Recommended

WORKING PAPERS

Widespread climate shocks, from heatwaves and droughts to hurricanes and coastal flooding, affect nations across all income levels, with profound implications for economic growth and human welfare. With the continued rise in average temperatures and prospects of even more severe events going forward, all countries need to adopt policies that both mitigate and adapt to climate change. Within the policy options available to governments, public spending and taxation policies will continue to play a crucial role. However, the specific choices available to countries´ governments are likely to differ considerably.

Advanced economies, endowed with significantly greater fiscal space, have been more inclined to rely on expansive spending policies to prepare for the challenges of a changing climate. On the other hand, emerging market economies and low-income developing countries, grappling with mounting debt levels in the wake of the COVID pandemic, face severe constraints on their fiscal space. As a result, they must seek external financing to fund climate-related investments, which often necessitate substantial investments, typically amounting to 2 to 3 percent of GDP annually.

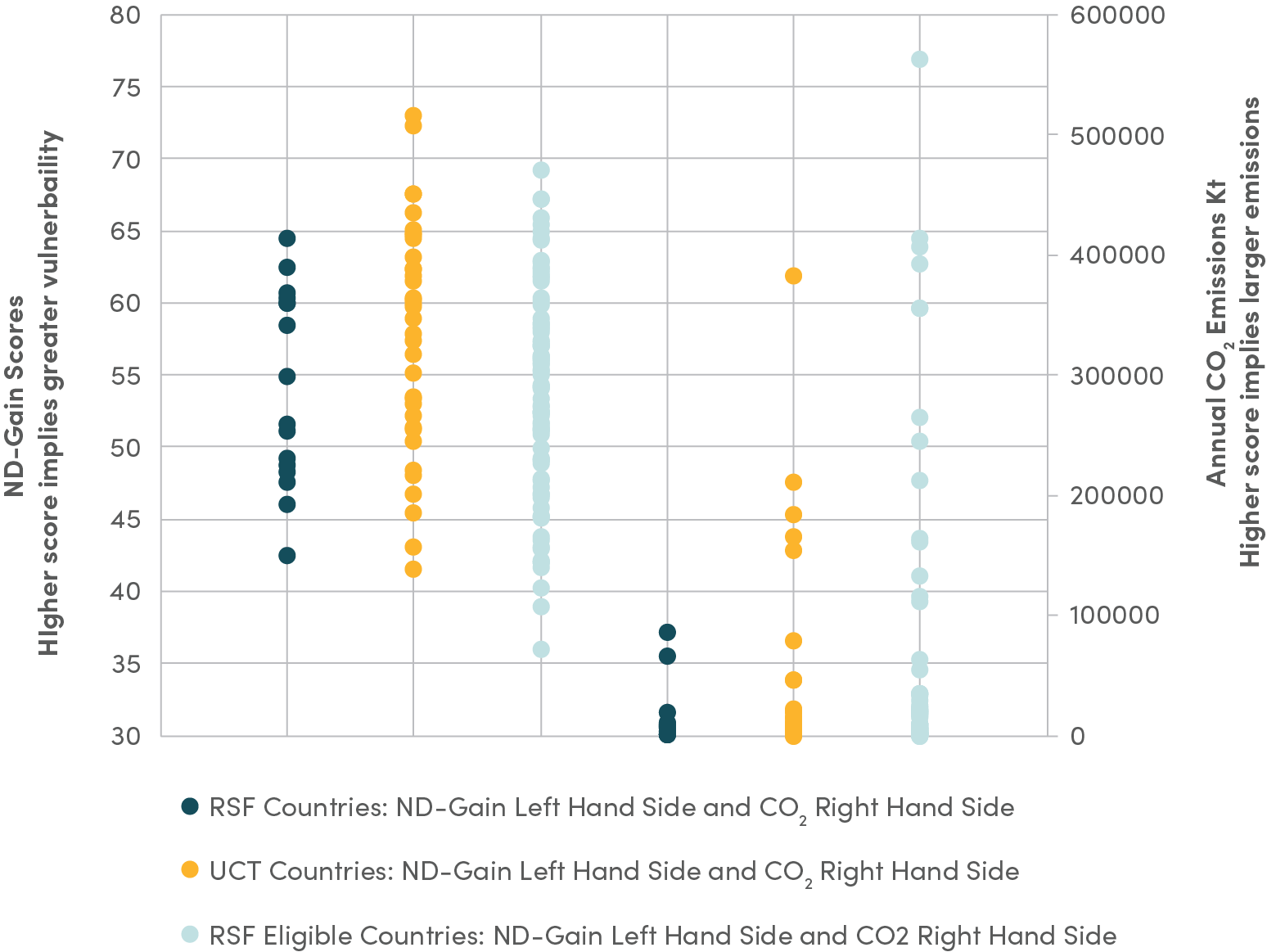

A key question is whether financial markets reflect the climate risks countries face in the interest rates they pay on their sovereign bonds. These risks emanate from the fiscal costs countries face in addressing climate change. Another potential risk, particularly relevant for advanced economies, is the need to compensate the rest of the world for the climate change caused by their high share of cumulative emissions. In a new paper, we use the concept of “climate debt” as explained below, and indices of vulnerability and resilience, measured by the Notre Dame Global Adaptation Initiative (ND-GAIN), to assess whether markets are capturing these climate-related risks in both advanced and emerging market economies.

We find that emerging market economies pay higher borrowing premiums due to heightened climate change risks. This can be perceived as an extra burden on these nations, considering a significant share of historical emissions originated in advanced economies.

Climate debt and sovereign bond markets

Climate debt represents the cumulative damage caused by carbon dioxide emissions, imposed on the world without compensation. As we can see in figure 1, advanced economies have accumulated the most significant climate debt due to their historically high energy consumption.

Figure 1. Climate debt per capita in US$

Source: Settling the climate debt, 2023

While no formal mechanism exists for nations to collect climate debt, developing countries are demanding compensation for climate damages. For instance, at last year’s United Nations Climate Change Conference (COP27), parties agreed to provide "loss and damage" funding for climate-affected vulnerable nations. Countries with high climate debt can be seen as having a contingent liability that may require significant fiscal commitments over the medium to long term.

Is the outcome fair?

Even though advanced economies were responsible for around half of the global climate debt through 2018, financial markets do not seem to account for this when pricing their sovereign bonds. This may be because markets assume that these nations are not expected to compensate emerging market and low-income economies for climate change-induced losses and damage. In contrast, markets do seem to add a risk premium when climate debt increases for emerging market economies. This may reflect the expectation that these high-emission countries will need to undergo substantial economic transformation to reduce their reliance on carbon-intensive energy sources. Overall, markets tend to attach a risk premium to the sovereign debt of climate-vulnerable countries, except for those at high risk for infrastructure and water system damage. Markets favor nations with robust governance and social readiness to adapt to climate change.

A triple whammy for emerging market economies

Our findings suggest that emerging market economies face a triple whammy from climate change. First, their economic activity is affected by climate change. Second, markets continue to impose a risk premium on nations with high emissions and substantial annual changes in climate debt, while advanced economies face no such penalty. Third, these emerging market economies must increase public expenditures to adapt to climate change and enhance resilience at a time when debt levels are already high post-pandemic.

Advanced economies, enjoying more fiscal flexibility, have greater latitude to provide subsidies and expand public spending for climate adaptation and mitigation. Our results indicate that sovereign debt markets in advanced economies do not incentivize emissions reduction and climate debt reduction. Accordingly, alternative mechanisms, such as carbon taxes that provide clear signals to reduce fossil fuel consumption, are necessary.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: malp / Adobe Stock