Regulatory arbitrage—the practice whereby banks try to escape jurisdictions with more stringent regulations in favor of less stringent ones—has been a topic of active research interest. Previous research has shown that banks do indeed direct financial flows to countries with less strict regulations, and take over banks or establish subsidiaries in these countries. In a recent paper, we explore whether multinational banks engage in such regulatory arbitrage through their choice of location for originating their share of syndicated loans. The short answer? Yes.

Banks that participate in the international syndicated loan market tend to be multinational themselves, operating banking establishments in several countries. This implies that banks typically have a choice in which country to originate their share of a syndicated loan, taking into account international differences in, among other things, capital regulation. Lending provided through a foreign subsidiary is subject to subsidiary-country bank capital regulation, and international banks thus can engage in regulatory arbitrage with respect to capital regulations by originating loans through foreign subsidiaries located in countries with relatively weak regulations.

Our study uses data for over 214,000 cross-border syndicated loan contributions by 42 multinational banking groups headquartered in 10 countries, providing loans to borrowers in 151 countries over the 1999-2014 period. Our estimation relies on within-loan contribution variation in origination locations for individual banking groups, which enables us to fully control for borrower, banking group, as well as loan characteristics.

Our research provides three main findings:

1. More stringent capital regulations reduce the probability of loan origination in a country

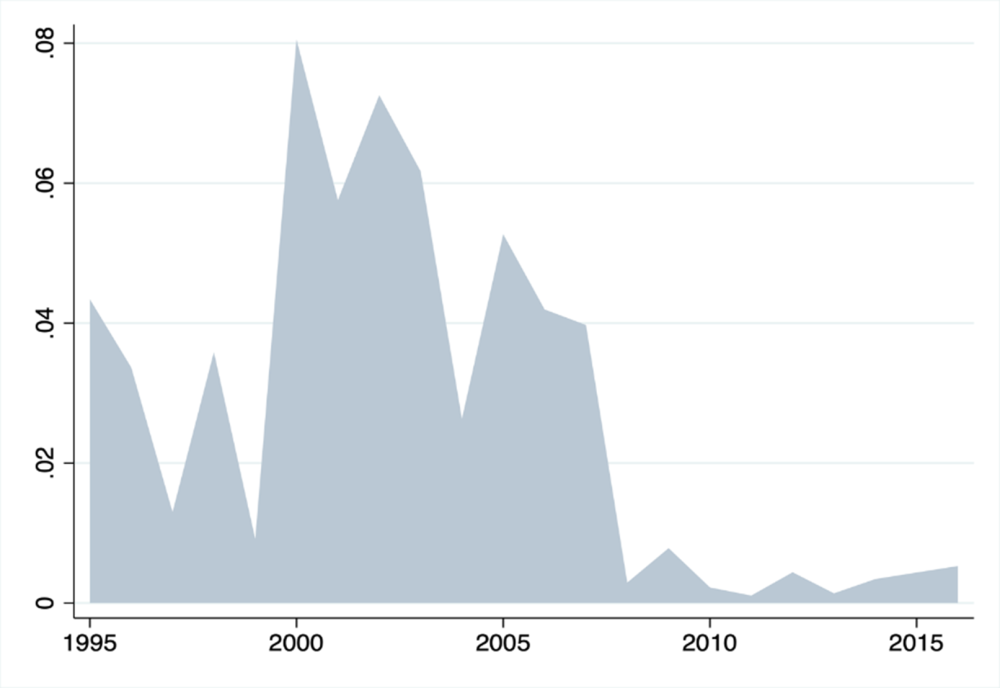

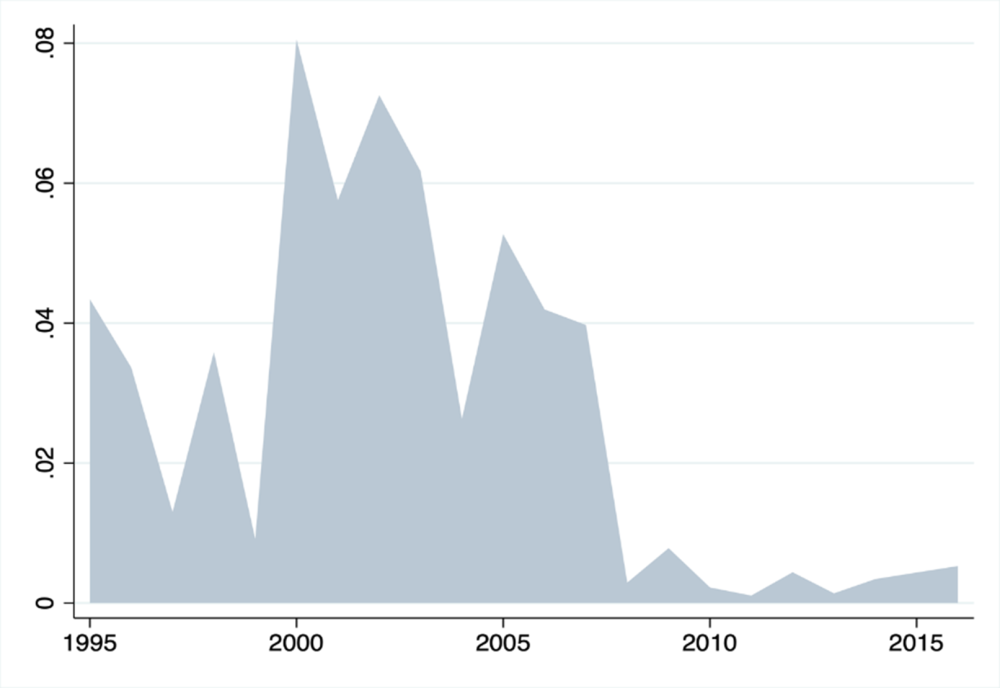

We see strong evidence of regulatory arbitrage. Since our data cover a relatively long period, we are also able to examine whether the intensity of regulatory arbitrage has changed over time, particularly following the financial crisis of 2008-2009 (see Figure 1). Indeed, the fraction of cross-border loans that have been arbitraged peaks in 2008 and significantly declines afterwards, potentially due to post-crisis changes in the regulatory regime and stronger enforcement through supervision.

Figure 1. Fraction of “arbitraged” cross-border syndicated loan volume

Note: This graph shows the volume of cross-border loans provided by foreign subsidiaries located in countries with less stringent capital regulation than in the parent bank’s country divided by the total volume of cross-border syndicated loans.

2. The regulatory arbitrage is more intense for weaker banks and riskier borrowers

Better capitalized banking groups engage in less regulatory arbitrage. This is consistent with the fact that these banks face less-binding capital constraints and therefore are less incentivized to engage in regulatory arbitrage to evade higher capital regulations. Similarly, loans to safer borrowers attract lower regulatory risk weights, thus requiring less regulatory capital. Hence location of safer loans is also less sensitive to international differences in capital regulations.

3. Loan location choices reflect a trade-off between a bank’s ease of information acquisition on borrowers versus the need to evade stricter capital regulations

Loan location is more likely to be in the borrower country, or in a country that specializes in the borrower’s industry, consistent with information gathering and evaluation being important choices, offsetting the potential benefits from evading stricter capital regulations. However, the easier it is to obtain information about prospective borrowers—say for more transparent borrowers that have a credit rating—the location choice becomes more sensitive to regulatory differences, and we see more intense regulatory arbitrage. In some cases this trade-off may prompt banks to originate loans in countries that are suboptimal from an information collection perspective, with regulatory arbitrage leading to a distortion in the bank’s information collection process.

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.