Ideas to action: independent research for global prosperity

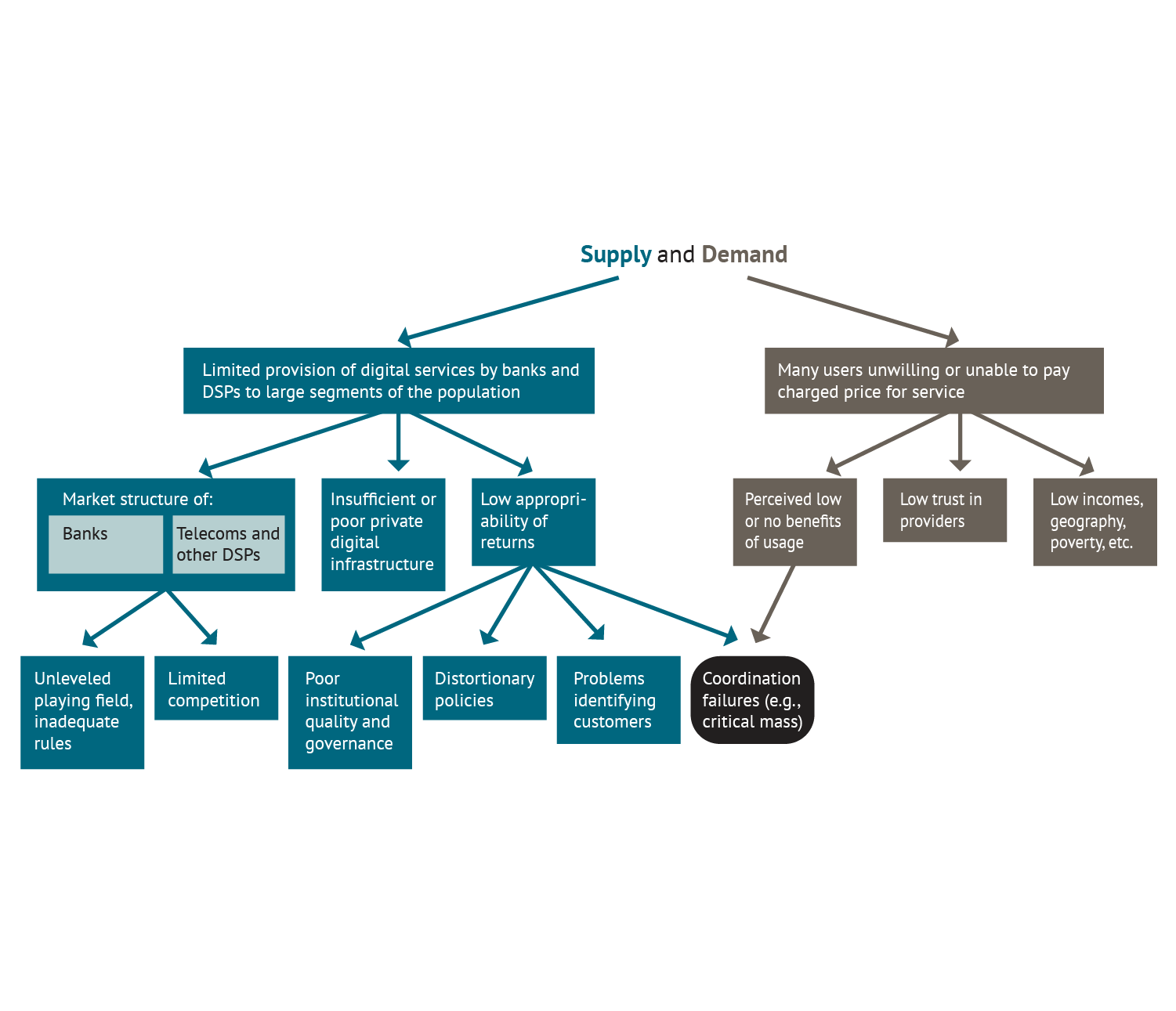

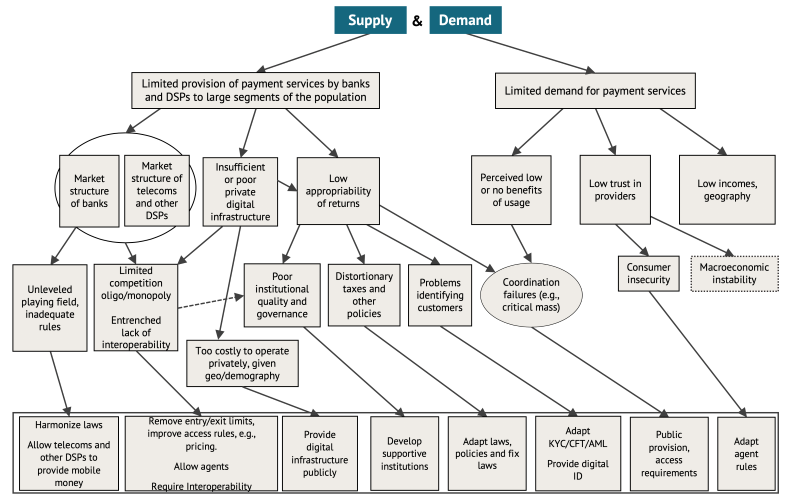

A Decision Tree for Digital Financial Inclusion

A new analytical framework to unravel the root causes of low financial inclusion.

About the Project

The Decision Tree framework presents a new methodology, adaptable to country-specific settings, that will help policymakers, researchers, and other stakeholders to diagnose the binding constraints, the limiting factors, impeding further digital financial inclusion.

Featured Work

A Decision Tree for Digital Financial Inclusion Policymaking

Stijn Claessens et al.

Decision Tree Workshop Takeaways

Liliana Rojas-Suarez et al.

Digital Financial Inclusion: A Decision Tree Approach

Liliana Rojas-Suarez et al.

Branch to Root: Event on CGD's Decision Tree Tool

et al.

Digital Financial Inclusion in India

Nandini Harihareswara et al.

Featured Work

Contact

For more information, contact afioritobaratas@cgdev.org.

Contact

For more information, contact afioritobaratas@cgdev.org.

Experts

Alejandro Fiorito

Alejandro Fiorito was a research associate for Liliana Rojas-Suarez at the Center for Global Development. Fiorito holds an MA in International Economics and Finance from Johns Hopk...

Liliana Rojas-Suarez

Liliana Rojas-Suarez is the Director of the Latin America Initiative and a senior fellow at the Center for Global Development with expertise on Latin America, financial regulation,...

Experts

Acknowledgments

For more information, visit CGD's How We're Funded page.

For more information, visit CGD's How We're Funded page.

Sign up for our weekly development update