Ideas to action: independent research for global prosperity

Research

Innovative, independent, peer-reviewed. Explore the latest economic research and policy proposals from CGD’s global development experts.

WORKING PAPERS

April 11, 2024

POLICY PAPERS

April 15, 2024

CGD NOTES

April 08, 2024

WORKING PAPERS

April 04, 2024

All Research

Filters:

Experts

Facet Toggle

Topics

Facet Toggle

Publication Type

Facet Toggle

Time Frame

Facet Toggle

Research

CGD NOTES

March 15, 2024

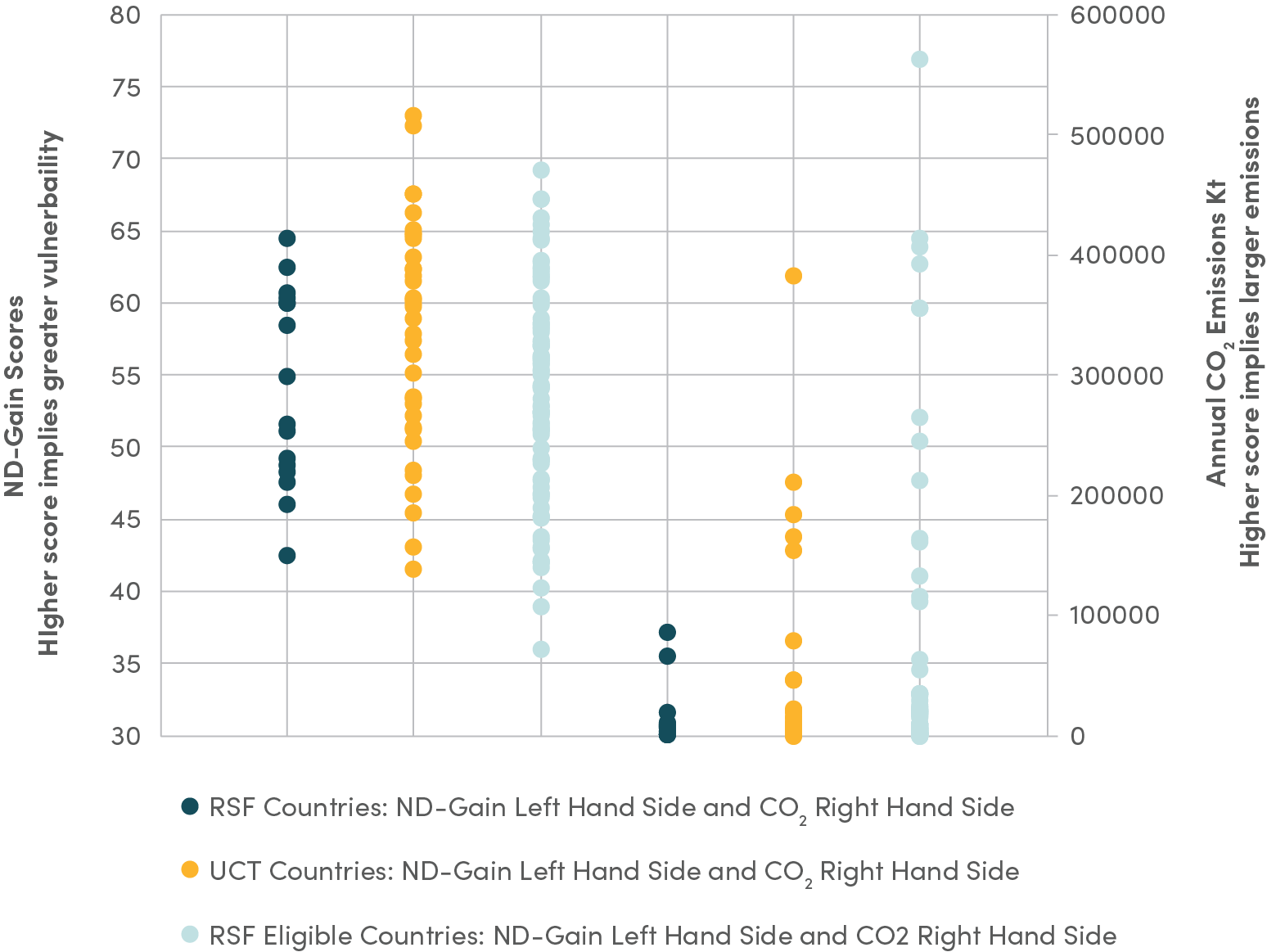

The November guidance on RSF seems to have addressed some of the shortcomings observed in the initial RSF programs. However, as we highlight in this note, other deficiencies remain unresolved and require attention from the IMF’s Executive Board during the upcoming RSF review.

CGD NOTES

March 11, 2024

Pakistan’s recent economic history shows why it has been so difficult to service the external debt and why this will continue to be a challenge in the future. First, external debt has not been used to expand public investment for many years now; instead, it has largely supported government consumpti...

POLICY PAPERS

March 06, 2024

The majority of refugees worldwide live in urban areas. It is often assumed that these urban-based refugees are self-reliant and no longer require external support, but the experience of 136,887 refugees who live in Kampala, Uganda and the 96,348 refugees who live in Nairobi, Kenya challenges that a...

WORKING PAPERS

March 05, 2024

Social safety nets can enhance women’s economic inclusion and agency, but their impacts vary by intervention type. Challenges remain in implementing gender-sensitive designs, and data gaps for certain regions, contexts and outcomes should be closed in future evaluations.

WORKING PAPERS

February 23, 2024

As the politics of polarization gain traction and electoral support, a new vintage of populism is emerging in Latin America. This new version shares some aspects with the type of cultural populism now common in advanced economies that divides societies into antagonistic camps. But there are also imp...

WORKING PAPERS

February 22, 2024

Antibiotic resistance (ABR) already contributes to almost five million deaths per year. Without action, this number will likely rise substantially. We provide the first comprehensive assessment of the economic drivers of ABR, arguing that ABR in large part arises from extensive unresolved market (an...

WORKING PAPERS

February 20, 2024

This paper provides a discussion of future trends as established in the literature on the interaction between socioeconomic indicators and projected future climate change scenarios. It enhances our understanding of future predicted patterns of climate change effects in the coming decades and the nee...