America’s development finance agency is constantly being pulled in three directions. The primary mandate of the Overseas Private Investment Corporation (OPIC) is to promote development by catalyzing private capital from US firms in emerging and frontier markets. OPIC is also supposed to support US foreign policy by making commercial investments aligned with diplomatic, security, or democracy objectives. Lastly, OPIC must operate on a commercial basis so projects are both sustainable over the long-term and cost nothing to US taxpayers.

OPIC has frequently succeeded in each of these goals, for instance by providing capital for an African credit fund for health clinics and debt finance for a power plant in Jordan. The agency has been run at a small profit too, enabling it to pay money into the US Treasury for 38 consecutive years.

Sometimes individual projects will check all three boxes: a commercially-viable project in a poor country that’s an important strategic ally. But often these three objectives are in tension and over time, the incentives can be distorted. That’s why OPIC’s overall portfolio matters more than any one project. Our analysis of OPIC’s portfolio since 2000 has found that the agency has done a good job of moving into sectors like infrastructure and financial services that are the biggest constraints to growth in most countries. But we’ve also found that OPIC’s overall portfolio has drifted lately into wealthier markets, where the development needs are less acute and where the necessity of government-backed finance may be far less obvious.

To get a better picture of how OPIC is balancing its portfolio, we have a new paper out that recommends two steps that could bring additional clarity to the tradeoffs for OPIC management, its board, and outsiders.

(1) OPIC should go much further in public disclosure, including the release of:

-

Development Matrix Scores, which it already assigns to prospective proposals;

-

Co-financing data to illuminate its catalytic effect (or not);

-

Project-level data on commitments, to give Congress and the general public a clearer picture of how well the agency is balancing pressures among its competing objectives.

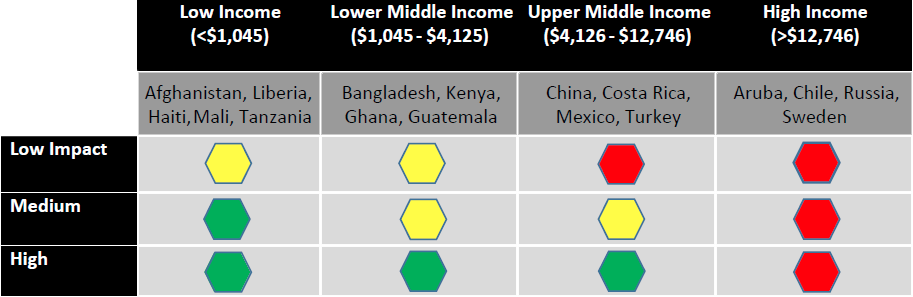

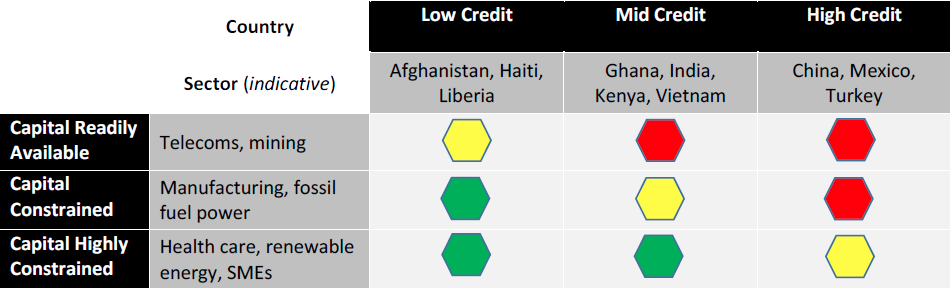

(2) Utilize Stoplight Screens to track prospective projects’ development impact and market additionality. Green-lit projects could be fast tracked, yellow-lit projects would require more board scrutiny and a higher approval bar, while red-lit projects would be approved only in rare exceptions. The portfolio as a whole could then be reported on its balance of green-yellow-red over time.

Development Impact Screen

Market Additionality Screen

OPIC is a high-performing, if still little-known, agency. These modest steps could help it better balance its competing objectives—and make it even more effective in supporting US policy. Read the full paper here.

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.