Subscribe

Subscribe today to receive CGD’s latest newsletters and topic updates.

All Commentary

Filters:

Topics

Facet Toggle

Content Type

Facet Toggle

Time Frame

Facet Toggle

Blog Post

May 06, 2024

MEL practitioners—and knowledge producers more generally—should adopt an approach that is attuned to a realistic model of the stages of the policy process and be ready to seize windows of opportunity to apply evidence. This may require navigating competing demands, recognizing tradeoffs, and making ...

Blog Post

May 03, 2024

One of the things I missed last week was Jishnu Das’s excellent, heartfelt piece about the state of development economics. But he’s not talking about causal identification or taking potshots in the war on randomization, but about the deeper values that he suggests have gone missing from the discipli...

Blog Post

May 03, 2024

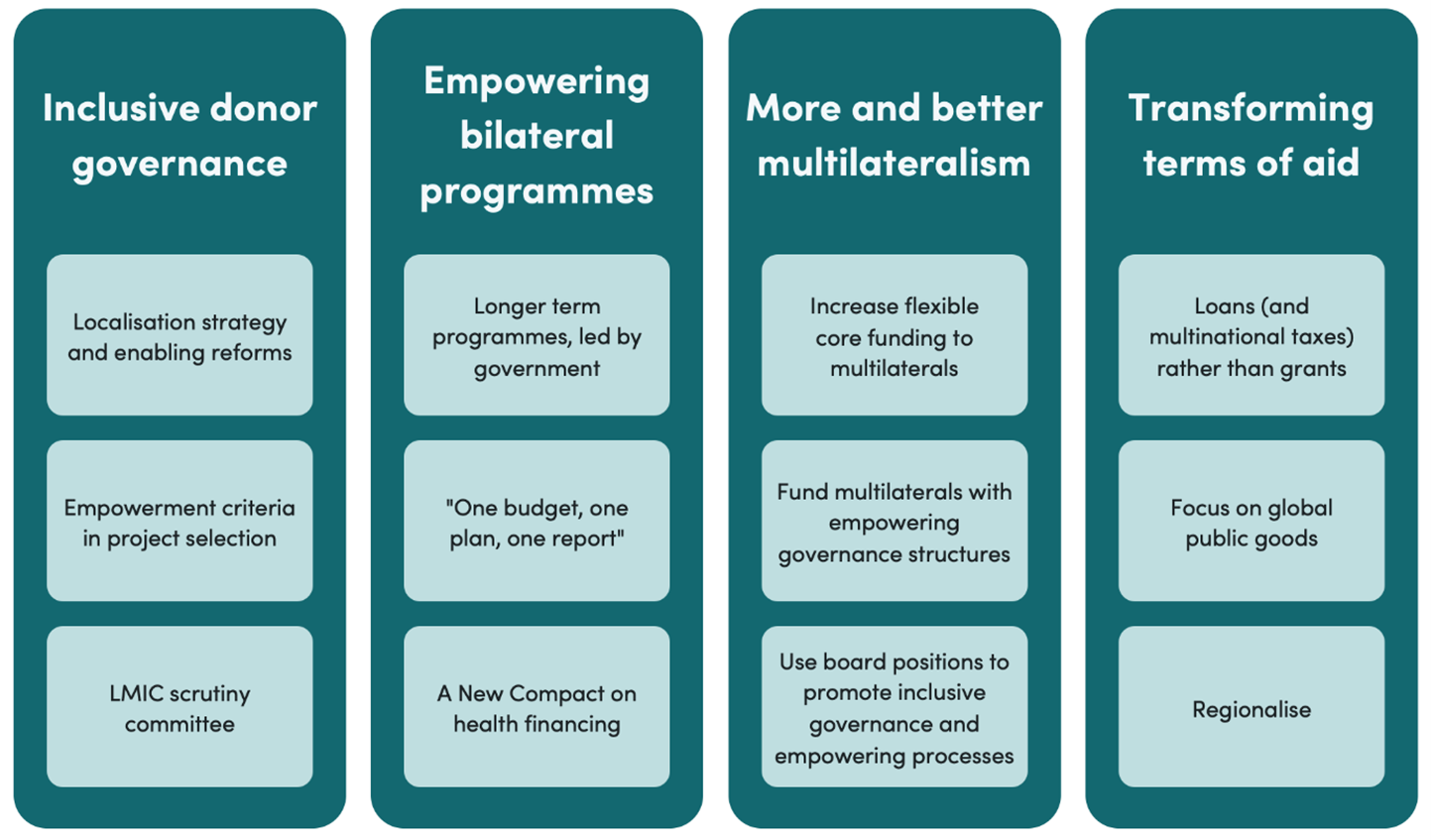

Global health is fundamentally undermined by power imbalances. Those who have the least access to health care, generally, have the least power to influence global health. This blog looks at one imbalance—the concentration of power in the hands of global health donors, in relation to governments and ...

Blog Post

May 01, 2024

At the core of African food insecurity are the continent’s notoriously low crop yields—the amount of produce farmers harvest relative to the area of land they farm. And one of the main reasons for low yield compared to other regions is that African countries, on average, use far less fertilizer to b...

Blog Post

April 30, 2024

The controversy around the IFC’s investment in Bridge Academies, a for-profit education provider in Africa and India, is not going away. Indeed, World Bank President Ajay Banga has committed to an external investigation of the entire fiasco. The Bridge investigation highlighted two significant accou...

Blog Post

April 30, 2024

Children around the world continue to face unacceptably high levels of corporal punishment in school and at home, with rates surpassing 90 percent in some places. It is one of the most common, widely accepted and preventable forms of violence. The education sector must ensure that bans are introduce...