Two weeks ago the FAO’s Somalia Food Security and Nutrition Analysis Unit (FSNAU) released an assessment of external remittances to Somalia, based on a survey of both urban and internally displaced families. The headline result from the report was that apparently remittances were on the decline: approximately one-quarter of remittance-receiving households in Somalia had reported that the amount of money sent to them had fallen over the past six months.

While the FSNAU was somewhat cautious in its interpretation of the results, others were quick to seize the study as evidence that remittances to Somalia are being hampered by excessive anti–money laundering and terrorist financing regulation (AML/CFT). Until now, there have only been anecdotal reports that Somali money transfer companies, who have recently had their accounts closed by banks under pressure from US regulators, are struggling to move money overseas. With the release of this report a recent Oxfam America blog post declared: “New assessment confirms major drop in remittances to Somalia.”

The problem is that the FSNAU survey doesn’t actually tell us much about how remittance flows to Somalia have changed in the past six months. Stay tuned and I’ll explain why.

The FSNAU survey asked the right people the wrong question

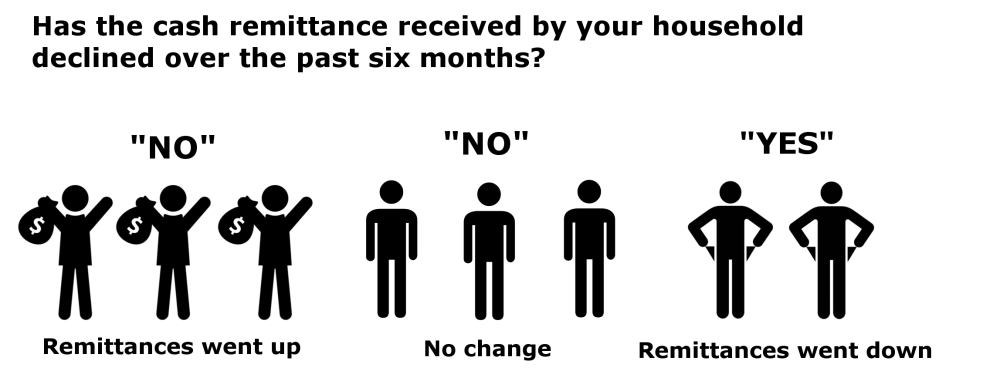

For their assessment, the FSNAU randomly surveyed 2,300 urban households across six different cities and towns in Somalia. They asked a number of remittance-related questions, including the amount each household had received over the past few months. The question which has received a lot of attention is the following: “has the cash remittance received by your household declined over the past six months?”

One hundred twenty of the 478 families who answered this question said “yes,” leading many to be concerned that remittances to the region were declining. These concerns were compounded by the fact that some of these families — about one-third — stated that remittances had fallen because their relatives were abroad in countries which no longer had the capability to send money to Somalia.

Yet there is a fault in the design in the survey which makes it impossible to tell if remittances have really declined. The key problem is that no families were asked if their cash remittances had increased in the past six months.

Consider the below example of eight people, of which three have seen an increase in the amount of remittances they receive over the past six months, three have seen no change and two (25%) have seen a decrease. By only asking households if they have seen a decline in remittances, the survey was unable to detect whether or not any households had seen any increase. In the below example, more people have actually seen an increase than a decrease, but the resulting statistic (25% have seen a decrease) makes it appear that overall remittances are going down. Average remittances to the region might have even gone up in the past six months, but the structure of the question inherently obscures this.

Before we know if Somali remittances are declining, we need more and better data.

To understand whether or not remittances to Somalia really were declining, we would need to know by how much each family’s remittances had changed over the past six months. Unfortunately, the way the survey was constructed, we’ll never know.

What’s the answer here? At the end of their report the FSNAU argues that the results “underscore the importance of the need for monitoring remittance flows and their dynamics more closely” and pushes for more data collection (primarily from remittance companies) to get a better grasp of whether regulation is having an effect on remittances.

I agree — more data is absolutely crucial to informing the debate on the impact of AML regulation on remittance flows. But if we want the data we gather to be reliable, we are going to need to design and implement better surveys with carefully considered questions. In fact, the need for more high quality data related to remittances and other cross-border transactions is one of the key recommendations of CGD’s Working Group on The Unintended Consequences of Rich Countries’ Anti–Money Laundering Policies on Poor Countries, which will be released very shortly, so watch this space!

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.