An extraordinary cascade of crises threatens Africa’s growth and economic stability. The incomplete economic recovery from the global pandemic, Russia’s invasion of Ukraine, food and fuel inflation, rising debt distress, and Israel’s ongoing war in Gaza have all aggravated geopolitical and geo-economic tensions and battered African economies. With the US explicitly focused on “peer and near-peer competitors” (per its most recent national security strategy), the continent unwittingly finds itself further drawn into geopolitical contests. Africa’s foreign policy is now a delicate dance of balancing engagement with China and Russia and the West.

The latest wrench in the works is the accelerating slowdown in the Chinese economy. According to the IMF’s Regional Economic Outlook, “a one percentage point decline in China’s growth rate could reduce average growth in the [sub-Saharan African] region by about 0.25 percentage points within a year.”

The effects are already extending to Chinese lending to Africa. Over the last two decades, no bilateral creditor has come close to rivalling China’s infrastructure lending to African governments, and with diminished Chinese credit, that role is unlikely to be reprised by any other external actor. In 2022, sub-Saharan Africa saw a precipitous fall in Chinese sovereign lending to below $1 billion, the lowest in almost two decades. Perhaps most importantly, because China is the continent’s largest trade partner, Africa’s commodity exporters, with their undiversified export baskets, are firmly entrenched in China’s value chains. China’s economic slowdown reverberates with a disproportionate negative impact in Africa.

The risks here are significant—but China’s slowdown, rising geo-economic tensions, and Western efforts to reinvent supply chains also offer some intriguing opportunities for bold African leaders.

The West’s response to Chinese influence

China’s rise has, however, delivered more than markets and credit: It also offered Africa’s developing economies leverage in their engagement with the West. In a talk at the Cato Institute in September 2007, former Senegalese President Abdoulaye Wade argued that the rise of a “third node” of global power had altered the dynamics between Africa and external actors. In his telling, up to that point, the only options available to African leaders seeking financing for projects were Brussels and Washington, who usually colluded and responded with monopolistic arrogance. The availability of a third option in Beijing brought a measure balance to those interactions and gave African leaders more flexibility.

The truth of Wade’s argument is particularly prominent today in the infrastructure financing space, where China’s dominance has provoked Western responses. Until China’s Belt and Road Initiative (BRI), there were no large-scale Western infrastructure financing initiatives. Western countries believed that expanding Chinese influence in the developing world was both a function of its infrastructure lending and came at the West’s expense, which played a big role in the emergence of Western alternatives. Western politicians who admonished developing countries against getting “ensnared” in Chinese lending were met with incredulous stares when they offered no alternative. The G7’s US-led Partnership for Global Infrastructure and Investment (PGII) and its European cousin, Global Gateway, have to be understood as explicit responses to China’s engagement.

It is therefore plausible that a world of diminished Chinese economic activity in Africa—retrenchment from infrastructure financing and reduction in demand for African commodity exports—could see Western interest in Africa also diminish to the much-lower pre-BRI status quo.

African countries should leverage their options

But African governments are not without agency in influencing this new reality. The geo-economic upheaval and China’s economic slowdown also present opportunities. First, the slowdown is an opportunity to bid for a substantive stake in global supply chains. The supply chain constraints created by the pandemic and China’s zero-COVID restrictions demonstrated China’s centrality to global manufacturing and the attendant risks of over-concentration of supply chains. Many firms responded with “China plus one” strategies, choosing another country to diversify into, but these plans remained Asia-centric. Tensions in the South China sea have compounded the risks of that decision, forcing some companies to turn to a “China plus 10” strategy to spread out risk and build more resilient supply chains. Herein lies an opportunity for Latin American and African countries. The continent’s relatively stable democracies which have made significant infrastructure investments—Kenya, Côte d’Ivoire, Ghana, and Zambia—have an opportunity to be one of the “plus 10” in the value chain of global manufacturers.

A second opportunity for Africa is the push by other G7 nations to reduce their dependence on China for critical minerals—metals like lithium, cobalt, and others critical for digital devices and clean energy technologies. China’s dominance of the supply chain of critical minerals has triggered efforts from the United States, Europe, and South Korea to seek access to these minerals outside Chinese supply chains. This renewed push comes as some mineral-rich African countries have imposed bans on the export of raw minerals. To demonstrate the seriousness of its commitment to processing minerals at home, the Namibian government ordered its police to prevent China’s Xinfeng Investments from exporting unprocessed lithium, accusing the Chinese miner of violating the ban. This space opens a new opportunity for Angola, Democratic Republic of Congo, Guinea, Tanzania, Zambia, Zimbabwe, Angola, and South Africa to develop a critical minerals processing hub in the sub-region. The accompanying investment in energy for such a venture would also spur value addition in other sectors—including adding value to agricultural products.

There is also an opportunity for African mineral exporters to diversify their markets. China’s role as Africa’s largest trade partner and primary destination of the continent’s mineral exports leaves mineral exporters exposed to the slowdown in China. As this IMF Working Paper puts it, “…the relatively large demand for raw materials during China’s unprecedented growth spell in the last two decades may have created incentives not to diversify some of economies that benefited the most from its spectacular rise.” Very few of these countries cultivated other markets and that lapse has left them exposed. This slowdown is thus important reminder for African mineral exporters to pursue their own “China plus one” strategy in developing new markets for their exports.

Financing should be met with institutional capacity-building

One final “opportunity” from China’s gradual retrenchment from the infrastructure space in Africa is the chance to focus on improving the quality of governance in the sector. Chinese lending for infrastructure is invariably tied to Chinese contractors executing the works. This has meant a dearth of experience for African firms doing complex civil works. It has also undermined the development of engineering capabilities to supervise these complex works. Quality governance in the sector means improving competencies across the project cycle from selection, risk allocation, development, and execution. If they were confined to financing projects using the national budget or the proceeds of commercial loans, African governments would have an opportunity to ensure that the agreements feature knowledge transfers, and to implement the transfer properly. This would include meritocratic selection of local construction and engineering firms to participate in the project and benefit from the transfer. A region that is under-resourced in financing its infrastructure must be more stringent in squeezing as much value as possible out of each infrastructure dollar. Improving the governance quality of the sector is one significant step in that direction.

Ultimately, China’s economic downturn brings strong headwinds for African economies in trade, investment, and lending risks. But these crises also hold latent opportunity for the continent—opportunities that require a proactive response and targeted investment from the countries that will be most affected.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

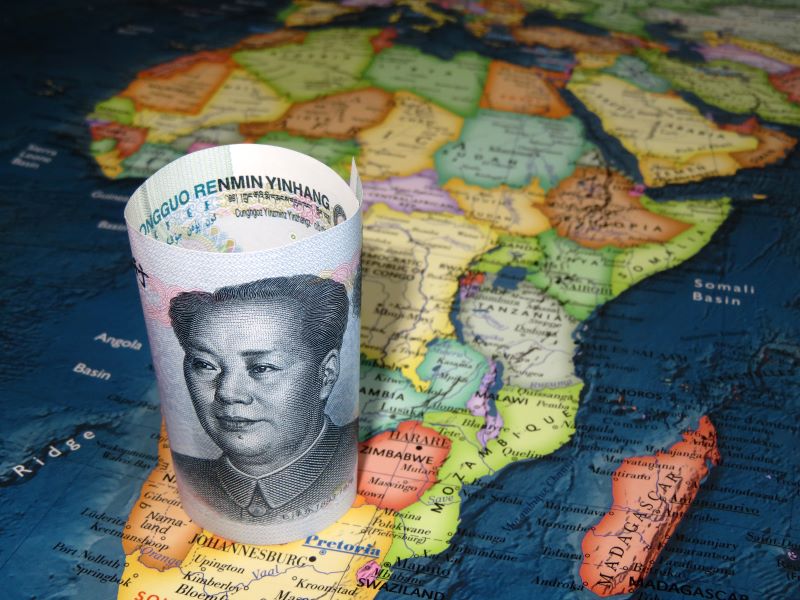

Image credit for social media/web: Comugnero Silvana / Adobe Stock