Ideas to action: independent research for global prosperity

Finance and Investment

More from the Series

Blog Post

March 21, 2024

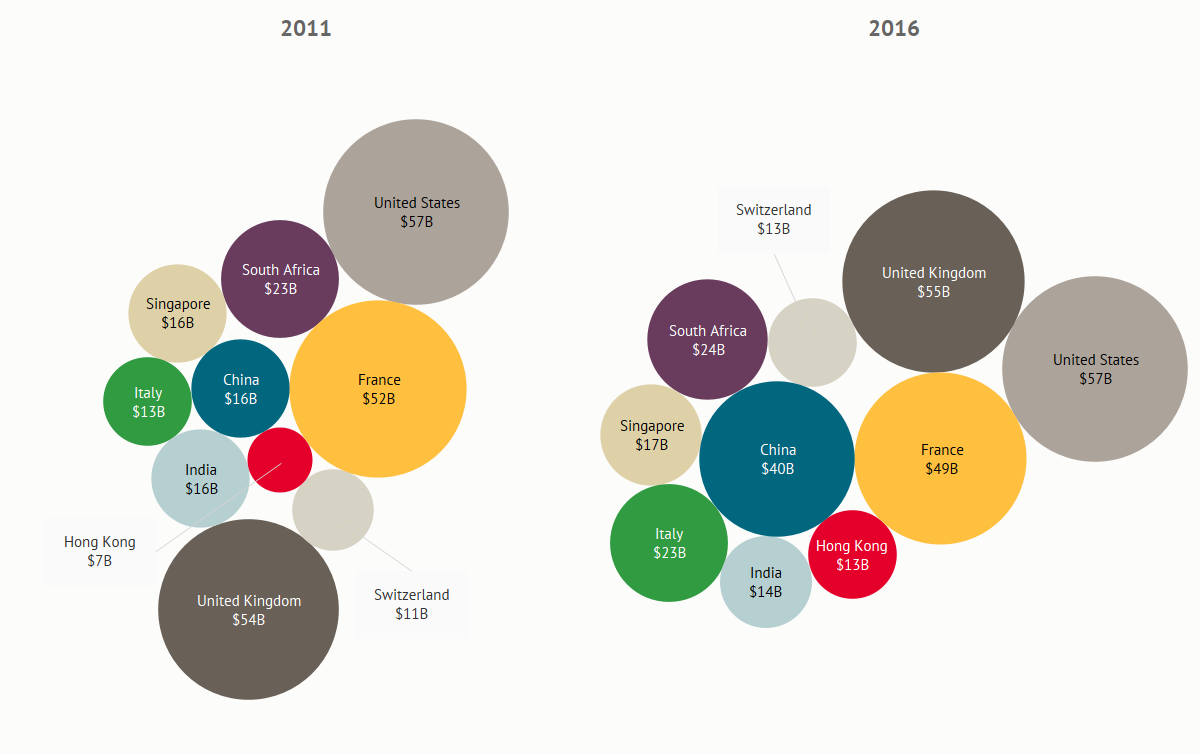

CGD's Gyude Moore speaks with Nick O’Donohoe from British International Investment and Frank Aswani from the African Venture Philanthropy Alliance about balancing local and international focus, the impact of a "funding winter," and how the public and private sectors can fill the financing gap for bu...

Blog Post

October 07, 2021

CGD’s Mikaela Gavas joins Gyude to discuss barriers to private investment in health and infrastructure projects and how a new initiative—an Accelerator Hub—could help local businesses and institutions in Africa develop financially viable proposals and connect them with investors.

Multimedia

September 09, 2021

Investment from the private sector and donor countries can boost growth in Africa, and is key to recovery from the COVID-19 pandemic. An Accelerator Hub would act as a one stop shop to help local businesses and institutions in Africa develop financially viable proposals, and connect them with invest...

Blog Post

August 17, 2020

In late July, we had called for the immediate release of the IFC/MIGA report, and we are pleased that the report has now been disclosed. The review is comprehensive and exposes serious problems in IFC/MIGA’s accountability system that have led to its dysfunction. The process for implementing reforms...