This week, emerging economy governments and multinational pharmaceutical executives announced they have agreed to a new way of working together, which should ensure people in those countries get the medicines they need at affordable prices. I’m glad to see this new framework for better priority-setting become a reality. Agreed to in April in Vietnam, it will allow public healthcare payers, the pharma industry and patients benefit from a more transparent process for deciding what drugs are made available to those who rely on strained public health care systems. While I have some questions and reservations about the agreement, at least it begins to address a chronic problem in global public health.

Emerging economies are booming markets for pharmaceutical companies. Roughly one-third of the global pharmaceutical market is expected to be sourced in emerging economies, and the share grows every year. Most of this growth is related to the economies themselves; as populations grow wealthier, more educated and more urban, more healthcare—more services, more medicines—is demanded. And governments are answering the call, declaring their commitment to ambitiously scale up health services and eligible populations.

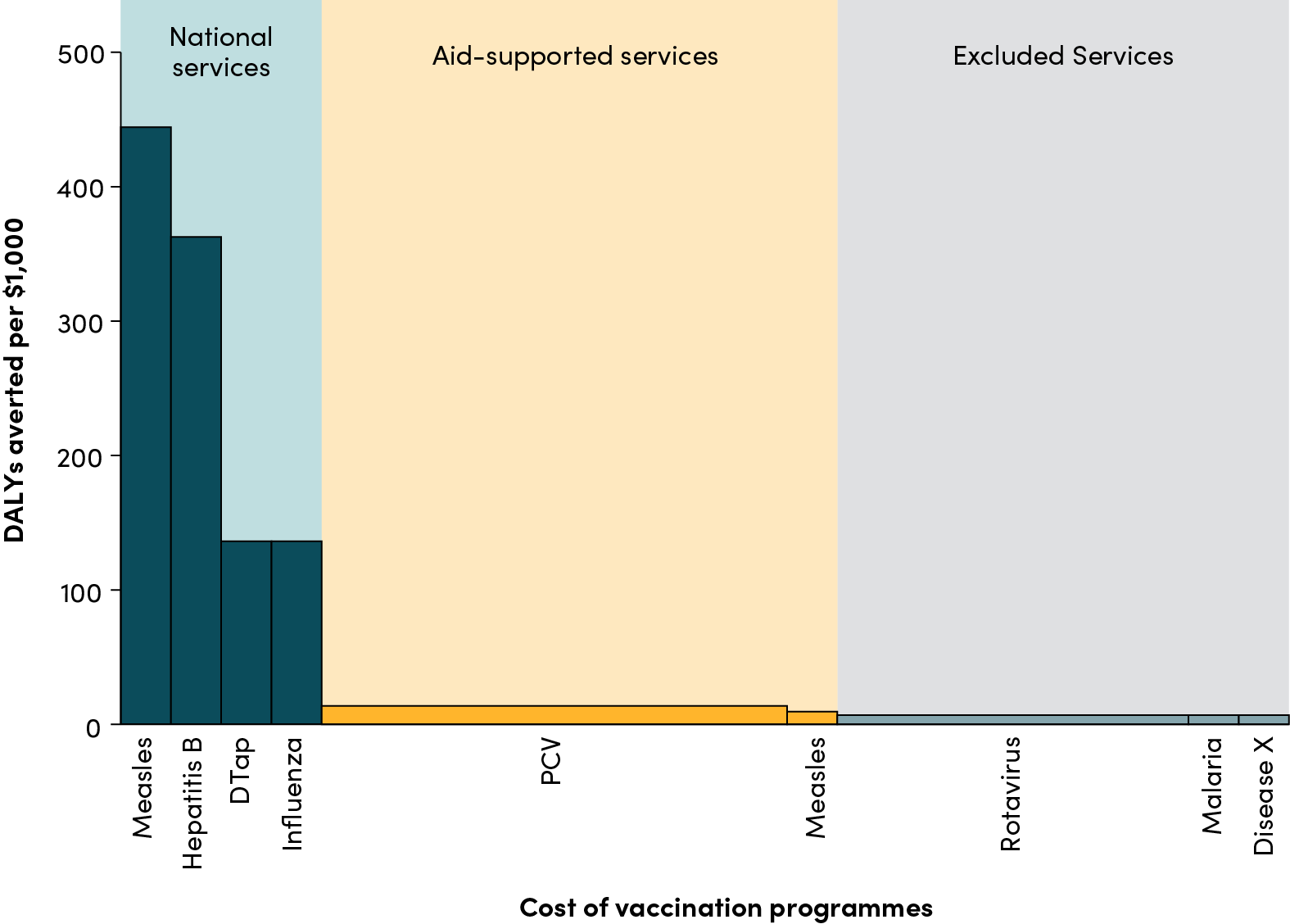

Yet these higher expectations run into the reality of still-limited public spending on health. Public spending on health generally grows alongside economic growth; historically about 2 percent per year. Because resources are still so scarce, tough decisions have to be made about the allocation of every dollar amongst multiple medicines and devices that may all generate health benefit. The difficulty is to select those that generate the most health, equity, and financial protection for citizens within the available budget.

This has led to fierce competition and high politics. When one company’s vaccine was selected over another’s comparator for public subsidy in the Philippines, the unsuccessful company went straight to President Aquino to complain, triggering legal investigations. When the Government of Colombia introduced new legislation on fast-track registration of biosimilars, similar to legislation included in the US Affordable Care Act, US Vice President Joe Biden (at the request of PhrMA, the US-based pharmaceutical lobbying group) sent a letter to President Santos of Colombia to complain. Aggressive marketing in China led to accusations of bribery. In several Latin American countries, use of the legal system to obtain public reimbursement for medications not approved is common practice.

All of these market and political pressures are normal in a competitive market, but are aggravated by the fact that many emerging economy payers have relied on ad hoc procedures to decide what will be publicly funded. This results in suboptimal outcomes for both government and industry. The multiple pressures run into informal procedures and institutions, resulting in uncertainty on market shares and prices on both sides. This all culminates in the public sensation that people’s health is last on the list of priorities.

In April, public payers—Colombia, Philippines, Vietnam, Thailand—and pharmaceutical executives—including GlaxoSmithKline CEO Andrew Witty and top executives from Janssen and Eli Lilly, among others—met in Hanoi to discuss more systematic ways for public payers to set expectations about what medicines will be funded, reduce uncertainty on implications of decisions to fund or not, and negotiate competing interests in healthcare purchasing. Efforts for more responsible and ethical promotion and marketing of medicines were also discussed. For example, GSK’s recent decision to eliminate incentive payments to sales representatives for the number of prescriptions written was highlighted as a positive development.

Industry in general has long been engaged though not particularly enthusiastic about health technology assessment (HTA) to determine value for money in pharmaceutical spend, in spite of their ubiquitous presence in all OECD countries except the US. Some companies have pushed back against HTA agencies that analyze the cost-effectiveness and budget impact of new medicines and devices and make recommendations for the use of scarce public budgets, arguing these are simply administrative obstacles to market access.

That view may be changing as the possible benefits of fair, scientifically rigorous and transparent rules of the game come into focus. For patients, clearer information on what treatment is available in case of sickness and an entitlement to receive certain services are game-changers. For public payers, more health for money, greater defensibility, and social acceptability of decisions to include or exclude a medication, and fiscal sustainability are key benefits. For pharma, clearer target product profiles, assured volumes or market share when recommendations are made to cover their drugs, and a more level playing field amongst domestic and international competitors will be hugely valuable.

Still, there are questions and disagreements: How fixed are healthcare budgets year-to-year? Should the budget impact analysis of a new product focused on the previous year’s budget be projected forward or focus on a more aspirational budget? Should economic evaluations include non-clinical or health system costs and benefits? Is conducting a health technology assessment to generate a value-based price inconsistent with reference pricing (i.e., asking for a price that a neighboring country received)?

Patients, health ministries and pharma do have one shared goal: they’d like to see a bigger share of public monies to be allocated to health, and for health to be seen as an investment—in people and as an economic sector. Can they agree to play by the same rules of the game?

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.