Ideas to action: independent research for global prosperity

Financial Access

More from the Series

POLICY PAPERS

May 23, 2019

As the organization responsible for setting international standards on anti-money laundering and countering the financing of terrorism (AML/CFT), the Financial Action Task Force (FATF) has encouraged countries to design measures that protect the integrity of the financial system and support financia...

REPORTS

April 23, 2019

The report considers three different channels through which Basel III can affect financial stability and devel­opment in EMDEs: (1) effects on the volume, compo­sition, and stability of capital flows arising from the implementation of Basel III in advanced economies; (2) effects on financial...

Blog Post

October 01, 2018

In November 2015, CGD published a report titled Unintended Consequences of Anti–Money Laundering Policies for Poor Countries. Today we release a follow-up to that report. Policy Responses to De-risking: Progress Report on the CGD Working Group’s 2015 Recommendations takes stock of accomp...

REPORTS

October 01, 2018

In November 2015, CGD published the report Unintended Consequences of Anti–Money Laundering Policies for Poor Countries, which warned that efforts to curb illicit finance were producing significant adverse side effects. This new report takes stock of what has been accomplis...

Blog Post

May 18, 2018

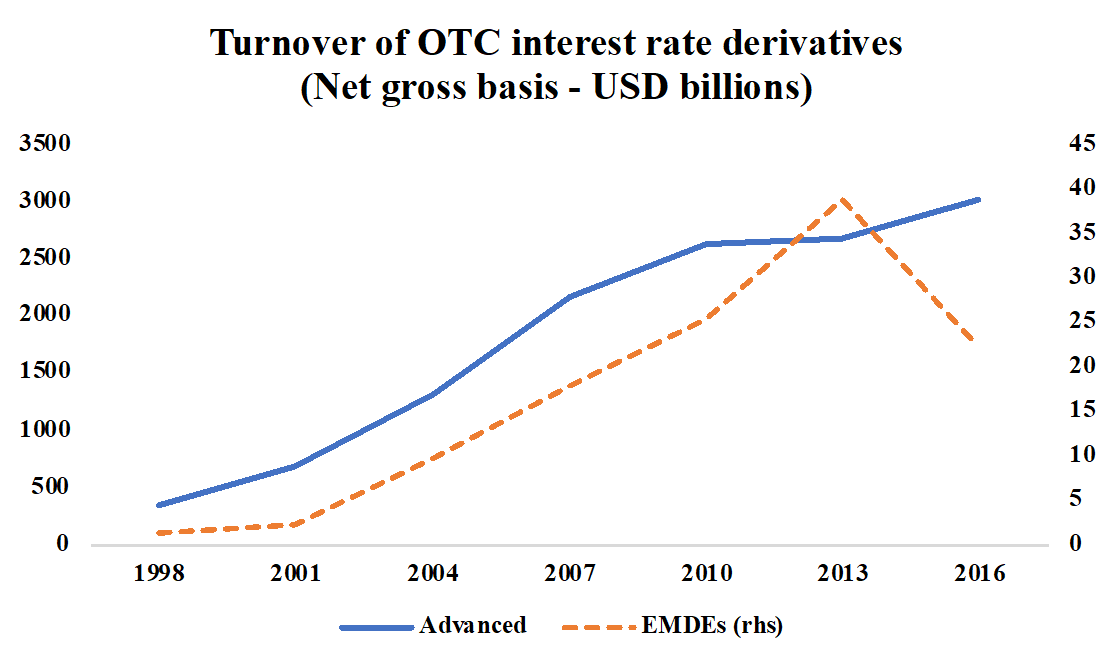

While the immediate and direct effects of implementing Basel III regulatory reforms in emerging markets and development economies (EMDEs) are in these countries’ banking systems, there might also be effects beyond them on other segments of the financial system. In this blog post, I will focus ...

Blog Post

May 17, 2018

The adoption of Basel III by developing countries raises the question of what the impact of such regulatory reform will be on volume, cost, and composition of domestic credit in these economies and for the development of financial systems more generally. This is against the background of many emergi...