As the debt ceiling looms and the government shutdown continues, it seems like a useful time to revisit budget-neutral ways to amp up US development policy. We recently released a proposal titled “OPIC Unleashed,” which provides a budget-neutral roadmap to strengthen US development policy’s best tool for the post-aid era.

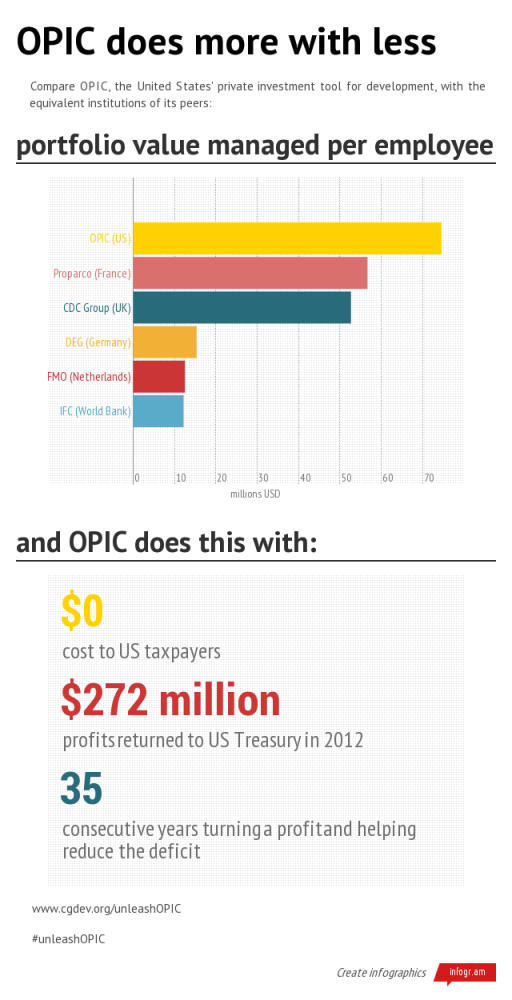

Why do we need to strengthen OPIC? After all, OPIC is pretty effective compared to peer development finance institutions—and as US development agencies go.

But OPIC could do much more for developing countries—and American small businesses—with a few simple, budget-neutral tweaks (more on those later).

Here are the critical reasons for unleashing OPIC now:

-

OPIC and the private investment it drives gives developing country citizens what they most want—and need.

Public opinion poll after public opinion poll tells us that citizens in countries from sub-Saharan Africa to Southeast Asia to Latin America to the United States want economic growth (read: jobs). As Ben’s forthcoming research demonstrates, only a modest share of US development funding goes to the top priorities of these citizens. OPIC is the US development agency that can catalyze growth and jobs by driving American investment into markets that would otherwise be too risky for an American small business.

-

By giving developing country citizens (and governments) what they want and need, we create better partners for the US economy.

OPIC doesn’t have the staff resources to support as many projects (and therefore American small businesses) in emerging markets as it needs. Due to its lack of staff, OPIC has been unable to use all of its available capital—right now; OPIC is leaving about $13 billion on the table. As a result, the US government is ceding emerging markets to other countries’ businesses. For example, US-Africa trade volume in 2012 was only $109 billion compared to Chinese-African trade volumes of $199 billion. And Standard Chartered analysts estimate that Chinese-African trade volume could nearly double by 2015. This means Chinese businesses are establishing a serious foothold in these dynamic economies while US businesses are forced to sit it out until it may be too late.

-

Support US small businesses.

Over 70 percent of OPIC’s projects in FY12 included a US small business. These are businesses that wouldn’t otherwise be able to invest in developing countries, just as other countries are ramping up facilitating support for their businesses and establishing critical footholds for the future.

-

It’s just good policy.

US development policy is behind the curve. Unleashing OPIC to an equivalent footing as peer countries’ development finance institutions might not be path breaking, but it at least would bring the US up to speed.

Unleashing OPIC would also support the most exciting development initiative to come out of the White House and Congress in years—Power Africa and Electrify Africa. More resources for OPIC means more deals, which means more power for Africa.

So, that’s the why, what about the how?

[Tweet this]

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.