Two out of five low-income countries (LICs) were in the grips of, or moving rapidly toward, unsustainable debt levels before the global pandemic. But the economic, financial, and fiscal effects of the pandemic have brought the day of reckoning for many countries much closer. The need for massive countercyclical spending and additional health and other social spending is now layered on top of huge finance needs for the Sustainable Development Goals (SDGs), which for LICs had been estimated by the IMF to average 15 percentage points of GDP. Such spending is no less essential in poor countries than in middle- and high-income countries given the dire effects of the pandemic on poor populations. The World Bank projects that the pandemic will push 26 to 39 million people into extreme poverty in sub-Saharan Africa alone.

Early predictions that the health effects of the pandemic would be less severe in poor than in rich countries, in part due to younger populations, are undercut by the emerging evidence. Latin America has now taken over as the global pandemic epicenter in terms of share of global cases, with death rates per million population higher in the most affected Latin American countries than in the United States.

Among the sources of finance (excluding the international financial institutions, or IFIs) the picture is no better: tax revenues are shrinking with steep drops in, or negative, GDP growth; official development assistance is stagnating; and private capital flows are at best volatile. Declining exports, in value and volume, and falling remittances aggravate countries’ balance-of-payments financing challenges. Sovereign borrowing costs for some African countries have already ticked up sharply. The IMF projects 2020 gross public debt to rise to 48 percent of GDP in LICs, with fiscal deficits ballooning to 6 percent of GDP.

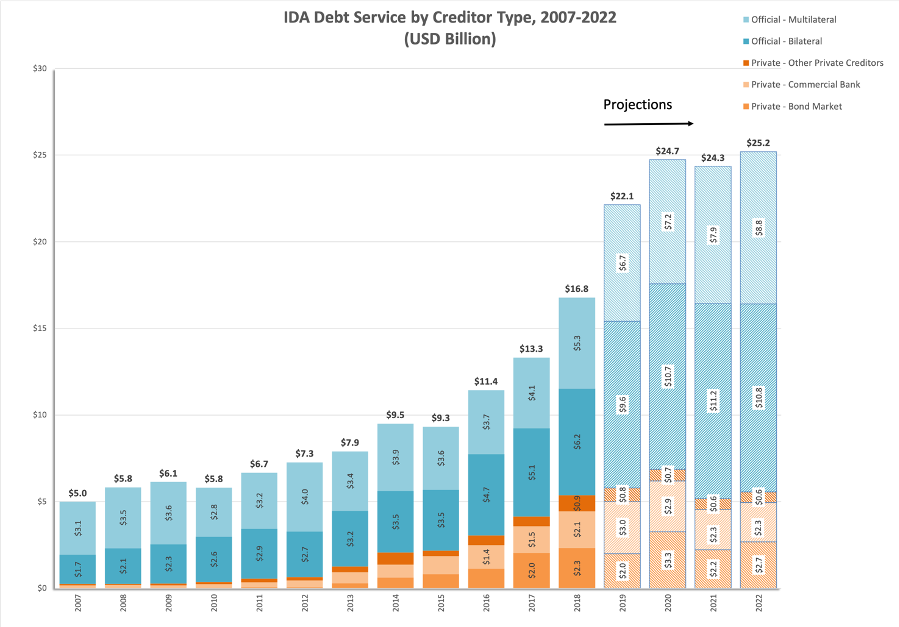

This latest debt buildup in LICs has been accelerated by better access to global private capital markets and credits on non-concessional terms, reinforced by relatively low market returns in the developed world. It follows the Heavily Indebted Poor Country Initiative and the Multilateral Debt Relief Initiative, launched in 1996 and 2005 respectively, which were supposed to have given LICs a fresh, low-debt start and strengthen incentives for better fiscal policies to avoid repeated cycles of buildups and write-offs. That reset proved fleeting in the face of pressing development needs and relatively cheap financing, and the global financial community is likely entering another period of messy, prolonged, costly, and contentious debt defaults and restructurings. It does so with no more—and in some ways less—consensus on the principles that should govern collective action by public and private creditors, debtor governments, and the IFIs.

This note describes the ongoing systemic failure to offer workable mechanisms for efficient debt relief with fair burden sharing for poor countries, defined as both LICs and LMICs (lower-middle-income countries) included in the G20 Debt Service Suspension Initiative (DSSI). And it suggests six key issues that must be addressed to build a better approach.

What makes sovereign debt relief so messy?

Countries risk legal default and/or sovereign rating downgrades if they seek temporary debt relief during a global crisis. The line between temporary liquidity problems in the face of external or internal shocks and long-term insolvency can be quite uncertain, especially early in a crisis. That has never been more evident than during this pandemic, when the incidence and duration of infection rates as well as the global and country-specific economic and financial consequences are so unpredictable. This highlights the futility of doing debt sustainability analyses (DSAs) now, making policy recommendations based on economic projections two or three years from now, and trying to establish the amount of debt relief that will ultimately be needed from various creditors (although it does not preclude an agreement in principle now that all creditors must participate in debt relief as ultimately required by DSA findings).

Addressing liquidity problems through temporary suspension of debt service to official public and private creditors makes sense until the depth and breadth of the fallout can be more reliably analyzed. Yet, under the G20-sanctioned DSSI, missed payments even to official creditors can be considered legal events of default under many bond and especially loan contracts, which account for 80 percent of the stock of long-term public and publicly guaranteed debt held by private creditors. Ratings agencies and regulators, concerned about being seen as easily manipulated or asleep at the switch as during the global financial crisis, are already warning about the consequences of compliance with the G20 call for comparable DSSI treatment across public and private creditors. S&P has indicated it will not treat debt relief from official creditors as a sovereign default, but it could view debt restructuring or changes in terms of private credits as a default under its criteria, depending on specific case-by-case circumstances. Moody’s has put the ratings of Côte d’Ivoire, Senegal, Ethiopia, Pakistan, and Cameroon on review for downgrade, noting that their participation in DSSI for official credits heightens default risk on private credits.

Unsurprisingly, the fear of losing market access has significantly undercut the financial breathing space DSSI is affording poor countries. So far, 32 of 73 eligible countries have not even sought relief on official bilateral credits under DSSI. And, according to the Institute for International Finance (IIF), there have been no formal requests to private creditors for relief from DSSI countries. To help address the serious disincentives confronting sovereign borrowers that want to participate in DSSI, the IIF has developed a template waiver letter that debtor countries can use to seek agreement from private creditors that a request for forbearance from official creditors will not trigger an event of default on their private debt contracts.

From the creditor side though, without defaults, there is no requirement or significant incentive to provide interim relief on debt service payments. This sets up strong private creditor incentives to free ride, putting the burden on those official actors willing to be first movers in debt relief, either by providing new finance or suspending near-term payments. Some argue that, for debtor countries where there is high uncertainty about debt sustainability, access to new IMF resources should have been conditioned on both private and public creditor participation in DSSI. It has been proposed in the EU context that new terms be added to EU bond issues to require an automatic extension of sovereign bond maturities in the event of publicly financed crisis support to debtor governments.

We are also seeing a breakdown even among official creditors in willingness to act collectively and comprehensively across their official credits: the July 18 G20 statement excludes credits from the China Development Bank (CDB) in the tally of payments debtor countries have requested to defer so far. In response, World Bank President Malpass called for “full participation of the China Development Bank as an official bilateral creditor” as “important to make the initiative work.” China argues that the CDB lends on commercial terms and therefore should be treated as a private creditor.

Collective action failures on debt relief lead to pressure on the IMF and other IFIs to bail out private creditors, constraining financial space for critical domestic spending. The spending needs and revenue consequences of the pandemic cannot easily be reconciled with the creditors’ usual preferred approach of maximizing the primary surplus to minimize the debt haircut. More than ever, the IMF will encourage countries to prioritize social spending—as well as preserve some public investment in DSAs—if poor countries are to return to healthy growth, poverty reduction progress, and the capacity to service restructured or unrestructured debt. As Gaspar and Gopinath of the IMF observe, “fiscal policy will need to remain supportive and flexible until a safe and durable exit from the crisis is secured. While the trajectory of public debt could drift up further in an adverse scenario, an earlier-than-warranted fiscal retrenchment presents and even greater risk of derailing the recovery, with larger future fiscal costs.”

The central role that DSAs play in IMF decisions on finance volumes and program content requires that IMF judgments remain grounded in the public interest broadly defined, taking into account effects on the citizens of debtor countries, on creditor rights, and on financial market stability and smooth functioning—interests which can and do differ from the financial interests of specific public or private creditors.

At the same time, the IMF must be mindful of systemic risks and contagion, particularly going into a situation where large numbers of countries may be looking for debt relief. Such contagion could generate capital flight that weakens debt sustainability in a growing number of poor countries, beyond those originally in debt distress. Fears of contagion confront the IMF with especially hard choices between filling finance gaps with more IMF resources or insisting on debt restructuring, as in the case of decisions regarding exceptional access to IMF resources for Greece.

As the IMF noted in its 2013 review, debt restructurings have often been “too little too late.” Post–default, protracted failure to agree on the necessary creditor contribution to debt sustainability exacts a high cost on all parties. In cases of large debt overhangs, the weight of uncertainty regarding the debt outcome on investment and growth can push the path away from, rather than towards, debt sustainability for the debtor country. This can leave the IMF in the position of lending in the presence of arrears to private creditors in programs and circumstances that do not address the member’s underlying balance of payment problems, as is required by the IMF’s Articles of Agreement. To avoid this, one option is to condition new IFI lending to a defined level of private creditor participation in debt restructurings.

Increasingly, risks come from the behavior of official as well as private creditors. Official bilateral creditors outside the Paris Club can be the source of delays in debt restructuring and a return to debt sustainability. This risk prompted the IMF to agree on reforms to its lending-into-arrears policy in 2015 to allow lending into arrears to official creditors in certain “carefully circumscribed circumstances.” More broadly, protracted debt negotiations and disputes deny countries a timely return to capital market access, even in cases where a majority of public and private creditors agree on the necessary resolution.

There is no standardized process for organizing creditor committees, including private creditor committees. Everyone agrees that early and cooperative consultations between debtor governments and creditors is a good thing. (See the Addendum to the IIF Principles for Stable Capital Flows and Fair Debt Restructuring.) In fact such consultations must be pursued to comply with the requirements of the IMF’s lending-into-arrears policy. But given the growing diversity of private creditors and debt instruments (especially for poor countries), no one wants to take responsibility for defining, convening, or managing a committee capable of gaining broad private creditor acceptance as legitimately representing their interests.

Still more challenging would be pursuing the Gelpern, Hagan, Mazarei proposal for the G20 to establish a Sovereign Debt Coordination Group consisting of sovereign borrowers and representatives of both the official (including non-Paris Club members) and private creditor community to collect and disseminate information and facilitate negotiations. There is little sign that the IMF is interested in taking on this role: its 2013 review clearly states that, “the Fund leaves the specific details of the debt restructuring strategy to be determined by the debtor, including formation of the creditor committee.”

Collective Action Clauses (CACs) are not a panacea. The resistance to the IMF’s proposal for a Sovereign Debt Restructuring Mechanism in the early 2000s (including by the US) was followed by optimism about CACs as a market-driven driver of debt resolution. Under CACs, a defined majority (e.g., 75 percent) of bondholders can agree to change some aspect of bond terms and legally bind all holders of the same bond to accept the change. This reduces the risk of minority holdout creditors blocking the restructuring of a bond or an exchange for a new bond.

But CACs are not universal in bond contracts. And so far more than half of sovereign bonds governed by foreign law do not have CACs aggregated across bond issuances, so holdouts for one issuance can block action on all affected bonds. Moreover, as noted above, a dominant share of LIC debt is in the form of loans.

To be sure, the legal process is by no means the only source of the financial turmoil associated with default. As Brad Setser notes, even “formal bankruptcy protection would not magically allow countries in default to avoid runs on their currency and banking system.” Still, the system needs some means of devising an orderly temporary solution to provide time for the legal process to play out. Blocking creditors’ ability to place claims on debtor country assets, as in the case of the UN Security Council resolution regarding Iraq in 2003, is one option. But it has been vigorously criticized by creditors as a preemptive strike on their legitimate legal rights that left them stripped of negotiating leverage. Another option is to amend sovereign immunity laws in the US and UK to temporarily stop lawsuits against countries where the IMF judges that debt service is not possible in crises. This might be more palatable if creditors see this as a way to increase the likelihood of future repayment as debtor country circumstances improve, in contrast to the Iraq situation where creditors were denied claims on oil revenues.

Creditor participation in debt relief is not all about sticks. Meaningful carrots are needed too. Some debt restructurings explicitly include incentives to encourage creditor participation. Buchheit et al. describe examples of value recovery instruments, loss reinstatement features, parity of treatment undertakings, contractual improvements, and credit enhancements.

Value recovery instruments provide participating creditors with assets that allow them to gain from upside developments in debtor countries in the future, such as warrants linked to the price of oil in the case of Mexico, Venezuela, and Nigeria, or GDP growth-linked instruments in Costa Rica, Bulgaria, Bosnia, Argentina, Greece, and Ukraine. Loss reinstatement commitments offer creditors protection against future restructuring of the same debt by guaranteeing that, if the debtor country seeks another round of restructuring, some or all of the original principal forgiven will be restored as claims by the creditor. Parity of treatment undertakings require debtors to offer any creditors that participate in a debt restructuring the benefit of any better deal that may be offered later to holdouts. Contractual improvements can come through issuing new bonds as part of the restructuring that offer stronger legal protections, such as switching from locally issued bonds to bonds issued in New York or London (e.g., Greece). And credit enhancements have been offered by donor governments to partially guarantee restructured or exchange bonds or secure them with collateral as in the case of Brady bonds.

But thus far the IFIs have generally not used their credit enhancement capabilities to incentivize creditors to participate in restructured bonds or exchanges. (Exceptions are the AfDB’s partial guarantee of the Seychelles’ 2010 restructured bonds and IDA’s 2018 guarantee of Benin’s debt reprofiling exercise.) The reasons are understandable. The IFI contribution to debt sustainability for poor countries is supposed to be in the form of new money and advice/support on policy choices and adjustment, and in some cases, with donor funding (e.g. the Multilateral Debt Relief Initiative), relief on debt owed to the IFIs themselves. The case for using IFI resources to induce private creditors to agree to debt restructuring is not obvious. But it is worth considering in the current circumstances given (1) the scale of the crisis and impact on poor countries and on poverty reduction progress; (2) the extraordinary crisis-related and SDG financing needs of both poor country governments and private sectors; (3) the broad interest of creditor governments in sustaining poor countries’ hard won access to capital markets; (4) the fact that developed country central bank purchases of corporate bonds offer analogous official support for their bondholders; and (5) the possibility of using the IFI resources committed to promote or mandate investment benefiting both poor countries and the global economy, e.g., green infrastructure.

Questions that need answers

Against this background, six questions are central to addressing critical problems and weaknesses in the system and building better response capability for the future.

-

What new mechanisms, legal provisions, and policies are needed to build an orderly system for providing poor countries with temporary, comprehensive suspension of their debt payment obligations in systemic crises in order to meet pressing needs, without forcing legal default as the first step in debt relief?

-

How and when should IMF and other IFI lending be conditioned in ways that encourage fair burden sharing by, rather than bailouts for, private creditors of poor countries?

-

How should IMF fiscal conditionality and DSAs change in the wake of the global pandemic and its likely profound and prolonged effects on poor country growth and poverty reduction progress?

-

What governance structure or institution should take on the role of organizing creditor committees or creditor coordination groups, encompassing both public and private creditors, to share information and facilitate negotiations?

-

How should the provision of new official financing (bilateral and multilateral) to poor countries best meet urgent needs during the crisis period while not creating or adding to longer term solvency problems? Should official bilateral creditors commit to concessional terms for all their lending to poor countries?

-

Should and how can IFIs use their credit enhancement capabilities to encourage private creditors to participate in debt restructurings, e.g., through a green or social bond scheme?

Many of these questions are not new. They all involve tough trade-offs. And many actors need to be involved in answering them—creditors and debtors, multilateral institutions, economists and lawyers, and advocates for economic justice.

Solutions have long eluded policymakers and those with direct financial interests. An opening of minds and serious pursuit of sound ideas will be critical in the months ahead. Decision makers need to demonstrate a willingness to embrace bold solutions, even if they depart from long-held positions.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.