More from the series

CGD NOTES

Ukraine’s dire financing situation is front and center in the debate over how the world will weather the war being waged by Russia. The IMF will play an important role in extending credit to Ukraine directly, but the institution is also being used a conduit for other countries’ assistance. In this blog we urge the IMF to be more transparent about these operations, with an eye toward transparency for the large special drawing right (SDR) recycling to come soon.

Ukraine and the IMF as a conduit for assistance

In early April, the IMF established a Special Administered Account (SAA) for Ukraine, in which donations and loans from other member countries could reach the Ukrainian Government. This is not the first time the IMF has used such an instrument: The latest IMF Financial Quarterly Report shows that, as of January 31st 2022, the Fund was operating 8 Administered Accounts set up for various purposes, amounting to SDR 1.7 bn under the Fund’s administration.

So far, the initiative for Ukraine has gathered support from a number of countries.

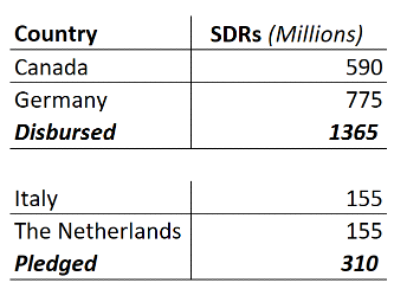

Germany and Canada have already contributed: Germany disbursed EUR 1bn and Canada the equivalent of CAD 1bn into the SAA in June, with the latter pledging an additional CAD 250 million not yet disbursed. The terms of the agreement differ: Germany announced it had provided a grant and Canada offered a loan with 10 years maturity and an interest rate of 1.69 percent per annum.

Canada and Germany are joined by The Netherlands and Italy, which have stated that they intend to disburse EUR 200 million each, although the money has not yet been disbursed. The modalities of the Dutch disbursement are not yet known, but Italy has announced that it would be a 15-year loan, with a 7.5-year grace period.

Before getting into the accounting details, we raise a unanswered question: why are Canada, Germany, and others choosing to transfer funds through a SAA at the IMF rather than transfer that money directly to Ukraine central bank accounts in New York, Frankfurt, Basel, or London? Does it have something to do with SDRs? Donor budgetary constraints? Fees? We do not know.

Tracking the flows through the IMF

The April IMF communique provides a vague description of the functioning of the SAA. According to the document, each country will disburse its loan or grant, either in its own currency or in SDRs, and the resources will be transferred to the Ukrainian SDR account.

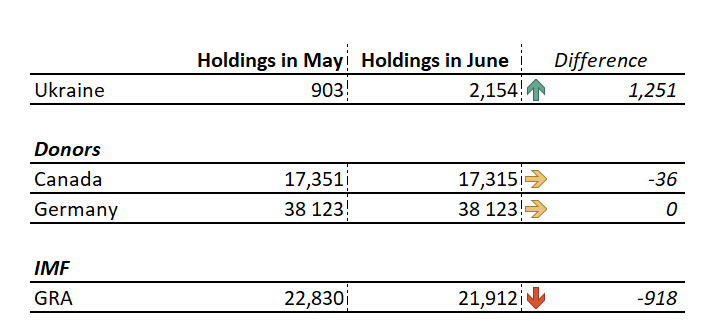

These flows associated with the German and Canadian disbursements, which went through in June, can be seen with a change in the IMF SDR accounts (Table 1): Ukraine’s holdings of SDRs jumped by SDR 1.25 billion.

Table 1. All numbers in millions of SDRs

The observant reader will have noticed that the increase in Ukrainian SDR holdings does not exactly match the disbursed amount (Table 2).

Table 2.

However, the numbers are so close that we can assume that the missing SDR 114 million have been used by Ukraine during the month of June.

Neither Canada nor Germany appear to have directly transferred their SDRs to the SAA, as both countries’ holdings remained roughly the same in June (table 1). Their contribution must have been done in a hard currency, which the SAA must have exchanged for the SDRs that then went to the Ukrainian account. Thus, a third party was needed to effect the change, possibly the IMF’s General Resources Account, which could have received the hard currency from the SAA and transferred its SDRs to Ukraine as its holdings fell by SDR 1 billion.

We previously compared tracking SDRs to tracking Bigfoot, given the paucity of data. We hope we are not chasing another mythical creature, but in the current state of things it is impossible to know for certain what country helped exchanged the currency the SAA received for SDRs. Is it the IMF’s GRA? Is it another country that holds SDRs? If so, did that deal go through the VTA (Voluntary Trading Arrangement) system facilitated by the IMF or a more informal bilateral exchange? And how do these exchanges interact with other uses of SDRs?

These questions may seem insignificant since only a couple of transactions are being followed, but they’re not. Right now, the only recycling of SDRs is via the IMF’s PRGT (Poverty Reduction and Growth Trust), but with more SDR recycling on the table, how will the global community sort out which SDR movement is recycling and which is not? How can we hope to get a true picture of the movement of an important global asset if we can’t even answer these simple questions?

The omerta surrounding SDR transfers

The IMF is not compelled to make SDR or other transactions amongst its members totally transparent. Instead, it touts the contributions to the Ukraine SAA via tweets on its IMF and Ukraine webpage. However, even that page does not seem to be up to date, as the Italian and Dutch pledges are not mentioned.

To date, the IMF has only reported movements in administered accounts in its IMF Quarterly Financial Report, but these are produced with a long lag. The latest Quarterly Financial Report covers the period up to January 31st, 2022 (the third quarter in the IMF’s financial year). The next report, covering up to April 30th, 2022, will be the audited statements for the full financial year; these have typically included more detailed reporting on administered accounts, and are usually finalised in July. However, activities related to the Ukrainian SAA (May – July) will only be covered in the following report, which, based on recent experience may not be published before November or December 2022. Given the keen current interest in financial support to Ukraine, reporting six months after the fact is not very informative.

A more transparent reporting of the Ukrainian SAA would not require the IMF to release much more information than it is already providing informally. The numbers could be centralized on a single simple table indicating the donor countries, date of disbursement, amount disbursed in which currency, and SDR equivalent transferred to Ukraine. It would be helpful to tracking overall SDR flows if the Fund could indicate the source of the SDRs when the donating country did not disburse in SDRs. The table could be updated whenever new disbursements or pledges are made – after all the website and Twitter feeds seem to be updated easily – or at least once a month, with little lag.

Besides being of vital interest to tracking member countries’ efforts to help Ukraine, setting a new standard of transparency for the Ukraine administered account will set a strong precedent for the anticipated recycling of up to SDR 100 billion promised by the G20. Already, external observers are having difficulty tracking just the pledges of SDR recycling, some of which pre-date the August 2021 SDR allocation. Once the SDRs start flowing, tracking whether disbursements are matching commitments will be very difficult under current IMF reporting standards. (We have a forthcoming blog on this.) Already, many in the developing world see differing standards in the rapid response to help Ukraine and the slow response to recycle SDRs.

At this point IMF procedures abet those who want to blur the lines between what is promised and what is delivered. As a public institution responsible not just to its shareholders but to the global community, the IMF should be striving toward transparency and holding countries to account for their commitments.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.