Introduction

The IMF’s concessional support for low-income countries (LICs) is provided primarily through the Poverty Reduction and Growth Trust (PRGT). Since the start of the pandemic, lending from the PRGT has risen very sharply in response to the unprecedented and urgent needs of LICs; total PRGT credit outstanding nearly doubled during 2020 to far exceed past peaks. Given the likelihood that these needs will continue to rise and persist for many years, there is an urgent need to ensure that the PRGT has adequate resources to face this challenge. Resources are also needed to ensure that the cancellation of debt service payments for a subgroup of the most vulnerable LICs that began in April 2020 can be extended for the maximum period of two years provided for under the IMF’s Catastrophe Containment and Relief Trust (CCRT).[1] This note considers possible financing sources, taking into account legal, political, and practical constraints including the timeliness with which different resources could be mobilized.[2]

The PRGT’s financial structure and lending capacity

The PRGT is financially distinct from the IMF’s General Resources Account (GRA) that encompasses the institution’s quota-based lending operations and other activities. The support the PRGT provides to LICs replicates many aspects of the IMF’s much larger non- concessional lending operations in GRA, including, for example, the use of policy conditionality on lending and a maximum maturity of 10 years on these loans. Given these similarities, there is an understandable tendency to think of the PRGF as simply another window for IMF lending that is geared to its LIC membership. However, PRGT loans do not draw on these quota resources, the GRA does not bear the credit risk of these loans, and the IMF’s Articles of Agreement significantly constrain the scope for GRA resources to be used to support the trusts such as the PRGT.

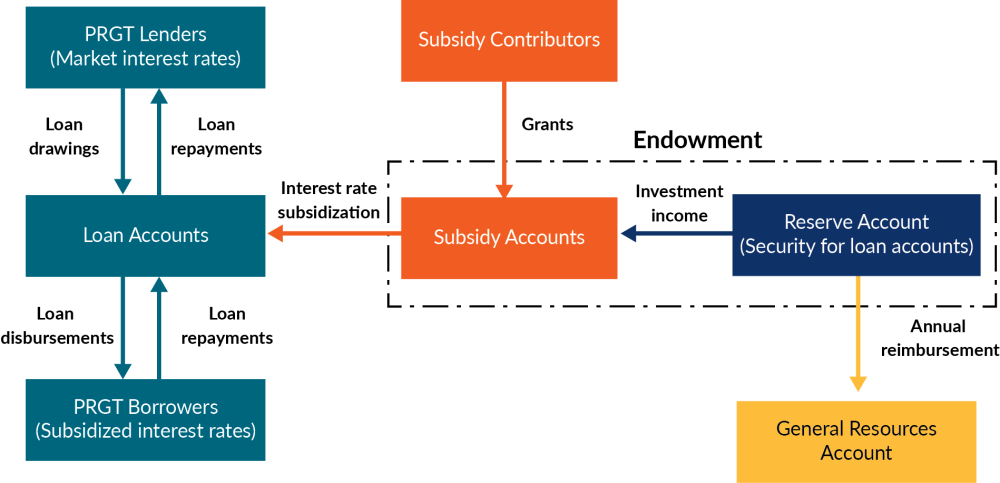

The financial architecture of the PRGT consists of Loan Accounts, Subsidy Accounts, and the Reserve Account (Figure 1). Loan resources borrowed from member countries at market rates are on-lent via the Loan Accounts[3] to PRGT borrowers at subsidized rates. Subsidy costs are financed from balances in the Subsidy Accounts. The Reserve Account provides security to lenders as its resources can be called upon to repay loans in the event of delayed payments by LICs borrowing from the PRGT. Investment income generated by the Reserve Account can also be used to meet subsidy costs.

Figure 1. PRGT Structure and Flow Funds

Source: Adapted from IMF publications

The PRGT’s loan resources are provided under a number of bilateral agreements with IMF member countries. When drawings are made under these agreements, the bilateral lender—typically a central bank or ministry of finance—is paid the SDR interest rate on these SDR-denominated loans.[4]

The recipients of these resources, the borrowing LICs accessing the PRGT, currently do not pay interest on these loans. By design, no interest is charged on drawings under the Rapid Credit Facility (RCF), which has been the main form of PRGT lending during the pandemic. The interest rates on drawings on the Extended Credit Facility (ECF), which provides commitments of three to five years to support long-term adjustment, and the lesser-used Short-Term Credit (SCF) are subject to adjustment depending on movements in the (three-month) SDR interest rate. However, no interest is currently charged on these facilities, and at the next biennial review of PRGT interest rates (scheduled for before end-June 2021) it is very likely that interest rates on all PRGT lending would remain zero; the 12-month average of the SDR rate would have to exceed 2 percent to trigger an increase in the rate charged on the ECF and SCF to 0.25 percent.[5]

These interest subsidy costs must be covered by non-GRA resources. Initially the subsidy costs of the IMF’s concessional lending (under the Structural Adjustment Facility, the Enhanced Structural Adjustment Facility, and then the Poverty Reduction and Growth Facility from which the PRGT evolved) were only covered by ongoing grants from member governments and repeated efforts were needed to supplement the resources in the subsidy accounts

In addition to the interest rate subsidy, the subsidy costs of this concessional lending include an annual “reimbursement” to the IMF’s GRA from the Reserve Account to cover the costs of running the PRGT. The largest element of this cost reflects staff time working on PRGT operations. The logic here is that, since the PRGT provides financial services that are available to only part of the membership, its costs should not be borne by the GRA, which encompasses the broader financial and operational support available to the membership as a whole.[6]

At the end of 2014 the PRGT was changed to a self-sustaining, endowment-based model structure. The endowment consists of the resources in the reserve and subsidy accounts. Total subsidy costs, including the annual costs of reimbursing the GRA, were to be met by the income generated from the investment of resources in these accounts. This change to a self-sustaining model was made possible by contributions from member countries, including the use of so- called windfall profits from IMF gold sales in 2009-10 (as explained later in this note). Under this new endowment structure, the subsidy costs could be met from income earned without the need for new fundraising and without depleting the resources in the endowment. This assured the ongoing lending capacity of the PRGT.

When the self-sustaining PRGT was established, it was envisaged that the subsidy and reserve accounts could generate sufficient income to support annual average lending commitments of around SDR 1.25 billion in perpetuity, without the need for additional subsidy resources. This average pace of lending commitments implied that, given the repayment profile for PRGT loans, over the longer term the level of PRGT credit outstanding would approximate to, or only moderately exceed, the size of the endowment.[7] This envisaged similarity between the size of the endowment and the stock of credit outstanding implies that, for the most part, the PRGT should be protected against movements in the SDR interest rate; a 1 percent increase in the SDR interest rate paid to bilateral loan contributors would be broadly offset by a 1 percent increase in returns on the assets of the SDR denominated endowment. The size of the endowment and thus the PRGT’s long-term self-sustained capacity is also influenced by the initial pace of lending; lower commitments and thus lower subsidy costs allow returns to accumulate in the endowment, bolstering future capacity.

In mid-2019, IMF staff estimated that the PRGT could accommodate annual average commitments of SDR 1.4 billion over the next decade without endangering the PRGT’s longer term lending capacity of SDR 1.25 billion. This reflected both earlier subdued demand for the PRGT and somewhat higher returns for the endowment, which over the longer term is expected to earn a premium of about 90 basis points over the SDR rate.[8]

Recent demand for PRGT resources

The demand for PRGT resources since the pandemic began has far exceeded these levels. In 2020, new commitments from the PRGT totaled about SDR 6.5 billion. Moreover, since the bulk of these commitments were under the RCF (which has a single disbursement of the amount committed) or augmentations to existing arrangement (which similarly facilitate quick disbursements) the stock of PRGT credit outstanding, which had been stable at around SDR 6.5 billion in the previous five years, also surged to about SDR 12.5 billion at the end of 2020.

The resultant disparity between the size of the endowment and the level of credit outstanding now exposes the PRGT to losses when interest rates rise. Before the pandemic, the PRGT’s endowment of around SDR 7.5 billion exceeded the level of credit outstanding but will approximate to little more than half this level in the near future even without a further sharp increase in PRGT lending. In the short term, the income from the endowment is likely to more than cover the associated subsidy costs; the SDR interest rate paid to contributors is just a few basis points, while the endowment’s income has been relatively strong.[9] However, even if new commitments were to revert to pre-pandemic levels, PRGT credit outstanding would increase to at least SDR 14 billion and remain at this level for some years given the grace period on PRGT loans. An increase in the SDR rate to close to 2 percent would then raise annual payments to contributors to about SDR 280 million but the returns from the endowment would, even assuming a premium of 90 bps over the SDR rate, be at least about SDR 50 million lower.

Including reimbursement of the GRA for PRGT costs, which in the FY2020 (to April 30, 2020) totaled SDR 62 million, the annual shortfall would be over SDR 100 million.[10] At higher levels of credit outstanding and higher interest rates, the losses would rise further. Interest payments by countries accessing the PRGT could be triggered by increases in the SDR interest rate, but these would not significantly alter this picture, in part because the RFC—on which no interest is charged—accounts for about half of the credit outstanding.

The sharp increase in PRGT credit outstanding has also weakened a key safeguard for PRGT lenders. As noted above, the risks to lenders to the PRGT are not carried by the GRA. Instead, the reserve account of the PRGT provides an assurance to lenders in that it can be drawn upon to repay lenders when users of the PGRT have fallen into arrears. The reserve account has typically equated to least one-third of credit outstanding but by the end-2020 had fallen below this level.

Although the self-sustaining structure of the PRGT is designed to accommodate significant annual fluctuations in the demand for PRGT resources,[11] the simple calculations above suggest that current resources alone are not adequate to deal with the scale of the increase in demand to date, let alone accommodate further increases. The agreed framework for the self-sustaining PRGT calls for contingency measures, including further fundraising from the membership and a suspension of reimbursement if the lending capacity falls short of the envisaged SDR 1.25 billion.

Avenues for financing the PRGT

PRGT lending is likely to grow even more in 2021 as the IMF begins to help LIC members address costs of the recovery from the COVID-19 crises. Additional financing will be needed to ensure that the PRGT can meet demand from LICs, both in the immediate term and over the long haul. How much financing is needed depends heavily on demand forecasts, both for COVID-19 recovery and for ongoing “chronic” needs beyond the recovery period. There are several avenues for mobilizing this financing.

First and most immediately, reimbursement of PRGT costs to the GRA could be suspended by a simple majority vote of the Executive Board halting the transfer to the GRA that would otherwise next take place in mid-2021 after the end of the current financial year.[12] Reimbursement of the GRA was included as part of the IMF’s New Income Model endorsed by the Executive Board in 2008.[13] At the time, the IMF’s income position was under extreme stress and operating funds were needed. However, that is not currently the case—suspension of reimbursement of the GRA would now have a relatively minor impact on the income position, marginally reducing the pace at which the institution is building reserves during a period of relatively high lending, and thus lending income. There are important precedents for such a step. During FY1998-2004 the Executive Board agreed to redirect over SDR 366 million of annual reimbursements that would have gone to the GRA to the then PRGF-HIPC Trust to finance both debt relief and subsidy needs in PRGT. Similarly, in FY2005-09, SDR 237 million was redirected to the PRGR-HIPC Trust. Suspending GRA reimbursement of about SDR 62 million would make a significant contribution to the PRGT, but it would not by itself be adequate to meet financing needs

Secondly, additional financing should be sought from bilateral donors. Early in the pandemic additional loan resources of SDR 12.5 billion were sought for the PRGT from bilateral contributors. By late August 2020, SDR 10.6 billion had been raised through new agreements or the augmentation of existing agreements with Japan and eight European countries; at the end of 2020 uncommitted loan resources totaled SDR 14.6 billion, compared with SDR 9.6 billion a year earlier.[14] Loan resources are relatively easier to mobilize, as donors continue to “own” the resources and receive interest on their use. Subsidy resources are a much tougher ask—they need to be in the form of grants to the subsidy account rather than loans that are on-lent to PRGT borrowing countries. They would typically require domestic budgetary approval by the donor and, even in the best of circumstances, cannot be provided rapidly.[15]

However, seeking bilateral subsidy resources now would run the risk of competing with the effort to mobilize grant resources for the CCRT, which is providing debt relief to 28 of the most vulnerable LICs. By early October the IMF had obtained commitments of grant contributions for the CCRT of SDR 360 million from 12 member countries and with the subsequent commitment from the EU of 183 million euros, just over half of the financing required to provide debt relief for the two years to April 2022 had been pledged. Although this has been achieved more rapidly than in past fundraising exercises—the CCRT was considered to be “chronically unfunded” prior to the pandemic—there remains an urgent need to compete the process; as was noted when the Executive Board approved a second six-month tranche of debt service relief through April 2021, continuation of debt service relief is “subject to the availability of sufficient resources in the CCRT.”[16]

A third financing option for the PRGT is the use of gold sales profits. The IMF holds about 90.5 million ounces (2,841 metric tons) of gold. The vast bulk of this stemmed from the original requirement that countries joining the IMF paid in 25 percent of their membership quotas in gold. Since the market value of this gold, over SDR 118 billion at end 2020, is substantially higher than its historic cost on the IMF’s balance sheet of about SDR 3.2 billion, it is not surprising that some have seen this as a potential source of additional financing.

The Articles of Agreement allow the IMF to sell gold outright at prevailing market prices and to accept gold from a member in payment of obligations to the IMF, also at prevailing market prices. These transactions require an 85 percent majority in the IMF’s Executive Board. The IMF does not have the authority to purchase gold or engage in other transactions such as loans, leases, swaps of the use of gold as collateral.

In the late 1970s the Fund sold about a third of its gold holdings following an agreement by the membership to reduce the role of gold in the international monetary system. Since then and following the approval of the second amendment to the Articles of Agreement, which formalized this reduced role for gold, the IMF has conducted two rounds of gold sales. Both of these involved relatively small shares (about one-eighth) of total gold holdings.

The gold sales that were conducted in 1999 to 2000 provide a useful illustration of a mechanism for possible future gold sales to support higher concessional lending. The IMF’s Executive Board approved the sale of up to 14 million ounces of gold to help finance the IMF's participation in the Heavily Indebted Poor Countries initiative (HIPC). The scale of this operation was consistent with the IMF's policy that it should continue to hold a relatively large amount of gold for prudential reasons as well as to meet unforeseen contingencies.[17] Between December 1999 and April 2000 separate but closely linked transactions involving a total of 12.9 million ounces of gold were carried out between the IMF and two member countries (Brazil and Mexico) that had financial obligations falling due to the IMF. In the first step, the IMF sold gold to the member at the prevailing market price and the profits totaling just over SDR 2.2 billion were placed in the “Special Disbursement Account” (SDA). In the second step, the IMF immediately accepted back at the same market price the same amount of gold in settlement of the members’ financial obligations.

Since the net effect of these transactions in 1999-2000 was to leave the IMF’s gold holdings unchanged, they did not affect the balance of the global gold market. The gold market is an unusual commodity market in that (aboveground) gold stocks are very large in relation to annual mining output. As a result, the gold price can be very sensitive to changes or expected changes in gold holdings, including holdings by the IMF. Avoiding disruption to the gold market remains an important facet of the IMF's policy on gold sales; assuaging concerns over potential market disruption is likely to remain important in gaining political support for any gold sales.

The world’s five largest gold producing countries account for about 30 percent of the voting power of the Fund’s Executive Board and thus could block any gold sales (which require an 85 percent vote). Thus, selling the Fund’s gold in a way that does not disrupt commercial markets is critical.

The Second Amendment to the Articles of Agreement, passed in 1978, introduced a distinction between gold that was acquired by the IMF before and after the Second Amendment. The Articles provide for profits from the sale of pre-Second Amendment gold—such as those from the gold sold in 1999-2000—to be transferred to the so-called Special Disbursement Account and used to provide concessional balance of payments assistance to members on a basis that takes into account their per capita income level.[18] In this case, investment income from gold sales profits in the SDA was to be used to benefit the HIPC initiative. However, a further stipulation was that profits from the sale of pre-second amendment gold (the vast bulk of total holdings) placed in SDA is that it can be used only for operations and transactions that are consistent with “the purposes of the Fund” as defined in Article 1. Accordingly, this architecture would not appear to support the use of gold sales profits to, for example, provide an earmarked fund to support directly climate or health spending.

An operation similar to that conducted in 1999 to 2000 could in principle be used to provide new subsidy resources for the PRGT. As well as Executive Board support of 85 percent, this would require agreement from a member or members to purchase gold from the IMF at market prices and then immediately use this to settle forthcoming obligations. The scale of principle amounts (repurchases in the language of the GRA) falling due in the near future—about SDR 7.5 billion in 2021 and almost SDR 18 billion in 2022—on the face of it suggests there would be scope for this type of operation. The main drawback is that accepting gold (instead of currencies or SDRs) for the settlement of obligations somewhat reduces the IMF’s liquidity and net income.[19] Alternatively, the IMF could seek to sell gold in off-market transactions to central banks wishing to increase their holdings of gold (so that the sales would not be followed by use of the same gold to settle obligations to the IMF). However, it may be difficult to ensure ex-ante that subsequent off-market transactions are sufficient to take up the desired volume of gold sales. If so, the resulting potential for significant on-market sales that would affect the balance of the commercial market for gold could engender opposition from gold producers.

In 2009-2010 the IMF again sold almost 13 million ounces of gold, but the modalities of this operation were different. This gold was acquired after the second amendment[20] and as a result the proceeds from sales had to be placed within the GRA for the benefit of the entire membership and could not be used to augment the SDA. The sales which were again structured to avoid disruption to the gold market took place over an extended period and included off-market and then phased on-market sales.[21] The operation was initially geared to generating profits to fund an endowment as part of the IMF’s New Income Model to provide a durable and more reliable form of financing to support the IMF's administrative budget. However, profits from gold sales were stronger than anticipated and the Executive Board decided that the resulting windfalls, totaling SDR 2.45 billion, should be used to support the PRGT. As there was no legal basis for a direct transfer of these profits from the sale of post-second amendment gold from the GRA (where they had accumulated in the General Reserve) to the PRGT, a cumbersome indirect procedure was adopted. The Executive Board approved, by 70 percent majorities, two distributions from the General Reserve to the membership in proportion to quota shares. However, these approvals were not granted until more than 90 percent of the membership had agreed that their shares of the distribution would be placed in the PRGT subsidy accounts. This inevitably entailed a lengthy delay of almost four years (the self-sustained PRGT formally commenced in late 2014) and some loss of potential income for the PRGT as not all IMF members agreed to the transfer.

One final point is worth stressing in relation to the 2009-10 sales and the related steps to fund the PRGT: it will be very difficult to use gold sales proceeds for operations outside the Fund’s mandate. While various analysts have proposed such an operation, it is important to note that the IMF’s remaining gold holdings were very largely, if not entirely, acquired before the second amendment. As a result, any profits from sales of this gold would in the first instance be placed in the SDA and could only be transferred to the GRA for “immediate use” in operations and transactions.[22] Transferring the proceeds to other uses would require a prolonged operation, such as the one described above.

A possible combination of financing options

The IMF faces immediate financing challenges in its support for LICs. Additional resources of close of SDR 0.5 billion are urgently needed to finance continued debt relief for its most vulnerable members for another year using the CCRT. At the same time, on plausible assumptions, including on the future course of interest rates, the subsidization capacity of the PRGT under its current self-sustained financing model appears close to exhaustion if not already fully exhausted.

Suspending reimbursement of the GRA for the cost of running the PRGT would help. A decision to suspend reimbursement would immediately end a significant annual outflow from the Reserve Account and thus the endowment which generates income to cover subsidy costs. But by itself it would not meet the PRGT’s financing needs.

Gold sales could provide additional financing for the PRGT, but even under the best circumstances this process could take years, not months. The 85 percent majority needed for these sales is a high bar, and past experience suggests that the sales modalities may well be protracted. In current circumstances the difficult process of generating near-unanimous support for gold sales would also be complicated by the uncertainties as to the needs of LICs in the short term and the scale of IMF support that should be planned for the longer term; both of these considerations would be key to determining the resources needed by the PRGT and thus the volume of gold sales.

A formal suspension of the self-sustaining financing model could serve as a bridge to future gold sales. The current framework entails that loan commitments should not be entered into if doing so would reduce long-term subsidization capacity below the threshold of SDR 1.25 billion. De facto, this constraint may already have been reached or even breached by the surge in lending in 2020. But if the PRGT is to draw significantly on its current uncommitted lending capacity of over SDR 14 billion, which includes the agreements from bilateral lenders that have only recently been put in place, a formal move away from this self-sustaining model would be required. A formal acknowledgment that commitments are not being constrained to preserve the self-sustaining model would also help to reassure LICs of the IMF’s ability to continue to lend at higher levels.

An analogy may be helpful. An accomplished runner knows she can sustain a steady pace for the duration of a marathon. She deliberately restrains her effort, maintaining reserves for later. If suddenly the race were to change from a marathon to a much shorter dash over a few miles, the runner knows that she can pick up her pace, digging more rapidly into her reserves to face this different challenge. But at some point, well short of the marathon distance, she would then need to ease off to below the pace she could sustain in a marathon or even stop to recover. Similarly, the PRGT could support a much higher pace of lending than allowed for in the self-sustaining model for a some years by drawing drawn the endowment at the cost of the future pace of lending capacity. Recovery for the PRGT and the return to a sustainable financing model would then need to come in the form of a replenishment of the endowment which could, as in the past, be provided by a combination of bilateral grants and profits from gold sales.

The lending capacity of the PRGT would be increased sharply over the medium term by suspending the self-sustaining model. Formally lifting this constraint to allow the endowment to be drawn down to finance subsidies on new lending commitments could greatly increase the potential lending capacity for the next few years. Box 1 provides an illustration of the scale of lending that could, in the extreme, be accommodated by depleting the endowment. Assuming an SDR interest rate of 2 percent, maintaining commitments at the elevated level seen in 2020 for the next three years (2021-23) would entail a corresponding commitment to meet subsidy costs, beyond those envisaged in the self-sustained framework of close to SDR 3 billion.[23] These additional subsidy costs equate to about three-quarters of total subsidy accounts of the PRGT.

While the subsidy account could absorb these losses, care would have to be taken to address another potential constraint within the PRGT. As noted above, the reserve account of the PRGT provides an assurance to lenders. If lending were to continue at the pace seen in 2020, the reserve coverage ratio would decline to under 15 percent, well below its past levels. However, a lower reserve coverage could be considered acceptable while repayments to the PRGT continue to reflect the pre-pandemic levels of credit outstanding; only in 2025 will repayments begin to reflect the surge in lending seen in 2020. This is another factor to be considered in the timing of possible gold sales which allow resources to be added to the reserve account.

After a period of higher lending, returning the PRGT to a self-sustained model would require a significant injection of resources. This could be provided through some sales of pre-second amendment gold. On past experience, support for such an operation would be more likely to emerge if gold sales were all off-market and if, as was also the case in 1999-2000, the intention was to retain the corpus of the gold profits in an endowment with only the income so generated used to support future lending. The volume of gold sales would probably not be out of line with past operations; at current prices a sale of 5 percent of the current gold holdings could generate profits of SDR 5-6 billion.[24] However, given the uncertain prospects for gold sales, and the possible scale of the PRGT’s need, concerted efforts to raise bilateral support should also be an integral part of the effort to mobilize resources.

None of the above would address the immediate financing needs of the CCRT. One avenue that could be explored is whether the PRGT’s subsidy resources could be used, in extremis, to meet some of the CCRT’s needs. Without addressing precise legal technicalities, this approach would appear feasible in that CCRT was initially funded using some of the same pool of resources emanating from the 1999-2000 gold sales that, via the SDA, ultimately contributed to the funding of the PRGT. If this were feasible without a significant delay (for example, if transfers from the subsidy account required the approval of bilateral contributors to the subsidy account) such a transfer could meet the immediate funding needs of the CCRT. This would further deplete the PRGT's endowment and raise the need for future financing from possible gold sales and bilateral support.

The magnitude of gold sales and possible bilateral funding would also need to be assessed in the light of the desired future self-sustained capacity. The longer-term consequences of the pandemic cannot be assessed at this stage. However, a range of factors suggest that the self-sustained capacity may need to be larger than originally envisaged. The LICs are likely to emerge with greater vulnerabilities and a need to accelerate growth to catch up. This could also mean that it would take longer for countries to “graduate” from the PRGT, thus raising future demand. The experience of the pandemic could also suggest that additional capacity be built into the framework to deal with future emergencies.

Box 1. The PRGT’s Lending Capacity

Lending in 2020 was much higher than provided for in the self-sustaining framework of the PRGT. Broadly speaking, this implies that even with an immediate return to lending at the rate sustainable before 2020, the PRGT would face subsidy costs that would need to be met by drawing on the principal of in PRGT’s endowment. The size of this drawdown is uncertain and would depend, most importantly, on the future course of interest rates. This box is intended to provide an illustration of the possible scale of the drawdown and thus give an indication of the scale of lending that could, in the extreme, be accommodated by depleting the endowment and, equivalently, the amounts that would be needed to restore the endowment and the PRGT’s self-sustaining capacity.

1. The self-sustaining lending capacity (with only income from the endowment)

Before the pandemic the PRGT was operating in line with the assumptions of its self-sustaining model. In this equilibrium, annual lending commitments of about SDR 1.25 billion could be sustained over the long term. The endowment of SDR 7 to 8 billion—roughly the same size as the stable stock of credit outstanding—was expected to be able to meet the actual and projected subsidy costs of loans committed at this annual rate. Put simply, the SDR interest rate earned by the endowment would cover the interest paid to loan contributors while the premium of 90 bps above the SDR rate the endowment’s investments were expected to earn would cover the annual cost of reimbursing the GRA (around SDR 65 million).

2. Lending capacity, allowing the endowment to be depleted

In 2020 commitments of SDR 6.5 billion were over SDR 5 billion higher than this sustainable pace of just over SDR 1.25 billion. These commitments therefore entail subsidy costs that cannot be covered by the income from the endowment—this income can be thought of as being already “committed” to cover the subsidy costs of annual commitments of SDR 1.25 billion. Assuming the SDR interest rate averages 2 percent over the period that these loans are outstanding, these additional commitments imply additional subsidy costs of SDR 100 million a year, or a total of about SDR 0.7 billion, taking into account the average maturity of about 7 years. Three more years of commitments at this rate (SDR 6.5 or about SDR 5 billion above the annual capacity built into the model) would entail total additional interest subsidy costs since the start of the pandemic of SDR 2.8 billion (or about three-quarters of the total in the subsidy accounts). Or to put it another way, if the rate of lending seen in 2020 were to continue through 2023 and SDR interest rate were to average 2 percent over the duration of the loans committed in the period, the PRGT would then require an injection of close to SDR 3 billion to restore the self-sustained capacity of SDR 1.25 billion per annum.

This amount could be reduced by suspending reimbursement of the GRA. But if the idea were to resume reimbursement in a few years, the annual savings of about SDR 65 million would not change this arithmetic significantly. The subsidy costs would also be lower if the SDR interest rate were to be lower. But an average of 2 percent does not seem excessive for the more than 10-year horizon—it may well be too low. (The cash injection needed to replenish the endowment would also be somewhat smaller if it were provided earlier, thus generating more income for the PRGT.)

The cost of replenishing the PRGT would also be greater if a future capacity above SDR 1.25 billion was warranted to allow the PRGT greater scope to address future emergencies. Using PRGT resources to allow CCRT debt relief to continue would also raise the future financing needs of the PRGT by about SDR 0.5 billion.

[1]https://www.imf.org/en/Publications/Policy-Papers/Issues/2020/04/02/Catastrophe-Containment-and-Relief-Trust-Policy-Proposals-and-Funding-Strategy-49305

[2] This note does not address the related fundamental issue of complementary steps that may be needed in the light of debt distress that was emerging in a number of LICs even before the pandemic took hold.

[3] This set up includes a number of distinct loan and subsidy accounts because some subsidy and loan resources have been earmarked by contributors for particular lending windows (or “facilities”).

[4] Borrowing agreements reached in 2020 include payment of the three-month SDR interest rate to bilateral contributors, whereas earlier agreements typically used a market derived six-month SDR rate.f

[5] If the SDR rate exceeds 5 percent, the rate charged on ECF and SCF loans would rise to 0.5 percent. Interest has also been waived on small amounts still outstanding under the Exogenous Shocks Facility, the precursor to the RCF. https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/06/26/Poverty-Reduction-and-Growth-Trust-Review-of-Interest-Rate-Structure-47035

[6] This logic was reiterated in the establishment of the IMF’s New Income Model, which included an endowment funded by profits from gold sales in 2009-10 to provide a stable and durable source of income to help finance the IMF’s non-lending activities in the GRA, which were seen as a global public good. Reimbursement of the GRA by the PRGT, which had been suspended, was resumed in FY2013.

[7] Loans under the ECF and RCF are repayable in 10 equal installments 5½ to 10 years after disbursement, implying an average maturity of about 7 years. SCF loans are repayable over 4-8 years.

[8] 2018-19 Review of Facilities for Low-Income Countries—Reform Proposals: Review of The Financing of The Fund’s Concessional Assistance and Debt Relief to Low-Income Member Countries https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/06/06/2018-19-Review-of-Facilities-for-Low-Income-Countries-Reform-Proposals-Supplementary-46970

[9] Declining interest rates, and thus rising bond prices, bolstered returns on the fixed income portfolio alongside gains on the smaller equity securities portfolio.

[10] Reimbursement costs for FY2021 could also be higher given the intensity of work on PRGT operations.

[11] 2018-19 Review of Facilities for Low-Income Countries---Reform Proposals: Review of The Financing of The Fund’s Concessional Assistance and Debt Relief to Low-Income Member Countries https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/06/06/2018-19-Review-of-Facilities-for-Low-Income-Countries-Reform-Proposals-Supplementary-46970

[12] The annual decision on the transfer from the Reserve Account reimburse the GRA for the costs of administering the PRGT GRA requires a simple majority.

[13] The IMF's New Income and Expenditure Framework—FAQs www.imf.org/external/np/exr/faq/incfaqs.htm. Reimbursement commenced in FY2013 after gold sales had been concluded.

[14] https://www.imf.org/en/Publications/Policy-Papers/Issues/2020/10/20/2020-Borrowing-Agreements-With-The- National-Bank-Of-Belgium-Banco-Central-Do-Brasil-Banque-49832

[15] Subsidies may be provided through low or zero interest loans to the PRGT which are then invested to gain income for the subsidy account. The grant provided to the PRGT for subsidies is thus equal to the income forgone by the provider.

[16] Catastrophe and Containment Relief Trust—Second Tranche of Debt Service Relief in the Context of the Covid-19 Pandemic https://www.imf.org/en/Publications/Policy-Papers/Issues/2020/10/06/Catastrophe-Containment-and-Relief-Trust-Second-Tranche-Of-Debt-Service-Relief-In-The-49810

[17] Since the last financial crisis IMF’s total lending capacity in the General Resources Account of US$1 trillion has been stressed as a bulwark for stability. This capacity for the most part represents quota resources and borrowing agreements that the IMF can draw upon from member central banks. In intermediating these resources the IMF (or strictly speaking the GRA) carries the risks so that central banks can in turn carry the resources lent to the IMF –their “reserve tranche positions” and drawings under borrowing agreements —at their full face value on their balance sheets. In this context the IMF’s (undervalued) gold holdings are seen as providing a fundamental strength to the balance sheet, providing an additional backstop to support the IMF’s unique financing mechanism

[18] Article V, Section 12(f)(ii)

[19] Settlement in gold does not result in the reduction in the reserve tranche positions of IMF members that would take place if payments were made in currencies. The potential future increases in reserve tranche positions are correspondingly lowered and the IMF continues to pay interest (broadly at the SDR rate) on these positions.

[20] These sales represented the gold acquired in the 1999-2000 operation.

[21] To limit the potential impact on the gold market, on-market sales were in effect accommodated within the envelope for sales in the 2009 Central Bank Gold Agreement entered into by the ECB and 21 other central banks.

[22] Article v, section 12(f)

[23] The calculations in Box 1 are on a commitment basis, capturing the projected subsidy costs of lending for the life of the loan. As such, and on the basis of the assumed rate interest, they are also intended to show the scale of resources that would be needed to restore self-sustained the capacity of the PRGT. (In contrast, the earlier estimates in this paper captured only the immediate losses on a cash basis).

[24] In the absence of gold sales, there could in principle be a distribution from the General Reserve geared to supporting the PRGT. This would require the same lengthy process followed after the 2009-10 gold sales to obtain commitments from member countries to apply the bulk of the distribution to the PRGT. More importantly, a significant transfer from these reserves is unlikely to be seen as prudent when GRA lending is at historically high levels.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.