Recommended

Despite substantial recent cuts to its aid budget, the UK has been stepping up its efforts to mobilise more finance, and in the development strategy published in May 2022, the concept of British Investment Partnerships (BIP) was formalised, with a target to mobilise £8 billion of UK-backed finance by 2025 using several new and existing tools.

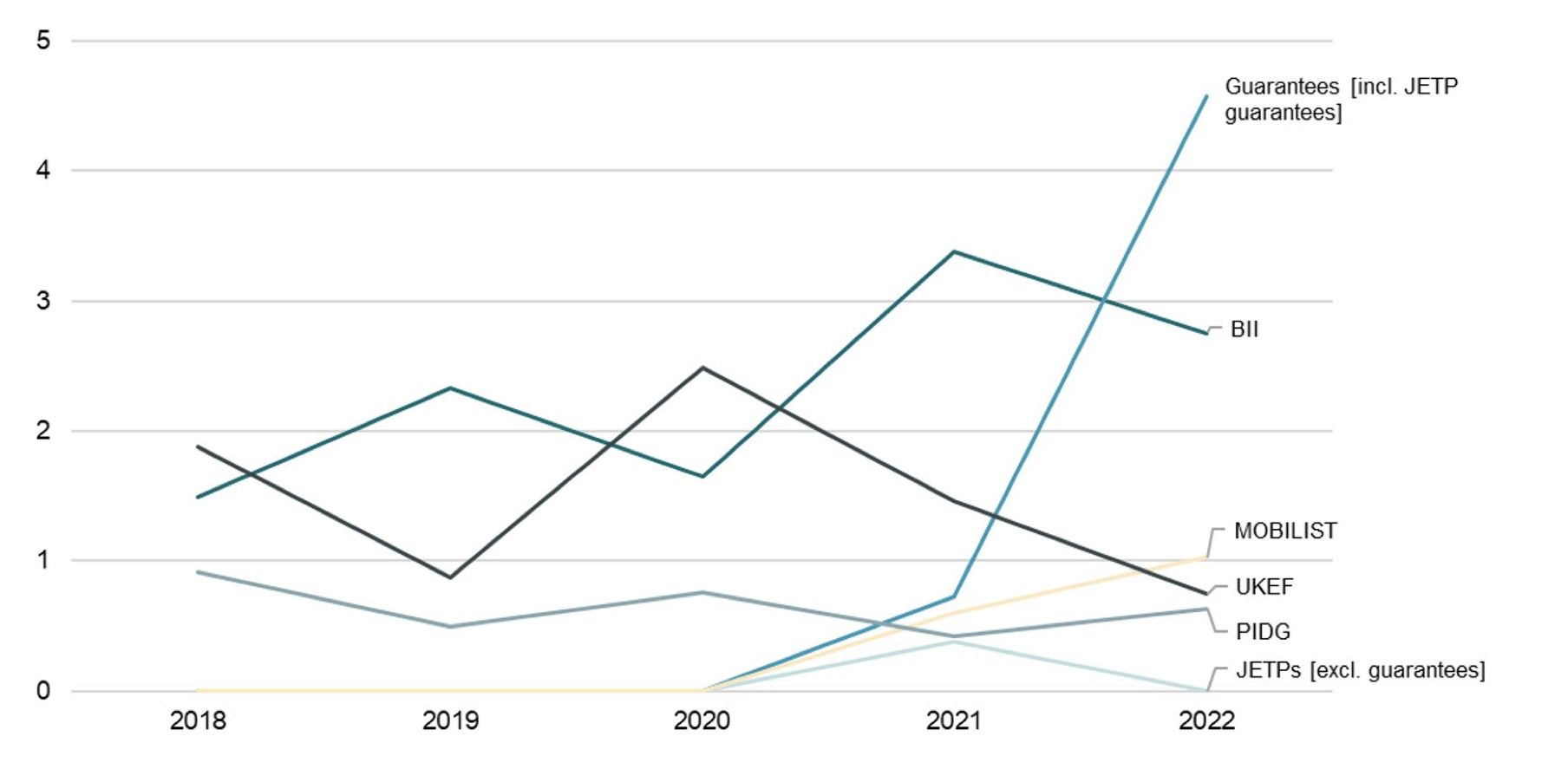

We have reviewed each of the UK’s seven main finance tools—from export finance to capital increases at its private finance arm, British International Investment. Overall, we find that the UK has substantially increased the level of finance it mobilises, from around £3bn in 2018, to £5bn in 2021, and depending when finance is recorded, we estimate it may exceed its target with £10bn mobilised in 2022. This has generated substantial new volumes of finance to support climate objectives, and increasing lending to Ukraine. Here we draw out four headline findings:

1. Guarantees are a new, innovative and powerful tool

The biggest and most innovative change in the UK Government's approach actually pre-dates the strategy—the use of loan guarantees to increase lending by multilateral development banks to developing countries. This has generated some £5 billion in lending for both climate objectives and supporting Ukraine. This is genuinely new finance made possible by the UK’s guarantees, and taking advantage of the Banks’ preferred creditor status (i.e. very likely to be repaid), and their ability to raise money from private investors. Of course, this isn’t lending directly by the UK—but in practice it is equivalent, the UK is able to catalyse loans with partner countries for shared development objectives.

Figure 1. Trends in Finance Commitments of Main BIP Elements (Nominal ₤M)

Transparency around the UK’s guarantees is seriously lacking, however, and the Government should follow Sweden’s example of an annual report. It should also ensure that the OECD’s Development Assistance Committee does not change their rules on aid to double-count the risk of guarantees (at the moment they—correctly—only count as aid if the UK has to cover the borrowers repayments).

2. The best way to mobilise finance is through multilateral banks

Billions of pounds worth of public money will not, in fact, catalyse trillions of private investment. Indeed, the mobilisation ratios, based on agreed methodologies, are relatively modest. For example, British International Investment—the largest spender under the BIP heading—has ‘mobilised’ a further 53p for every pound of UK taxpayer money invested. Put another way, when BII makes an investment in a company, private investors also do so but with half as much finance as BII. Other tools have better ratios—in particular, the Private Infrastructure Development Group mobilised three times this amount (£1.50 for every pound) and some smaller instruments like MOBILIST—that enables stock market listings—have mobilised some £4 per pound.

A much better way to use private investment to support development is through multilateral development banks. Unlike the UK’s investment vehicles, they are able to issue bonds that can be purchased by private investors, multiplying the amounts banks have to lend. So, £1 in capital can be used as equity to enable the bank to issue bonds and make loans of around 5 times the original capital value. The use of guarantees (in place of capital) can increase this ratio even further.

3. Scope to report greater volumes of climate finance

The UK has long taken the principled position of reporting conservatively on climate finance to the UN; and its own headline commitment is of £11.6bn in Official Development Assistance (ODA) by 2025-26. Still, much of the finance mobilised—particularly through guarantees and multilateral development banks—arguably meets the UN criteria of being ‘new and additional’ and could legitimately be reported as climate finance. This is not just a reporting issue but also about focussing resources: developing countries have emphasised their desire for grants, and for support on adaptation rather than mitigation. The UK can respond to this with its grant and ODA resources, focussing them on adaptation and resilience in the poorest places where other finance is unsuitable; while using less concessional resources like guarantees, export finance and multilateral lending to support mitigation for countries with higher emissions.

4. Poverty focus is variable and needs sharpening

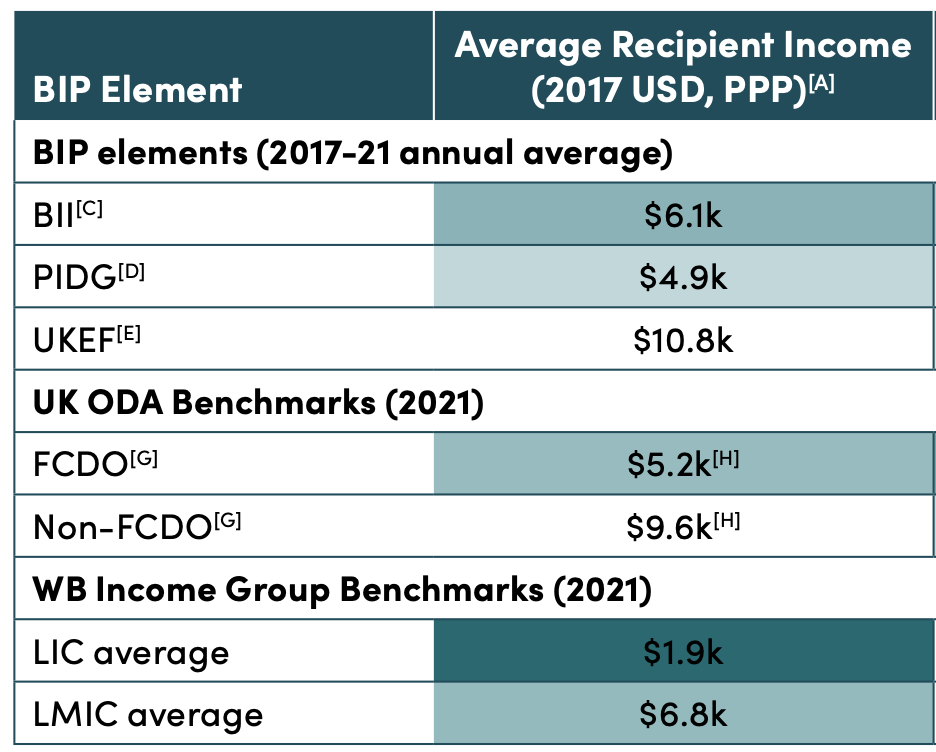

Finance has the greatest impact when it affects the lives of the poorest, and an important guide to that is whether institutions are spending in low income countries. The context is that the Governments’ allocations are losing focus on the poorest. We’ve undertaken the first analysis of the BIP instruments’ poverty focus and compared it to the FCDO’s (and other departments’) bilateral ODA spend.

The Private Infrastructure Development Group—which is a multi-donor organisation that seeks to mobilise investment—is reaching countries with relatively low average income (and achieves relatively high mobilisation of private finance, as above). Indeed, its recipients have lower average incomes than those of FCDO.

Table 1. Poverty Focus of BIP Elements

Source: Authors analysis, [A-H] see report for full notes

It’s also notable that, while BII is generally investing in countries with a higher average income than the FCDO’s typical partners, it is more pro-poor than other government departments spending ODA (especially the former Department for Business, Energy and Industrial Strategy (BEIS) and the Conflict, Stability and Security Fund (CSSF)).

Finally, export finance—which enables trade by lending to overseas Governments or companies so they can buy from UK companies—is in part focussed where there is demand, rather than the poorest countries. However, export finance is valuable in lower-income countries and volumes have declined in the last two years. The government can shape where its export finance is focussed through its deployment of International Export Finance Executives; and we encourage it to further expand its efforts.

Taken together, we think that the country allocation and poverty-focus beyond FCDO needs closer attention and direction with clear expectations on country income allocation to ensure the UK’s overall portfolio of aid and finance is focussed where it’s needed most.

Conclusions

The UK’s development strategy and its claims to be a reliable and stable partner were immediately undermined with further cuts in its country allocations.

But the UK’s use of guarantees has been innovative and meaningful, demonstrating to other countries that multilateral banks can do more with their balance sheets. Guarantees, and funding through multilaterals more generally, offer significantly more mobilisation and impact than ODA funding through BII. This focus on finance beyond ODA is long overdue; and the UK can take the opportunity to be more transparent and focussed in its use of finance instruments going forward.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.