide as big a boost to productivity as expected, especially since the dotcom bust?

Strangely, it is academia that obsesses over these two conundrums; in the popular press, and among practical folk, the more popular questions are: Are poor countries/societies (a.k.a. “frontier economies”), especially in Africa, going to lift themselves up by their bootstraps through innovation? Having mastered innovation, can frontier economies apply it to shortcut painful, drawn-out, development marathons and to pole vault ahead of the mature/advanced economies (a.k.a. “leapfrogging”)? Is the leapfrogging of frontier economies going to be reinforced by the stagnation of mature economies caused by the displacement of labour because of increasingly cognitive technologies?

Yet, both sets of questions are prompted by the same underlying and overlapping confusions and gaps in analysis. Pondering over my Accra Uber experience brought home to me with a sudden force of clarity how a certain kind of “macro-ethnography” (observing at close quarters but maintaining a strong theoretical detachment) ties together the many insights academia has unearthed into how innovation drives economic growth with observations from the field.

Among the conclusions emerging from such an exercise is the sorry realisation that frontier economies, especially those in Africa, are not really doing a good job of “leapfrogging” through innovation, and unless major shifts in mindsets occur, they may in fact relapse into lower growth in economic productivity.

Going back to my Uber example, the key question is, “what does Uber have in its North American and European markets that it lacks in Africa?” Research and observation reveal a core deficiency in Uber’s African operations: the absence of strong open and closed “coupling” opportunities for sharing risks, enhancing distribution, sustaining quality, and reducing customer frustrations.

“Coupling” may sound like an odd word, but it is popularly used in the innovation literature to discuss the collaboration, cooperation, “joint innovation” (co-innovation), and broad partnership linkages that innovative firms tend to develop as their ecosystems become more productive. As I explain in this note, platforms for co-innovation are highly underdeveloped in frontier economies in a manner not adequately explained by institutional and infrastructure constraints. Without deliberate efforts to promote “co-innovation,” innovative business models shall continue to struggle to scale because of unnecessary complexity, denying frontier economies the vitality of innovation-driven growth.

A study by Hein, Bohm, and Krcmar aptly demonstrates how Uber’s “tight coupling” approach in its “expansion phase” evolved into a “loose coupling” strategy once market leadership was attained and the existential threat became how to manage “self-renewal.” Uber’s partnerships with GM and Toyota enabled it to influence the quality of its “fleet under management” without overburdening its “partner-drivers” and thus compelling them into perverse coping mechanisms, as I experienced in Accra. Elaborate arrangements with Paypal and American Express has enabled Uber to explore a variety of low-cost, fast-time, payment structures, including Instant Pay for Drivers, that lower incentives for drivers to devise their own “time value of money” tricks. The ride-sharing company’s partnership with SAP-owned Concur has enabled a fairly impressive suite of integrations to simplify Uber adoption for businesses by harmonising mileage expensing and other annoying tracking issues. Its driver perks programs, such as Pro, involves multiple partnerships across various loyalty points, discounting, and rewards initiatives. Alliances with many training providers bring in valuable skills and increases accessibility options around town.

Hein and his co-authors simplify the point as follows:

“Thus, it was important to first strengthen core services through strategically selected tight coupling partnerships and then opening up to utilize the innovation capability of a loosely coupled ecosystem.”

The willingness of Uber’s partners to customise and adapt to changing contexts in the fast-evolving ride-sharing landscape allows co-innovation, that is to say, joint experimentation to uncover what works over time and eventual digitalisation once trust creates stable expectations and performance requirements. This is crucial in understanding the propellers of business model digitalisation. Digitalisation often rides on the back of other simplifications but is rarely the driver of simplification itself.

Another major difference between Uber-in-mature-economies and Uber-on-the-frontier is the high number of driver-owners in Europe and America compared to Ghana and elsewhere in Africa. Driver-owners operate with an entrepreneurial mindset and are subject to the constraint that they cannot easily exit the Uber network with one profile and re-enter with another. In the various African countries where I have studied Uber, the majority of Uber drivers are workers for hire. These operators have a far lower “partnership” mentality compared to driver-owners who appear to appreciate the bigger picture of “making this experiment work.” These entrepreneurial drivers serve as the microflora in the Uber ecosystem, filling in the gaps left by the bigger and more formal partnerships.

Whatever one may think of Uber’s overall business model and the equity in its relationships, and even if one is wont to dismiss it as exploitative, one cannot deny the strength of the co-innovation model and the relevance of Uber’s seeming inability to fully replicate it on the frontier to the discussion on innovation diffusion and scaling.

Wanted: Local intermediaries and innovation enablers

An even more intriguing point is that some of Uber’s “home-based” ecosystem advantages do effortlessly scales globally, unlike the others we have discussed above, lending emphasis to the earlier point on the limits of digitalisation. So, for example, Uber’s deployment of APIs such as TripExperience and UberRUSH, as well as the two dozen SDKs and three major software libraries, designed to attract around its platform an orbiting microflora of developers, has succeeded in impacting the core platform globally. The effect is felt best in the most digital element of its offering, the app interface itself, and even though very few of the contributors to its open-source efforts are African, its African consumers benefit as much as customers elsewhere. I refer to this variation on the theme as the “global intermediation opportunity.” Global intermediation of this sort is one variant of the co-innovation dynamic. It tends to work well in the highly digitalised layer of the business stack, but it falls short of being transformational when local co-innovation petri dishes are barren and microflora is absent.

Uber was designed to be ecosystemic from the get-go. To the extent that in some markets in Africa its capacity to rely on local ecosystems is constrained, the service suffers. If Uber struggles to scale a seamless service, it shouldn’t come as a surprise that many other African innovators struggle to do same.

Take Konga, for instance. As Nigeria’s first mega VC-backed ecommerce play, massive hopes rode on its success. Unfortunately, Konga felt compelled in the course of scaling up to build its own payment platform, courier network, anti-fraud program, fulfilment centers, call centers, and training system—all in the early days of the start-up, when it was still iterating towards a stable way of doing business. After nearly $80 million in investment, it had to be let go in a fire sale after investors refused to offer more cash, destroying much value and jobs in the process. Of course, start-ups fail everywhere in the world, even those started by top entrepreneurs of the calibre of Konga’s founders. The point is that the systemic causes of failures differ from region to region and closeup ethnographic studies can point to critical patterns relevant to an ecosystem as a whole. So when we see Konga’s still-surviving and therefore supposedly more successful rival, Jumia—which used to pride itself on a transport fleet larger than UPS, FedEx, and DHL combined—now tell investors that its logistics network comprises “more than 100 local third-party logistics service providers, whom we integrate and manage through our proprietary technology, data and processes,” and assure them that their own fleet is limited to contingent last-mile uses, we are better able to discern the underlying anxiety they seek to dispel.

We also have the example of FoodLocker, a much smaller, still-thriving, food delivery start-up (like a DoorDash or Grubhub) based in the Nigerian city of Ibadan. Though its founder is positioning FoodLocker for VC backing, and clearly considers it part of the “ecommerce” trend, the company makes only 4 percent of its income online, and has invested in physical facilities right from its infancy. Thus, FoodLocker, an ecommerce play in the food sector, is not merely concerned with server uptime, Facebook algorithm changes, and online customer costs of acquisition; its valiant founders are also contending with sanitary regulations, pest management, chef hiring, and outdoor signage.

The Konga and FoodLocker situations are not just typical but emblematic of the innovation sector across frontier economies. Players that aim to focus on broad-based penetration into the local market, and to “serve the masses” consistently feel compelled to build out “across the value chain” and take responsibility for multiple steps along that chain. Thus, at every stage of growth, core competencies must diverge as the different elements of the business model do not scale in similar ways. As the complexity unfolds, most operators limit investment in end-result innovation and focus primarily on process innovations to keep the complex, vertically integrated edifice stable. Digitalisation retreats to make way for more sturdy brick-and-mortar components.

It is likely that the same forces currently driving the innovation sector in this direction have been present in the general economy for a long time. They most likely account for the high degree of conglomeration—the phenomenon where entrepreneurs prefer several, weakly scaled, highly diversified, vertically integrated businesses instead of a few, high-productivity, large ones—observed in frontier economies.

The rational justifications for doing innovation, or business in general, this way are easy to come by and to understand. They derive from calculations about risks based on concrete concerns about institutions and infrastructure. Risks from partner betrayal, supply disruption, political interference, contract evasion, employee defection, and so on.

But, obviously, not every frontier or African entrepreneur aims to build for the masses. Consciously or unconsciously, some entrepreneurs build models suited only for churning products and services relevant to vanguard consumers and segments of the economy. These are also the entrepreneurs most likely to attract Western-style venture capital for a number of reasons, some of which will become clearer later.

Whilst all types of innovation are useful for an economy, for economic growth to be substantial and inclusive, “locally penetrative” innovation is essential. The chief constraint on the current innovation trend on the global frontier is the impoverishment of local ecosystems caused by vanguard innovators and entrepreneurs focused too much on exploiting global intermediation opportunities to plug into the already-networked layers of the economy where fast digitalisation is possible. Nice slices of the business stack prosper as a result of these “fast-track start-ups” and then are able to attract capital without the full set of growth benefits, such as job creation, government transformation, increased market efficiency, and positive price effects in critical sectors such as education, health, and agriculture.

Fast-track start-ups naturally operate in segments where the underlying heavy-lifting of co-innovation has created the necessary simplifications to allow global intermediation to operate. Some of them focus on aggregating inventory for global platforms at the same time as they plug into “simplified layers” of the local ecosystem. Many hotel booking platforms in Africa for instance specialise in aggregating inventory for Expedia and Booking.com. A good chunk of the fintech companies connect to Mastercard and Visa Rails via any one of a number of global intermediaries and then plug into national electronic payment APIs set up over the years through the hard work and advocacy of local pioneers long out of business. Implicit in the last point about “dead pioneers” is a critical insight.

The fast-track start-ups are only effective where the work of simplification has laid the groundwork for digitalisation to be feasible. Companies like E-Tranzact had to sacrifice years of growth to light up the way for the fintech boom now seen in West Africa. Ecosystem nurturers like Guido Sohne died before they could witness a time when national APIs for banking services are a reality.

A far more effective architecture of pluralistic innovation, therefore, would be one where there are far more local intermediaries and ecosystems enablers nurturing the microflora of small-time contributors, thereby reducing the risks of co-innovation and collective exploration and experimentation. To continue the biological metaphor, “microflora” work like probiotics in strengthening the immune system of firms against disruption risk. Innovation scholar Pim den Hertog has identified critical service companies focused on “supplying intermediate products and services that are knowledge-based,” and shown quite convincingly how the proliferation of these enablers in an ecosystem determines its health.

In the absence of such a situation, however, aspiring innovators are deprived of the positive examples of successful intermediary service providers and ecosystem enablers, and therefore feel compelled to choose between one of two options: build a fast-track start-up in the highly digitalised strata or aim for “mass penetration” by focusing on final products—never intermediate inputs—and sole—never shared—ownership of the complete end-customer relationship.

The weak and underdeveloped ecosystem governance frameworks, which should lower the barriers for co-innovation and reduce the apprehension of entrepreneurs and innovators for this approach to business model design, is itself, of course, a product of the absence of “intermediary entrepreneurs” who specialise in interfaces, interchange, interactions, and intersectional value creation.

A Nollywood story of missed potential

What insight does this account provide into the search for an effective model of spreading innovation beyond a few vanguard firms striving to own the end-customer relationship by self-mediation, or at best global intermediation, of the value-chain for delivering final goods?

To address this question, we need to take a deep dive once more into theory, supplemented by ethnography. This is because the popular, readymade, dominant models of how to use innovation as fuel for transformative development have important gaps that need filling before they can be effectively utilised. Let me provide a few illustrations.

A great example of the sequence of logic showing how transformative innovations can break out in frontier economies and pole vault them towards productive success is to be found in the recent work of Ojomo, Christensen and Dillon.

Ojomo and his collaborators are right to focus on scalability and diffusion, for these indeed are the crux of the matter. So, one cannot quibble with them when they say, “market-creating innovations can be scaled up. In fact, because they make a product simple and affordable, bringing it within many people’s reach, scaling up is a fundamental part of the process.”

My contention is that this is precisely where the weaknesses of current innovation-for-development models lies. They insufficiently address the barriers recounted above which block scaling and penetration, and confine innovation to the vanguards, to borrow a theme from the works of Roberto Unger, Dani Rodrik, and others.

For example, the key African example that Efosa and his co-authors use to make their point about “new market creation”—Nigeria’s film industry, Nollywood—is somewhat problematic.

As an aside, the numbers quoted, such as the “one million jobs” supposedly created and the $3.3 billion industry value, suggest insufficient attention to detail, and yet ethnography is so important to get to the bottom of this issue. These numbers seem to have been given a patina of “official statistic” through frequent requoting by the likes of the US International Trade Commission’s Office of Industries. Try as one might, an actual study documenting them is impossible to find. And circumstantial analysis would suggest that they are unreliable.

For one thing, unionisation and the formation of industry associations, even informal ones, are major features of Nigerian economic organisation. If these employment numbers were real, they would reflect in union and association numbers, with resultant feed through into politics.

Take Hollywood, with which Ojomo and co-authors compare Nollywood: its $43 billion of output supports 2.1 million jobs. The foundation of these projections is in the well-documented union membership of more than 200,000, with the IATSE crew union alone responsible for more than 140,000 members.

My careful review of data related to the 30 registered guilds in Nollywood, including the 11 major ones recognised by the primary government regulator, suggests membership of around 7,000. The multibillion-dollar output is also suspect considering a number of facts. By far the biggest licensor of Nollywood content historically has been the successful video-on-demand (VOD) operator Iroko TV, and its annual licensing budget has never exceeded $5 million. Compare this to the $6 billion licensing budget of Netflix, which plays a similar role for Hollywood. Even if we discount the comparison by many orders of magnitude to accommodate the differences in industry structure, it is hard not to marvel at the comparative ratios. We know for certain that the 50 titles a week oft-quoted figure is inaccurate because the Nigerian film regulator provides stats on its website that few bother to review and that shows fewer than 10 titles a week. In fact, my argument is that Nollywood is hampered in reaching its full potential by the very ecosystemic factors that I have outlined earlier.

Jade Miller’s careful ethnographic study of the Nollywood, Nollywood Central, whilst highly adulatory, reveals the one factor that matters most for this analysis: the lack of ecosystemic co-innovation. The cinema industry, the animation talent in the emerging ICT industry, and the sign art technicians all significantly diverge in their focuses and activities from Nollywood, when tighter coupling and joint experimentation would serve all parties better. No wonder then that there are only 140 cinema widescreens (fewer than Dublin) for a country the size of 45 American states.

If Nollywood’s output, despite the massive constraints of its ecosystem, was indeed $3.3 billion, at least Nigerian banks would know. And yet the biggest credit facility dedicated to Nollywood is the Bank of Industry (BOI)-managed $3 million NollyFund. This is half the amount of money the country’s leading development bank devotes to university graduate entrepreneurship, for instance. The bank has not expanded the facility in 4 years.

The pressure for anyone attempting to innovate on top of a situation like Nollywood to adopt a fast-track, high-digitalisation, global intermediation, approach is well exemplified by the fate of Wura, which collapsed after Facebook changed its algorithms.

Ojomo and his co-authors also discuss the case of Microensure, which underscores the fundamental importance of some of the issues we have raised already. The digitalisation part of most innovation models is often easy to scale. Having intermediary enablers is, however, more critical. That is exactly what happened in the case of Microensure. By leveraging symbiotic partnerships with global telecom companies, innovators like Bima, Microensure, and MFS Africa have been able to make some headway in introducing mass market products in multiple markets through a deft combination of co-innovation partnerships with telecoms, thereby jointly innovating around many risks around privacy, identity, illiteracy, adoption, attrition, etc. The high global intermediation opportunities and deep digitalisation potential of the telecom infrastructure has, however, made it easier for them to postpone embedding even much deeper into the ecosystems. This is why microinsurance penetration across Ghana, Nigeria, and Kenya, despite the impressive success of microinsurance innovators remains lower than 0.1 percent of the population, and still considerably less than traditional insurance.

What about the powerful Galanz case study in the same work? About the entrepreneur who nearly single-handedly converted low-income Chinese households into microwave users? What Ojomo et al. don’t dwell on is more interesting than the heroism of Chinese entrepreneur, Liang, which they extol in great detail. And that is that it is the painstaking efforts to work with Toshiba as an intermediary enabler that gave Galanz the capabilities it deployed to such great effect.

China’s large internal market meant, however, that Galanz’s bargaining power with the global intermediary was sufficient to get it to act like a local enabler, customising essential components of the co-developed production system to suit niche requirements. That Galanz succeeded in moving beyond vanguard markets is based on a few simple facts about how the fixed costs of switching from a well-established solution—traditional Chinese stoves—were attenuated through pricing innovations. The point about fixed costs is important and requires further analysis, which I provide below in relation to Ricardo Haussman’s work.

Working toward fractal simplicity

Ricardo Haussman, one of the most effective simplifiers of development paradigms in the world today, talks about specialisation being the path to diversification, the corollary of complexity. Whilst this is of course insightful, the truth is that even at high resolution there are different types of specialisation. What Haussman is really talking about in such works as the Atlas of Economic Complexity is “competitive specialisation,” a Polanyian approach where people seek niches to increase their bidding value. But there is also co-optive specialisation, a more dynamic situation where people specialise to fit into a setting without regard to whether this increases their bargaining power or value. But a specialisation that follows Haussman’s precise prescription would be narrow specialisation based purely on “knowing a lot about less.” Universities are actually full of those kinds of specialists. And they don’t necessarily generate economic complexity in the form eulogised in the Atlas of Economic Complexity. One therefore has to choose their form of specialisation carefully, and realise that ultimately, the goal is to simplify the production process for all co-innovators, with the high-altitude picture of “complexity” that emerges merely owing to what I would call “fractal simplicity.”

Fractal simplicity borrows from the motifs of Mandelbrot sets to describe how simplification of core processes is enabled through the delegation of edge-cases to co-optive specialists which alter their core competences over time to serve critical intermediary functions. By “shedding baggage” for agility, the co-optive model which emerges is both highly scalable and nimble. At each successive stage of growth, the winning pattern is replicated. Co-innovators strive to build core cultural capabilities in the hope of doing several things with the same pattern that at scale looks highly heterogenous. So, food delivery companies become extremely good at just-in-time navigation, which they use not just for ad hoc labour synchronisation but also customer service queuing and delivery coordination.

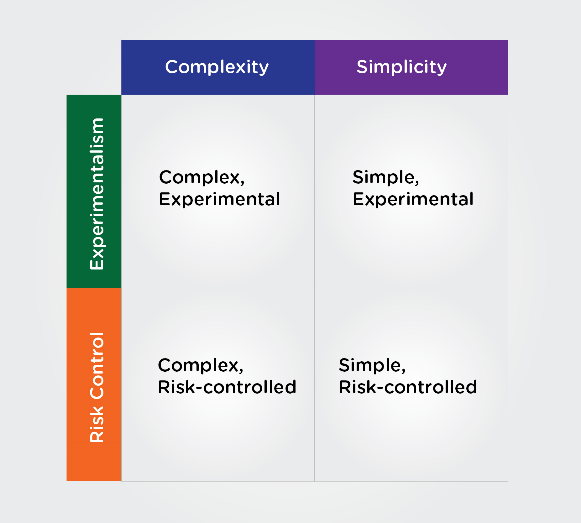

To simplify the point further, we will introduce the only equation in this article:

Fractal simplification = simplicity + experimentation

Risks are socialised through the formal coupling relationships and mitigation reinforced via the microflora paradigm, enabling a simplification of core business elements at successive levels of scale.

Figure 1. Fractal simplicity as an enabler of scale and inclusivity

It is important to acknowledge that simplicity in this paradigm is indeed dominated by the user calculation more than the producer calculation. Complexity clogs up switching and retention on the innovation adopter, and stalls diffusion. The modularisation of the business model so that partners can handle edge cases enables more experimentation with less fear about encountering more tail risks and derailing the scaling effort. As already conceded, value chain control paranoia is a rational approach to risk in environments where institutions and infrastructure are weak, but carefully analysed, it is in fact a form of “weak rationality” since controlling risks by owning more of the value chain merely transforms the risk from counterparty (or betrayal) risk to complexity risk. This opens the lumbering striver to disruption on the high-end by fast-track innovators applying global intermediation principles and to slog and excruciatingly slow growth on the low-end due to environmental risk multiplication.

Indeed, socialising the risk of innovation diffusion and scaling through modular interactivity among co-innovators within a “de-verticalised” and “unbundled” value chain is the most elegant approach to minimising the impacts of weak institutions and infrastructure. Since innovation is indeed required, à la Ojomo et al., to create effective workarounds for institutional and infrastructure bottlenecks, it is simply impractical to expect any one firm to master such a broad cross-section of innovations to succeed.

The fixed-costs and co-innovation nexus

Related to the scaling point is another interesting hypothesis by Haussman: technology/innovation diffusion is considerably promoted by innovations that reduce the fixed costs of expansion. He uses fixed line and mobile networks as an example. In his formulation, the high costs of fixed line infrastructure production limited the penetration of telecom services in frontier markets until mobile telephony came around. Here again, the insight, whilst sound, needs modification in light of the above discussion.

In fact, a careful examination of GSMA data on the comparative costs of producing fixed line and mobile network infrastructure shows that there is no inherent cost advantage of mobile networks over fixed line networks. Depending on design considerations, mobile networks can be as much as three times more expensive than fixed line networks. So, why then did mobile telephony succeed so spectacularly in frontier economies when fixed line networks had failed for decades to spread?

It turns out the shift was on the customer/consumer side rather than the producer side. What mobile network innovation succeeded in doing was crashing the fixed cost of adoption on the end-user side, so that even though variable costs are far higher, end users didn’t mind too much. In much of Africa and South Asia, until mobile telephony came around, users could be expected to pay up to half a year’s wages to bribe and cajole their way to securing a phone line. Even today, the waiting time for a fixed phone line in Africa is nearly 100 days, and time is a fixed cost too. With mobile telephony, all customers need is the money to invest in a handset, the costs of which continue to fall. This analysis is corroborated by several facts, including that mobile penetration in Africa was initially very low because SIM cards and handsets were sold for a small fortune.

The collapse of fixed costs in user adoption of mobile telephony, however, did not just happen. Massive amounts of co-innovation among handset manufacturers, telecom mast producers, live network contractors, regulators, and app stores were required. Even more crucial was the microflora of agents and small-scale retailers who unbundled distribution and customer service around issues like billing, repairs, and education. This is why even though mobile data costs in Africa tend to be four times the cost in South Asia, and far more than fixed broadband, cellular penetration continues to advance on the continent.

The fixed costs-co-innovation nexus, despite its obviousness, is often missed. And this blind spot accounts for why writers such as Brynjolfsson and McAfee continue to exaggerate the labour impact of smarter machines. It is not merely about falling costs of production. It is primarily about lowering the costs of user adoption through effective use of risk-mitigating partnerships that smooth out edge frictions (such as costly to scale training, support, migration tools, transition architectures, integrations, etc.) The sad story of business process automation, where three-year rescue missions of botched enterprise resource planning and customer relationship management implementations are all too common thanks to an unreconstructed consulting industry, shows that production and diffusion are often motivated by different impulses, and for diffusion, co-innovation beyond traditional vendor arrangements is critical for success.

Charles Sabel and his collaborators have recognised the importance of co-innovation in tackling the high fixed costs of building resilient platform industries in a world of increasing volatility and technology risk, and where “vendor lock-in” is increasingly a useless tactic for the vendor who fears disruption as much as the customer.

One may argue that this is all a matter of sequencing and timing, and that frontier, especially African, innovation-based firms are already working towards a deepening of the ecosystem, but such a view would have to be buttressed by evidence of movement exhibiting the trend. It is important to bear in mind that the most advanced angle of the innovation narrative—information technology—has been prominent in Africa since the early 90s, and many African ICT companies are in their third decade of iteration. I argue that the trends do not show an organic movement towards richer innovation ecosystems, and that without deliberate interventions and mindset shifts the leapfrogging through innovation hope shall not actualise.

What about Africa’s VC funding boom?

The first piece of counterfactual evidence likely to be thrown at me is the apparent funding boom being witnessed in the African technology sector, with venture capital reportedly surging through the roof[1] and the number of start-up accelerators growing by 50 percent since 2016.

Venture capital (VC) can indeed be an important bellwether of growth and innovation. It has been noted, for instance, that 43 percent of all publicly listed US companies founded since 1979, when pension funds were allowed to invest in VC, were initially VC-backed. Eighty-two percent of all research and development conducted since then has also been by VC-backed companies. This is remarkable since VCs invest in less than 0.2 percent of American enterprises. Accelerators also have great credibility. Eric Harvit, a Fulbright fellow and incubator researcher, states in a 2002 report that “the [National Business Incubation Association] claims that 87 percent of firms that ‘graduate’ from incubators are still in business today.”

There is reason to be more restrained in our exuberance, however. VC funds in frontier economies aggressively select for companies with high global intermediation prospects, which, naturally, are usually led by expatriates or a few Africans educated in prestigious universities abroad who have built global connections. All the easier for the binary Silicon Valley model (go big or go bust) to be imported into Africa. The steady-growth model imposed on much of the rest of the innovation sector is effectively excluded. This works great for tiny slivers of the innovation opportunity in a few big markets but does little, as I have argued elsewhere, to build enough momentum to change the structure of economies.

Another, perhaps more worrying, aspect of the VC situation in Africa is this: as we have already mentioned, because innovative entrepreneurs prefer, or are forced, to build out most of the value chain themselves instead of co-innovating, the average investment horizon is usually far longer than most venture capital funds can tolerate. It is thus not surprising that the high rate of business success recorded for accelerators globally is not reflected in African accelerators,[2] which have by far the lowest rate for successful exits for any region in the world. Investors place less than 1 percent of incubator investments in Africa, less than a third of Africa’s over share in global FDI as a whole. Overall exit rates in the VC sector per my calculation using publicly available data also hover below 2 percent, compared with 13 percent for India, 7 percent for China, 25 percent for the UK, and 33 percent for Silicon Valley.

And it is not just VCs that have held back from broad incursions because of the horizon issue. Other investors who made massive bets on an Asia miracle 2.0 type situation in Africa have also pulled out: General Motors, InMobi, NGB, BNP Paribas, KKR, Chevron, Shell, and many more.

More patient capital with a preference for less binary outcomes and more steady growth would certainly help. But with foreign direct investment into the continent on the decline (down 21 percent year on year according to the latest UNCTAD data) and return on investment having dropped for five consecutive years and currently at half the level it was in 2012, the prospect seems dimmer than yesteryear, unless something changes.

At any rate, the funding boom has been ongoing for more than a decade now, having risen on the back of the even older leapfrogging narrative. If there existed a positive organic trend as argued by optimists in the business-as-usual tribe, some strong hints would have been discernible in productivity numbers.

Inter-sectoral labour productivity growth (a proxy for allocation of labour to higher-productivity, presumably more innovative sectors of the economy) in the largest, innovation-leading, sub-Saharan African economies (Kenya, Nigeria, South Africa, and Senegal) have averaged less than 0.75 percent per annum over the last two decades.

Devising realistic remedies for innovation ills

So, if you are willing to concede my hypothesis that the lack of ecosystem-enabling intermediaries is the key constraint to accelerated development through innovation in frontier economies, and that popular innovation-for-development models, by ignoring this, tend to offer incomplete diagnoses and remedies, the question on your mind might be, “What can be done?”

The answer depends on who we are advising.

For entrepreneurs, it helps to re-evaluate core business models according to whether they pass the “fractal simplicity” test.

The more fractally simple business models in the ecosystem become, the better the chances of good innovators seeing the benefit of focusing on becoming co-optive specialists and intermediary enablers, and the lower the search and transaction costs for co-innovation partnerships will become.

But I also freely concede that the “fractal simplicity” model needs heavy backing from industry associations working in concert with governments to deliberately promote ecosystem-enabling organisations. The case of Interswitch in Nigeria, set up through collaboration within the financial industry and the regulatory bodies, is an interesting example. After initial hiccups it is becoming an important enabler of fintech innovations in a country that is lagging far behind rivals like Kenya, where deliberate government policy, including intentional hacking of regulation, has tended to favour platform innovation. Some incubators, such as Hacklab in Ghana, are also moving more aggressively towards the role of talent intermediation.

A greater proliferation of such enablers and intermediaries and a more receptive attitude by incumbents in Africa and other frontier economies should help mitigate the institutional and infrastructural risks to innovation diffusion through business model scaling, thereby broadening the benefits of growth beyond a small vanguard reachable by current support models such as venture capital.

Bright Simons is President of mPedigree and a member of CGD’s Study Group on Technology, Comparative Advantage, and Development Prospects.

This note is part of a special series authored by members of CGD’s Study Group on Technology, Comparative Advantage, and Development Prospects. Learn more at cgdev.org/future-of-work.

[1] Confusing methodologies and definitions mean that the amount of funding going into the “most innovative” segments of the African economy could be anything between $334.5 million (210 deals), according to Disrupt Africa, and $1.19 billion (415 investment deals and 39 mergers and acquisitions), according to Digest Africa.

[2] Of the 178 publicly reported accelerator exits in 2017, none could be independently confirmed for African accelerators. South African accelerators tend to self-report stellar success, but objective data is very hard to come by.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.