How can decision makers leverage the private sector to improve the lives of women?

-

For firms:

Diversify global supply chains by increasing the number of women-owned firms in procurement channels.

-

For banks:

Design financial services with women’s needs in mind and collect and disseminate sex-disaggregated data.

-

For nations and international organizations:

Eliminate formal and substantive biases that prevent female-owned firms from participating in international trade.

Recently CGD hosted the Second Annual Birdsall House Conference on Women, which focused on beyond-aid approaches for women’s economic empowerment, with particular emphasis on private sector engagement. CGD experts have written about how international organizations and national agencies should examine and correct gender biases in the design and delivery of their strategies for financial inclusion. But while public sector interventions are crucial for promoting women’s economic empowerment, the panelists pointed out that the private sector is in many ways better equipped to provide opportunities for women to grow their businesses, investments, and incomes. Here’s our takeaway.

Possibly the most popular weapon in the “beyond-aid fight” to promote both development and women’s financial inclusion has been microcredit. Yet despite strong claims that microcredit is the silver bullet we all need, there is little rigorous evidence that these programs have been as transformative as once assumed. Our keynote speaker Dr. Dean Karlan, who has conducted field research on financial inclusion and enterprise growth in the developing world, explained that in reality, the gender-effects of microcredit are limited: while credit may promote better risk management and business confidence, it does little to spur growth, mitigate market failure, and create positive spillovers for communities. Truly gender-inclusive development should promote female decision making in addition to economic growth.

How can the private sector help?

First, corporations should diversify their suppliers by widening their pools of contractors to source from female-owned enterprises. While aid channels can provide assistance to women entrepreneurs, they can’t provide the trillions of dollars of purchasing power held by the private sector.

Aside from promoting social responsibility, introducing diversity into supply chains just makes business sense. Developing more robust female-owned businesses creates competition, which can lower prices. It also brings in new customers: companies can reach poor and rural consumers who may not have had access to their products before. WeConnect provides a perfect example of how to get this done: started by Elizabeth Vazquez, the initiative connects companies like Walmart, Coca-Cola, and IBM to businesses owned by women worldwide. These partnerships have resulted in a scale up unlike any national project: Walmart has sourced $20 billion in contracts from women-owned businesses and doubled its sourcing from female suppliers abroad since 2011. Further, to address demand-side, capacity-related constraints, WeConnect has encouraged firms to pair up with organizations like SEWA and WIEGO to train and mentor women business owners. This way firms can connect with the most vulnerable women, especially informal workers, to enhance their capacity, visibility, and voice.

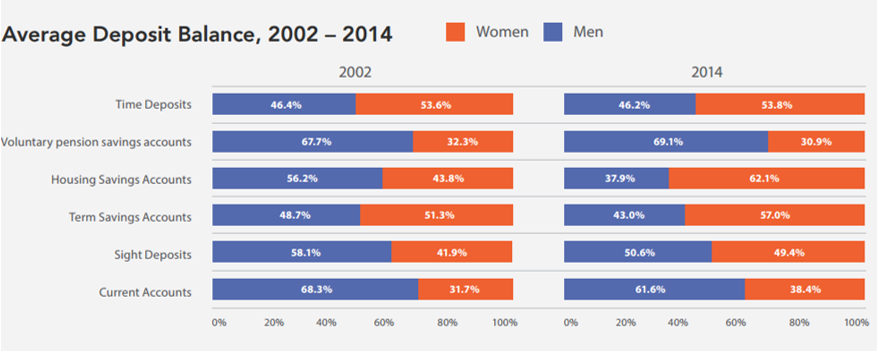

Second, and perhaps obviously, banks and other financial service providers are uniquely positioned to promote women’s financial inclusion. While the number of formal bank accounts has increased significantly over the past few years, the gender gap in account ownership has not budged. Among the poorest, this gender gap is larger still, despite numerous studies showing that women are more prone to save than men. Banks will continue to miss out on a huge growth opportunity until they start viewing women as important consumers of financial services and design products to help them save.

Providing secure, confidential savings is a start and can be easily achieved through mobile platforms, which have the potential to mitigate women’s mobility constraints and the pressures they face to spend rather than save. Other simple changes banks can make are to make their branches open during hours accessible for women and hire female bank agents. And, as we’ve emphasized before, banks need to monitor their progress on promoting financial inclusion with sex-disaggregated data on their customer base, as Chile has done for over 10 years.

Figure 1: Sample Indicators Collected in Chile

Source: Data 2x’s Case Study: Chile’s Commitment to Women’s Data

At CGD, we’re running our own evaluation in Indonesia and Tanzania to measure the impact of supply and demand side interventions on women’s use of mobile savings platforms. Through this evaluation, we’ll generate better data for practitioners and policymakers to improve their approaches in narrowing gender gaps in access to and use of financial services.

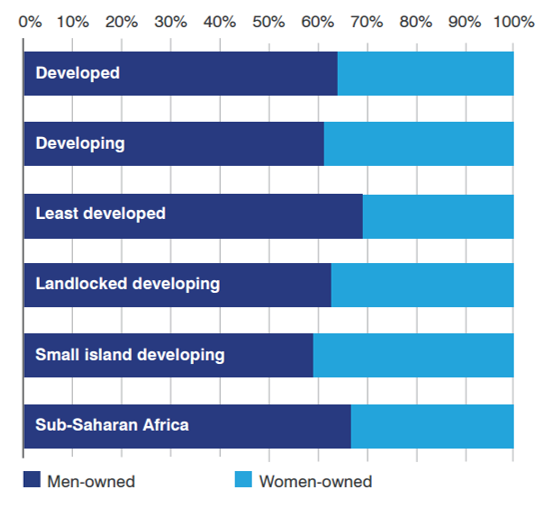

Finally, governments and international organizations must do their part alongside the private sector to enable female-owned firms in developing countries to trade and invest, which will boost economic growth and productivity, and create better paid jobs. Even though 34% of SMEs are owned by women, regulatory and legal barriers prevent integration of female-owned businesses in international markets. 155 countries have laws discriminating against female businesses. In parts of the Middle East and North Africa, women need permission from male guardians before registering their business, and even in countries like Australia, 55% of female-owned businesses reported that access to finance is difficult. But the evidence is clear: SMEs engaged in international markets are more productive than those who are not. With agreements like the Trans Pacific Partnership on the horizon, we need to start eliminating procedural and substantive biases against female-owned businesses immediately.

As we enter into a period of political transition, it’s crucial women and girls stay on the development agenda. We urge decision makers to consider beyond-aid options to empower women, particularly by leveraging the resources and positioning of the private sector to narrow gender gaps. We need to start thinking beyond common practices like microcredit and link women directly to supply chains and financial services that meet their needs, while systematically eliminating gender-biased laws and institutions.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.