Recommended

WORKING PAPERS

Blog Post

When the Inter-American Development Bank (IDB), alongside other multilateral development banks (MDBs), responded to the G20’s call to lend aggressively into the Global Financial Crisis over a decade ago, they did so by risking their long-term financing positions. Within a year of that crisis, the IDB and other MDBs came back to the G20 to say that they were facing a financing cliff resulting from their outsized crisis lending. Absent a new infusion of capital from their shareholders, they would be forced to dramatically scale back their development lending programs in the years that followed. The G20 in turn responded, and an unprecedented round of capital increases proceeded across the MDBs.

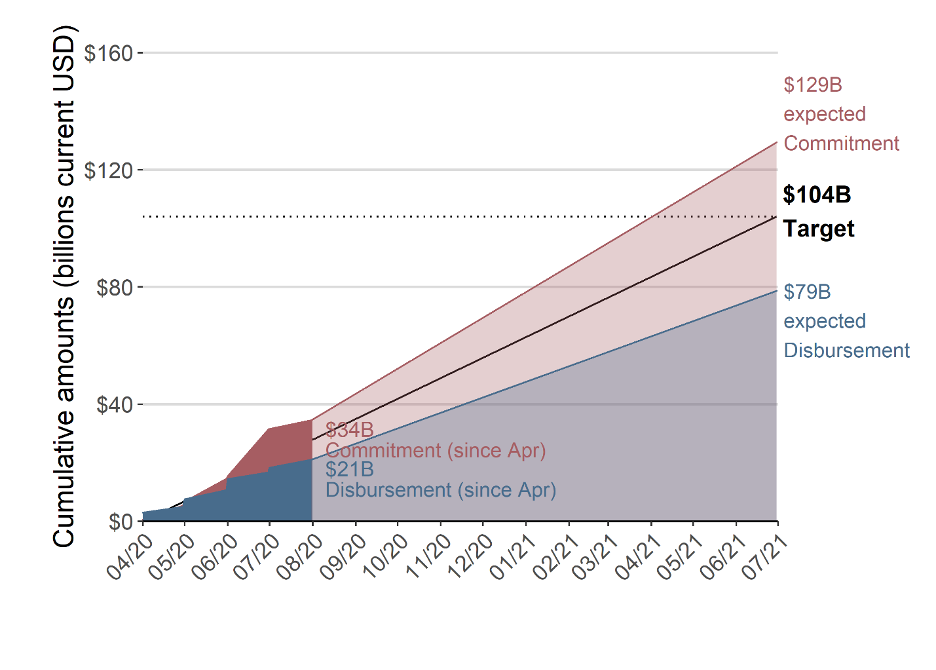

Today the IDB is again making the case for a capital increase to its shareholders. Yet, despite an unfolding crisis that threatens development progress in Latin America to a degree that eclipses the Global Financial Crisis, talk of a financing cliff at the bank is absent from its appeal for more capital. That’s because a spike in crisis financing has yet to materialize in IDB’s lending numbers. According to published numbers, new IDB commitments to governments in the region were flat between 2019 and 2020. “Crisis” commitments of $12.6 billion look about the same as pre-crisis commitments in 2019. At these lending levels, there’s no financing cliff to fall from.

That doesn’t mean the IDB has been passive in the face of the pandemic. The bank reportedly has been focused on more timely disbursement of existing loans, though data on such disbursements are not yet published. Getting money to countries faster, particularly in a crisis moment, is well worth prioritizing given the immediate fiscal needs facing governments under stress.

But the absence of any significant scale up in new loan commitments since the start of the crisis last year is striking. Over the same two-year period, World Bank (i.e., IBRD & IDA) commitments to the region grew from a fraction of IDB lending pre-crisis to eclipse the IDB in 2020, from just $4.9 billion in 2019 to $13.9 billion as the crisis unfolded in 2020. And as we have described elsewhere, it is reasonable to question whether even this degree of crisis response is adequate to the financing needs of developing economies during this crisis.

Of course, backstopping a scale-up in crisis-related financing is not the only rationale or path to a capital increase. The long-term development finance needs of the region are likely significantly higher as a result of the pandemic shock. Combined with the pressing challenge of financing climate change mitigation and adaptation, these needs make a compelling case for more of the type of financing and expertise the IDB and other MDBs can offer to Latin America.

But the cautious stance of the IDB, evidenced by lending commitments that have failed to budge in the face of an unprecedented crisis in the region, ought to give the bank’s shareholders some pause. Yes, the needs of the region would point to a bigger IDB. But if the bank receives more capital, will those resources be put to work?

Hace más de una década, el Banco Interamericano de Desarrollo (BID) y otros bancos multilaterales de desarrollo (BMDs) respondieron al llamado del G20, prestaron agresivamente durante la crisis financiera mundial y arriesgaron sus posiciones financieras de largo plazo. Antes de que se cumpliera un año desde el comienzo de la crisis, el BID y otros bancos multilaterales de desarrollo volvieron a dirigirse al G20 para comunicar que, como consecuencia de sus préstamos desmesurados durante la crisis, se enfrentaban a un “precipicio financiero.” Sin una nueva inyección de capital por parte de sus miembros, se verían obligados a reducir drásticamente sus programas de préstamos para el desarrollo en los años siguientes. El G20 también respondió y se llevaron a cabo una serie de aumentos de capital sin precedentes en los BDMs.

Hoy, el BID vuelve a defender ante sus inversores la necesidad de una ampliación de capital. Sin embargo, a pesar de una crisis que amenaza el progreso en materia de desarrollo de América Latina y que eclipsa la crisis financiera mundial, el banco no habla de un “precipicio financiero” en su solicitud capital. Esto se debe a que las necesidades de financiación de la región aún no se han materializado en los préstamos del BID. Según las cifras publicadas, los nuevos compromisos del BID con los gobiernos de la región se mantuvieron estables entre 2019 y 2020. Los 12.600 millones de dólares en compromisos de "crisis" están más o menos al mismo nivel que los compromisos anteriores a la crisis en 2019. Con estos niveles de préstamo, no hay un “precipicio financiero” del que caer.

Esto no significa que el BID haya sido pasivo durante la pandemia. Según se ha reportado, el Banco se ha enfocado en que los desembolsos de préstamos ya existentes sean más puntuales, aunque todavía no se han publicado los datos sobre dichos desembolsos. Conseguir que el dinero llegue rápido a los países, sobre todo en un momento de crisis, es algo que merece la pena priorizar, en especial teniendo en cuenta las necesidades fiscales inmediatas de los gobiernos en esta situación de estrés sin precedentes.

Sin embargo, llama la atención la ausencia de un aumento significativo de nuevos compromisos de préstamo desde el inicio de la crisis el año pasado. Durante este mismo período de dos años, los compromisos del Banco Mundial con la región pasaron de ser antes de la crisis una fracción de los préstamos del BID a eclipsar al BID en 2020, creciendo de sólo 4.900 millones de dólares en 2019 a 13.900 millones de dólares en 2020. Y, como ya hemos analizado en otros estudios, es razonable cuestionar si incluso este grado de respuesta del Banco Mundial es adecuado para las necesidades de financiación de las economías en desarrollo durante esta crisis.

Por supuesto, apoyar un aumento de la financiación relacionada con la crisis no es la única razón para el aumento de capital. Es probable que las necesidades de financiamiento a largo plazo de la región sean significativamente mayores como resultado de la pandemia. En combinación con el apremiante reto de financiar la mitigación y adaptación al cambio climático, estas necesidades constituyen un argumento convincente para incrementar el tipo de financiamiento, y el conocimiento, que el BID y otros bancos multilaterales de desarrollo pueden ofrecer a América Latina.

Sin embargo, la postura cautelosa del BID, evidenciada en los compromisos de préstamo que no han aumentado durante esta crisis sin precedentes en la región, debería hacer reflexionar a los países miembros del Banco. Sí, la región necesita un BID más grande. Pero si el Banco recibe más capital, ¿logrará desembolsar estos recursos?

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.