There is no shortage of investable capital in the global economy. However, while the opportunities exist for investment and while funds are available, few projects actually reach financial close. A dearth of bankable projects – projects that are well structured to meet the stringent requirements of financiers – remains a key bottleneck to investment in developing countries. Part of the problem is that limited financial resources are being dedicated to developing strong feasibility studies, analysing market prospects and developing viable business plans, which results in many projects being rejected. McKinsey estimates that 80 percent of infrastructure projects in Africa fail at the feasibility and business-plan stage and an additional 10 percent fail between the planning stage and financial closure.[1]

The basic premise of this note is that although technical assistance (TA) for project preparation, management and implementation helps develop a pipeline of bankable projects, reduces risk, and creates an enabling regulatory environment for investors, it continues to be underinvested in by the European development finance institutions (DFIs). Although most DFIs have established TA facilities and have scaled up their TA offer over the last years, the ratio between the amount dedicated to TA and the amount for new commitments is below one percent. Furthermore, the majority of TA is targeted at post-investment interventions and less than a third at upstream activities focused on developing a pipeline of bankable projects.

This note takes stock of the TA funding, approaches and activities of the European DFIs. It then explores a potential model for TA activities for the EU’s external assistance delivered through the European Fund for Sustainable Development Plus (EFSD+).

TA in theory

Technical assistance/cooperation is defined by the OECD as “the provision of resources aimed at the transfer of technical and managerial skills or of technology” for the purpose of building up general national capacity or for the purpose of implementing specific investment projects.[2] In the context of DFI investments, it serves four core purposes:

- To develop a pipeline of projects, through the financing of feasibility studies and market development research to identify and overcome obstacles to investments.

- To de-risk investments, by financing project preparation and management, staff training, and legal and contracting fees, and improving financial controls or improving governance systems of private companies[3] to make business ideas commercially viable and attract investors.

- To bolster impact by supporting clients to improve standards, particularly environmental, social and governance (ESG) performances.

- To facilitate an enabling business environment and create market opportunities by supporting policy reforms in areas such as labour laws, fiscal regimes, competition policy and market regulation.

The case for TA derives from its crucial role in mitigating risks and increasing investors’ confidence. The United Nations Capital Development Fund (UNDCF) emphasises the importance of TA in blended finance for the so-called missing middle – small and medium enterprises (SMEs) – which are “too large for microfinance, but too small or risky to access […] capital from conventional debt and equity investors,” and in particular, in least developed countries (LDCs) (OECD/UNCDF, 2019).

TA in numbers

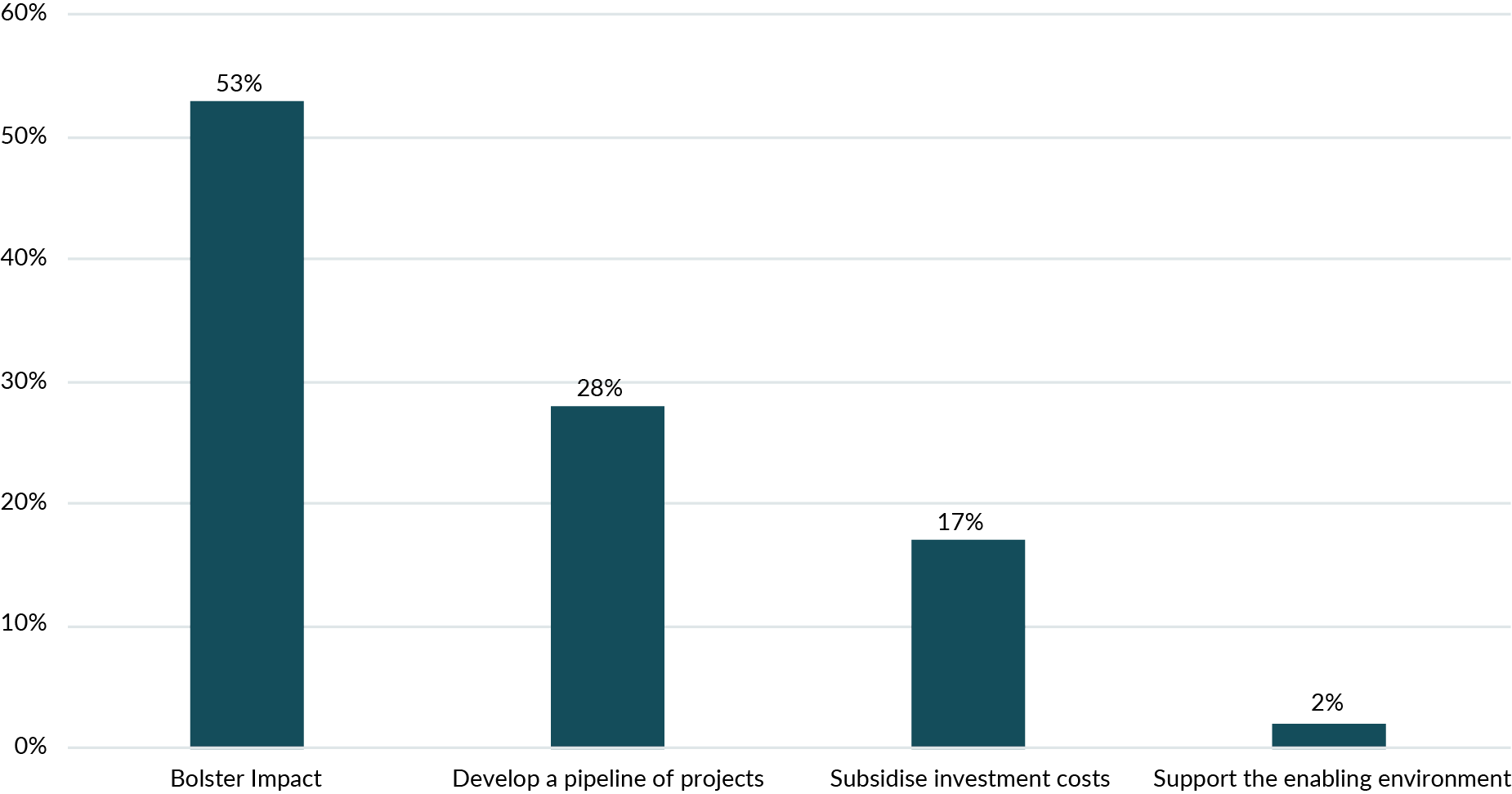

TA is used at different stages of the investment cycle. At the pre-investment stage, it is used to develop a pipeline of projects or to facilitate the conditions for a business enabling environment. At the investment stage, it is used to subsidise the investment. Post-investment, it is used to bolster the impact of the project. According to Convergence’s historical database on blended finance, out of 136 transactions with a TA component, a majority (53 percent) of TA was targeted at post-investment interventions and less than a third (28 percent) at upstream activities to develop a pipeline of bankable projects (see Figure 1).[4]

Figure 1. Breakdown by type of TA

Source: Convergence, Blending with technical assistance, Data Brief, February 2019

Information on technical assistance provided by European DFIs and Multilateral Development Banks (MDBs) is scarce and often not publicly available. Hence, as illustrated in Table 1, only 10 of the 15 members of the association of European Development Finance Institutions (EDFI)[5] reported on the amount disbursed for TA and the number of TA projects.[6] The European MDBs – the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD) – do not provide this type of data for their investments outside of the EU.

Table 1. TA provision of EDFI members

| Institution | Country | New annual commitments in 2020 (in EUR millions) | Number of TA projects approved in 2020 | Amount dedicated to TA in 2020 (in EUR millions) | Source of TA funding |

|---|---|---|---|---|---|

| BIO | Belgium | 194 | 14 | 1.3 | 100% government funding |

| CDC | United Kingdom | 1366 | 110 | 8.8 | 100% government funding |

| DEG | Germany | 1400 | 100 | 10.1 | 38% own funding / 62% government funding |

| FMO | The Netherlands | 1099 | 110 | 9.5 | 34% own funding/66% government funding |

| IFU | Denmark | 211 | 18 | 1.1 | 73% own funding/ 27% government funding |

| Norfund | Norway | 453 | 13 | 1.2 | 100% government funding |

| Oeeb | Austria | 302 | 8 | 0.4 | 100% own funding |

| Proparco | France | 1295 | 19 | 2.8 | 52% own funding/48% other funding |

| Swedfund | Sweden | 94 | 30 | 2.9 | 100% government funding |

Source: EDFI website

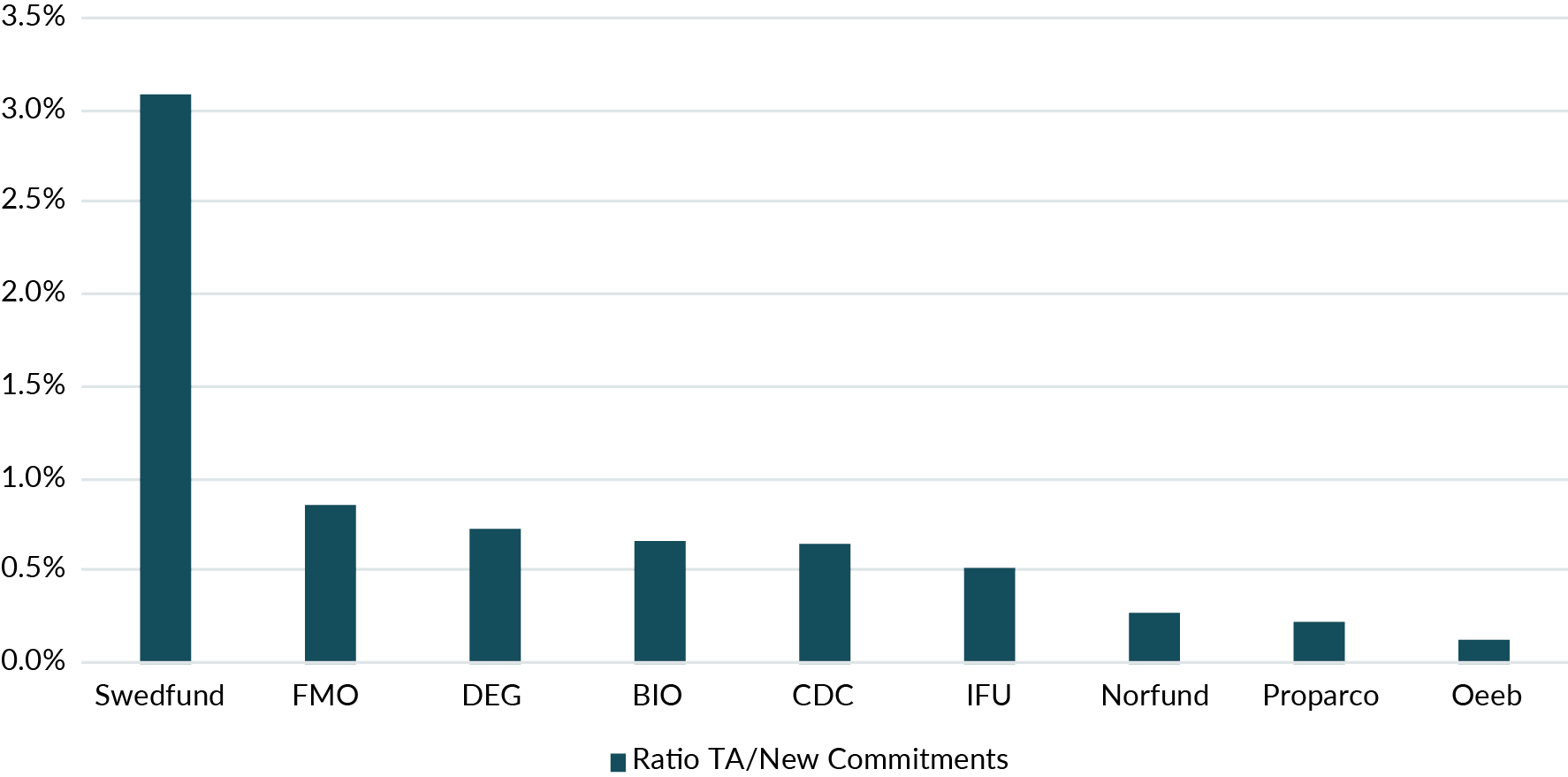

The data shows that TA provision remains small for these organisations. In 2020, the ratio between the amount dedicated to TA and the amount for new commitments was below one percent (see Figure 2). The exception was the Swedish DFI, Swedfund, which was just over three percent. This can be explained by the fact that Swedfund invested in the health sector and decided to use TA to finance the purchase of personal protective equipment and material to create isolation units in clinics and hospitals in its portfolio.[7]

Figure 2. Ratio between amount dedicated to TA and new financial commitments in 2020

Source: Authors’ calculations based on data from EDFI website.

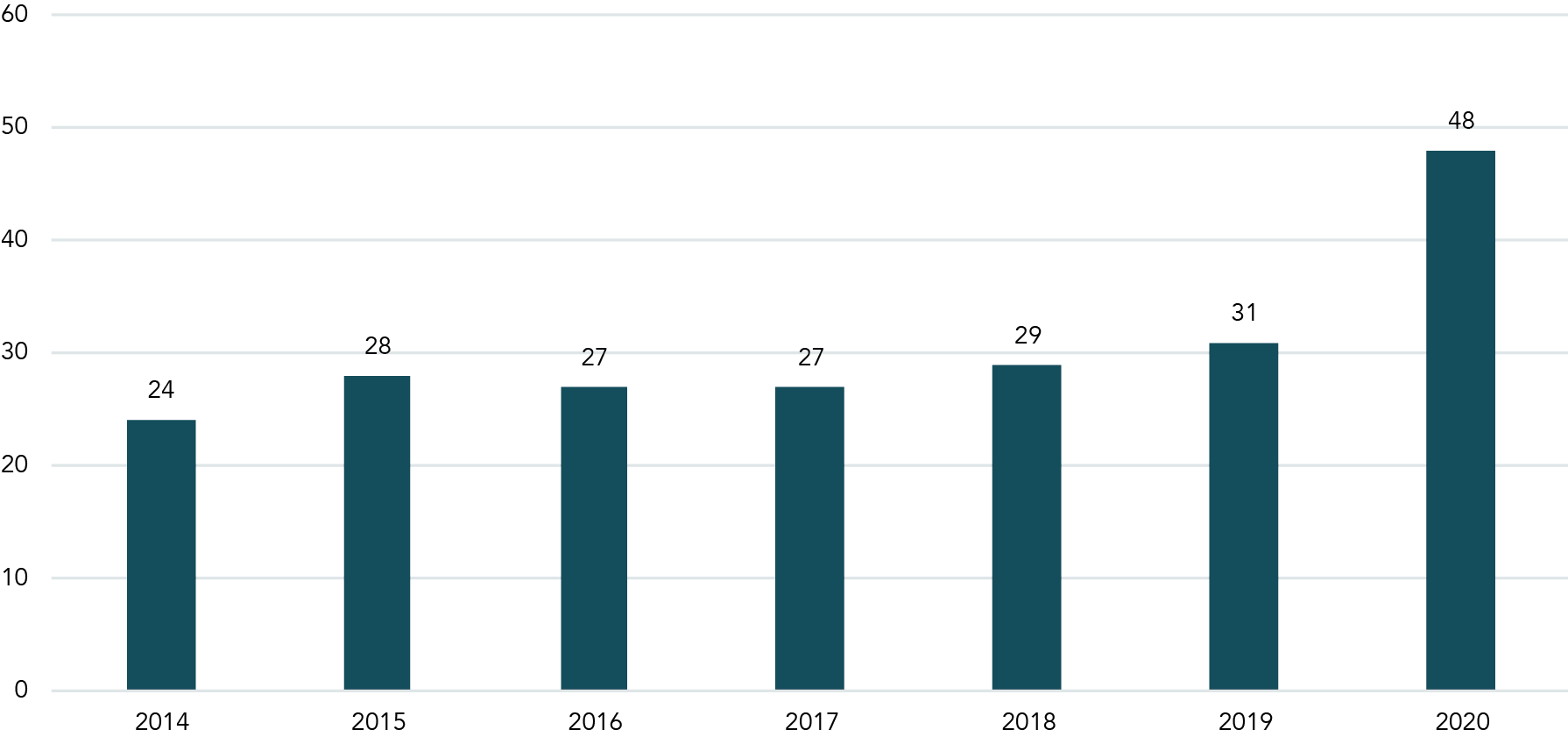

Even if TA remains small in comparison to new commitments by European DFIs, the amount spent on TA activities have considerably increased in the last years, growing from €24 million in 2014 to €48 million in 2020. As illustrated in Figure 3, there was a modest increase between 2014 and 2019, before accelerating in 2020 as DFIs provided extensive TA to help their clients face the impacts of COVID-19. In 2020, reporting by EDFI members and published by Proparco also reveal that Africa was the main beneficiary of TA, capturing 42 percent of the projects and 33 percent of the total TA amount of ten European DFIs.[8] This is in line with the share of EDFI’s members investment in Africa (33 percent of the total portfolio). More than 40 percent of the 152 projects targeted the financial sector, while only 15 percent focused on infrastructure.

Figure 3. Consolidated budget for technical assistance of 10 European DFIs, 2014-2020, EUR millions

Source: Proparco’s Private Sector & Development, nr. 36.

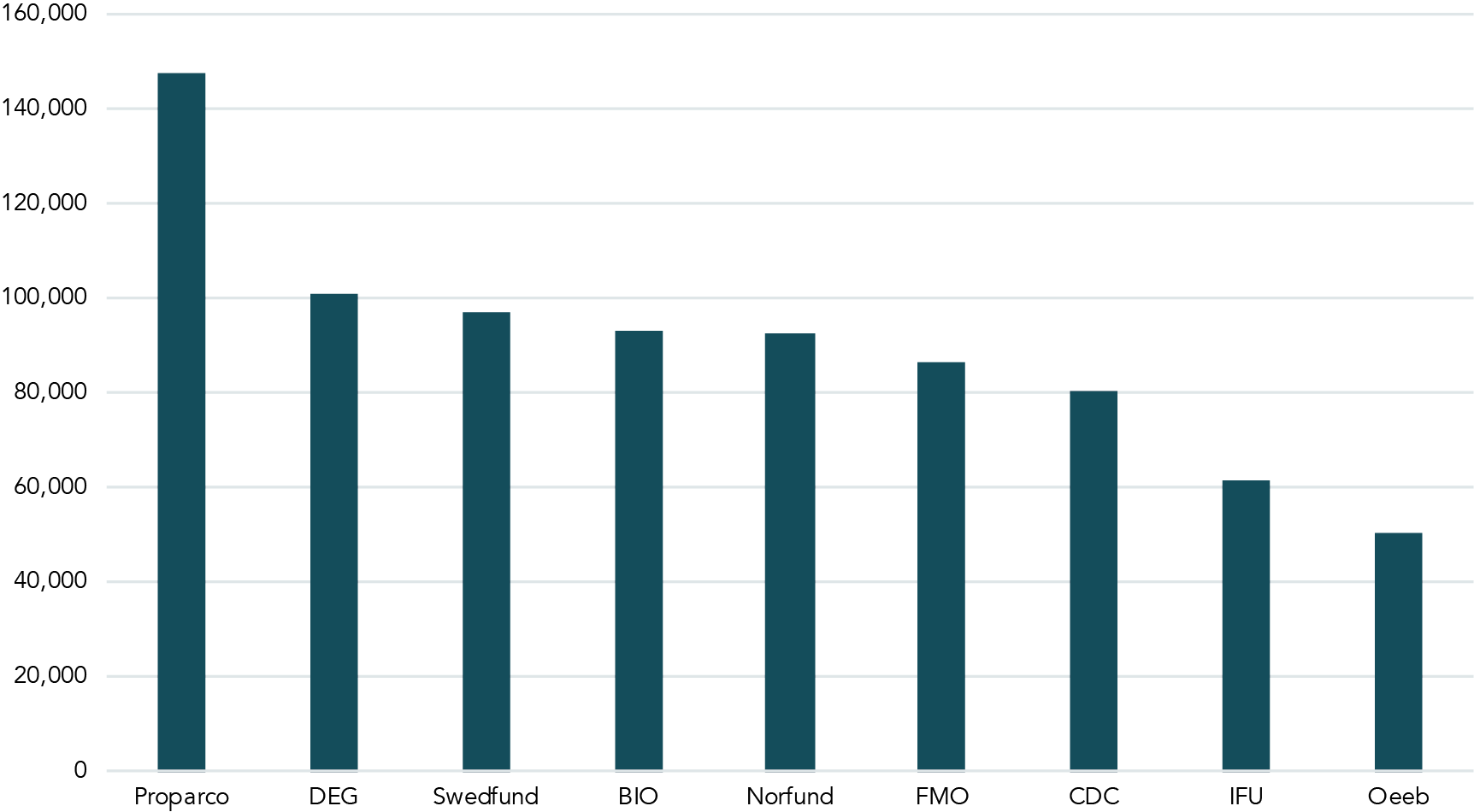

In 2020, the average ticket size for TA funding spent by European DFIs was €92,000. This can be explained by the fact that many of these institutions have set up a cap on TA spending per project. Proparco, the French DFI, has an average TA spend per project of €147,000 (see Figure 4).

Figure 4. Average TA amount by DFI per project, EUR

Source: Authors’ calculations based on data from EDFI website.

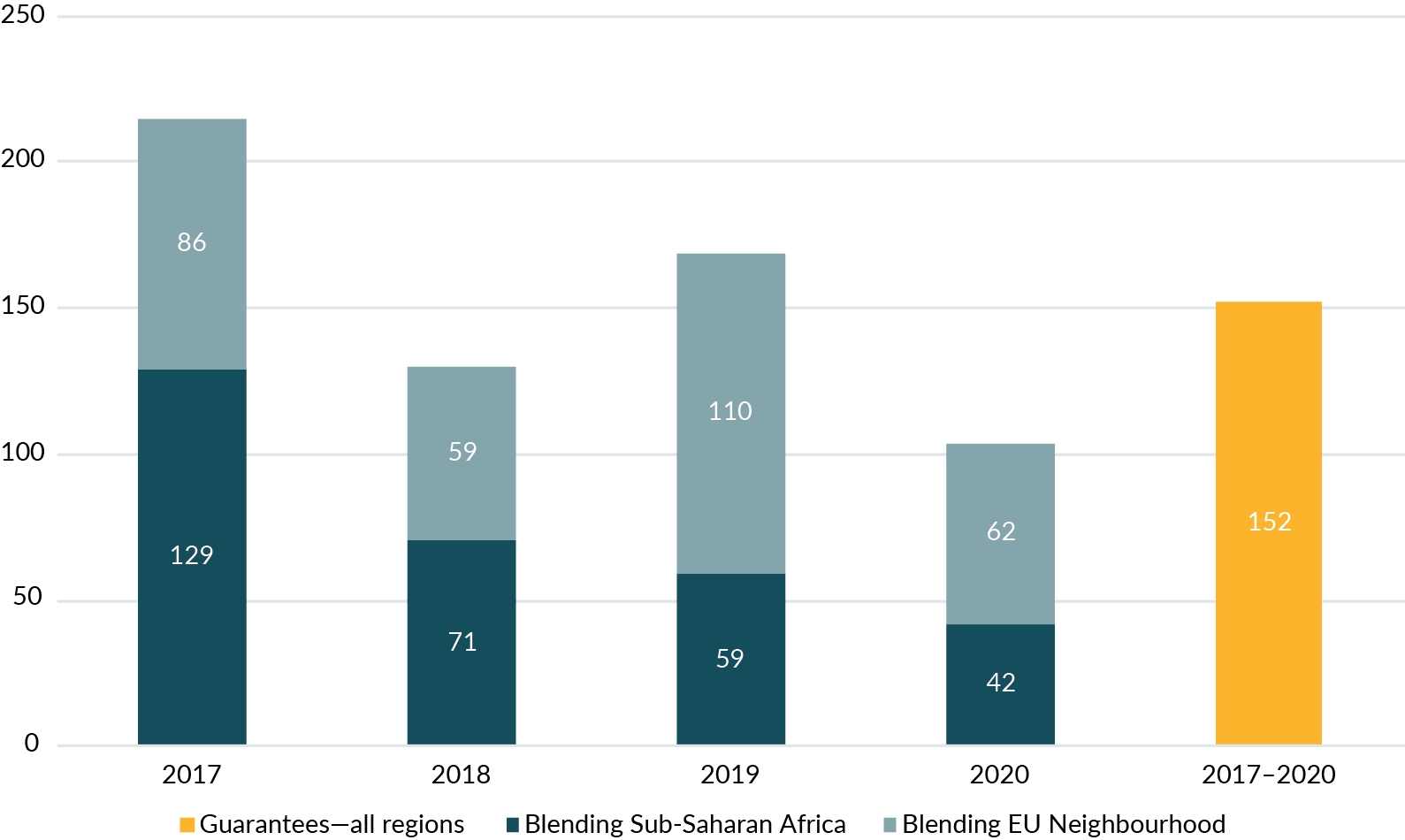

For the EU, TA also represents a key component of its strategy to foster investment in low and middle-income countries. TA constitutes a key pillar of the External Investment Plan (EIP) launched in 2017 with the dual objective of helping DFIs and investors develop projects which can be financed through the European Fund for Sustainable Development (EFSD) and of supporting partner governments to reform the business regulatory environment through policy dialogue. Between 2017 and 2020, the EU provided €618 million in TA for blended finance projects and up to €152 million for guarantees. In 2020 alone, the European Commission signed technical assistance contracts linked to the EFSD worth €93 million.[9]

Figure 5. TA disbursement under the EU External Investment Plan, 2017-2019, EUR millions

Source: EFSD operational report 2020

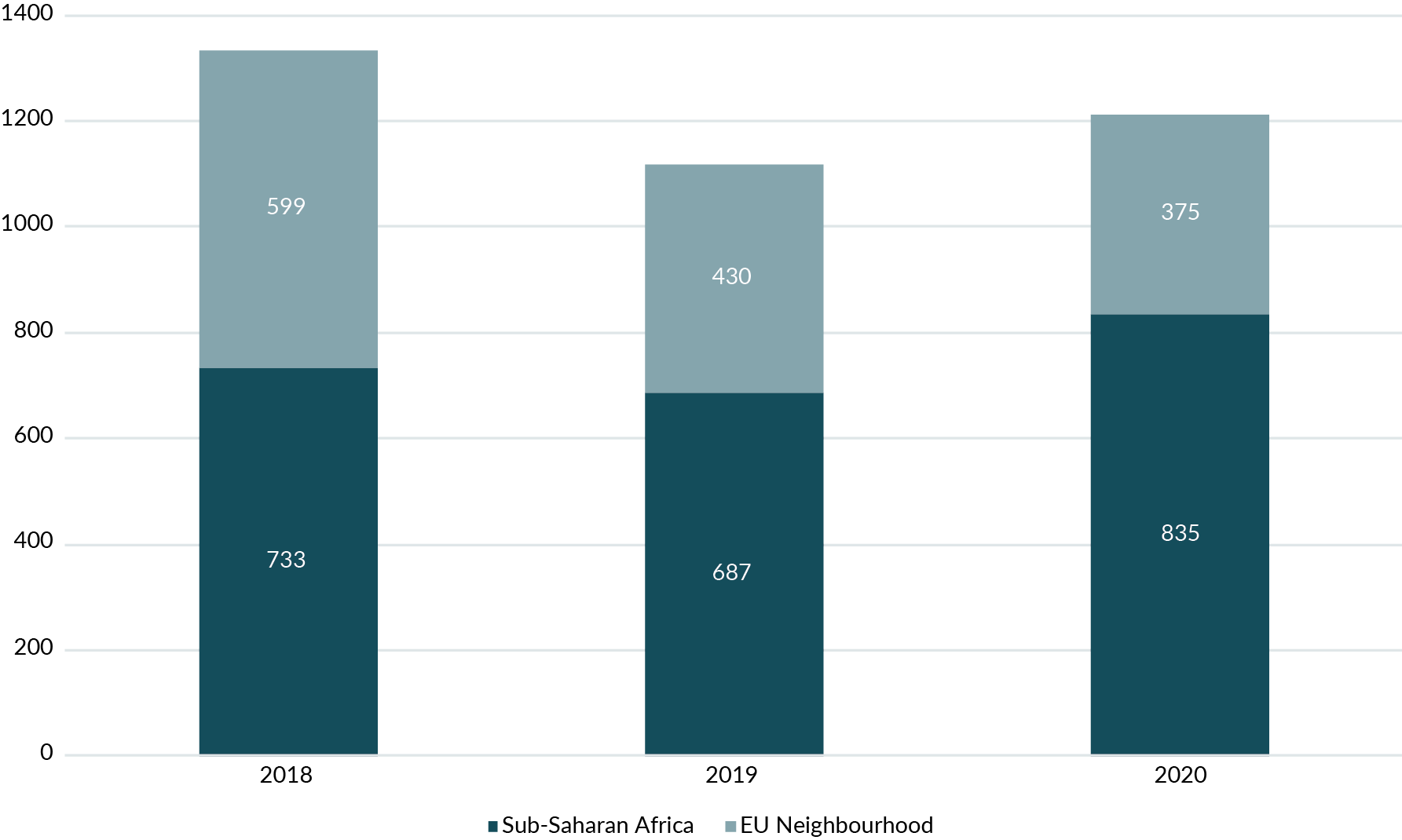

The amount spent by the EU on TA on project preparation under the EFSD comes in stark contrast with the financial support to improve the investment climate in partner countries. As shown in Figure 6, the EU spent close to €3.6 billion between 2018 and 2020 in an effort to remove obstacles to investment in sub-Saharan Africa and in the EU’s neighbourhood. However, while TA on project preparation under the second pillar of the EIP is separately agreed for each transaction, support for improving the business climate under the third pillar of the plan is provided at the sector level. This structure can lead to discrepancies between the objectives of pillar 2 and 3.

Figure 6. Investment Climate Support under the EFSD, 2018-2020, EUR millions

Source: EFSD Operational Report 2020

TA in practice

In this section, we look at examples of DFIs’ different approaches to TA – pre, during, and post-investment.

Upstream investments: Swedfund and DFI Country Pilots in fragile contexts

At Swedfund, the Project Accelerator programme provides grant support and technical expertise to public institutions to prepare and implement projects in the sustainable infrastructure and energy sectors. Key products include feasibility studies or pre-studies. For example, the programme financed a feasibility study for the introduction of an integrated and coordinated public transport system in Abidjan.[10]

It is in fragile countries that upstream work to create a more favourable investment framework is most needed. It is for this reason that a group of DFIs decided to collaborate on the development of projects in seven fragile countries.[11] The group is composed of the IFC, Proparco, CDC, SIFEM, AfDB and the African Finance Corporation. As upstream interventions are particularly costly for DFIs and offer no direct guarantee of return on investments, such cooperation enables the spread of costs between multiple institutions and facilitates future co-investments.[12]

During the investment: FMO and EBRD

The Dutch development bank, FMO, has a “capacity development programme” that has contributed €52 million in TA to over 500 projects over the last ten years. The programme has four focus areas: (1) gender; (2) governance and risk management; (3) green; and (4) environmental and social risk management.[13] TA has supported financial institutions to target women entrepreneurs or to offer training for sustainable investment.

The EBRD Small Business Initiative is another innovative method to facilitate small and medium-sized enterprises (SMEs) to become leaders in their market. Active in 25 countries, the initiative matches SMEs with international advisers with at least 15 years of experience in senior management in a similar field. The initiative also relies on local consultants to add local knowledge to the advice delivered. The EBRD works with a network of more than 10,000 professionals. The bank claims that on average, its clients’ revenues increased by 50 percent and productivity by 38 percent over the course of the project.[14]

A comprehensive approach: The InvestEU Advisory Hub

For investments within the EU Member States, the InvestEU Advisory Hub is the single-entry point for advisory services and TA. The InvestEU Advisory Hub is the successor to the European Investment Advisory Hub (EIAH) which was launched in 2015 as a partnership between the European Commission and the EIB as a key component of the Juncker Plan to stimulate investments in the EU.[15] While initially set up as a “demand-driven” tool, its successor – the InvestEU Advisory Hub – has a stronger policy steer embedded, with the European Commission taking the lead in offering an integrated package of advisory and TA support. It intervenes throughout the investment cycle, as well as upstream. The Hub can also support the establishment of Investment Platforms by helping clients from the public or private sectors to assess market potential, develop an investment strategy and structure a platform to manage investments in a particular geography or sector. It is active in all 27 EU member states and covers a wide range of sectors, from energy to transport, as well as human capital. For the EU budgetary cycle 2021-2027, the European Commission and the EIB signed an agreement to provide the Hub with up to €270 million. Under this agreement, 75 percent of this amount will be implemented by the EIB, while the remaining 25 percent by other advisory partners.

The Hub relies on a strong network of partners to provide advice to project promoters and connect them with investors. Since 2015, it has built a network of around 40 partners and signed almost 30 cooperation agreements with national promotional banks, institutional investors and local partners. It also seeks to develop or create TA units among its partners and expects to conclude 16 of such agreements by the end of 2021. Relying on the expertise of institutions such as the EIB and the EBRD in providing TA and financial advice has also helped the Hub to scale its operations in a relatively short space of time.

As illustrated by Figure 6, all the requests are centralised in the Hub through its website. The Hub then screens the requests and offers the project owner the adequate level of support, from light advice to long-term follow-up.

Since 2015, the Hub has received more than 3300 direct requests from project promoters. Between 2015 and 2018, the Hub delivered 285 assignments to public and private sector beneficiaries. 88 percent of assignments consisted of the provision of technical or financial advice on specific projects, while the remaining 12 percent related to non-project specific financial advice, cooperation with National Promotional Banks (NPBs) and general issues.

Figure 7. European Investment Advisory Hub’s handling of advice requests

Source: European Court of Auditors

The InvestEU Advisory Hub as a TA model for the EU’s external investments

In a post-COVID-19 context, the EU will need to incentivise European DFIs to invest in high development impact interventions at the riskier and more innovative end of the spectrum through the European Fund for Sustainable Development Plus (EFSD+). As these projects can be more complex to prepare (thereby disincentivising applications), the European Commission must play a stronger role in helping to develop the supply of projects, providing project preparation support and assisting DFIs to coordinate, while ensuring that smaller DFIs are integrated.

Through its EIAH, the EU has built solid experience and lessons in project preparation within its own borders by connecting project promoters and intermediaries with advisory partners who work directly together to help projects reach the financing stage. Initially, as a “demand-driven” tool, it struggled to make a significant contribution to the supply of projects suitable for investment by the end of 2018 – it received few requests that could have led to assignments compared to the resources at its disposal. The new InvestEU Advisory Hub has now been set up to be more proactive in steering policy and developing cooperation with NPBs in order to improve the local access to Hub support.

Building on this approach, the EU could establish a similar hub for its external investments - an Accelerator Hub - which would provide targeted support to identify, prepare, and develop investment projects under the EFSD+. The Accelerator Hub could take the form of a transversal type of hub which would act as a convenor between different the TA programmes of the European DFIs and draw on their expertise, to create coherence between the programmes and to be more responsive to client needs. The hub through its budget would create delivery capacity and would act as a single point of entry and convenor of expertise. This would entail minimal overlap and duplication between the European DFI offers that are already on the table. As such, the hub would be a gap filler rather than a facility which would take the place of existing TA sources of funding.

The hub would be driven by experts from the European Commission, the European DFIs and multilateral development banks and national development banks to work directly with investors and firms, offering tailor-made advice to dramatically accelerate the process of the development of a pipeline of high-quality projects. TA would be fully integrated into all parts of the project. Experts would provide project development support throughout the stages of the project as well as upstream advice on market studies, sector strategies and project screening.

Local knowledge and market intelligence, and an in-depth understanding of the local investment climate, will be key. Here, national development and promotional banks have a large role to play. The hub could build on direct cooperation with national development and promotional banks and institutions to ensure geographical coverage of advisory services and develop a proactive approach by means of local presence.

List of institutions interviewed:

- European Commission, DG ECFIN

- European Investment Bank

- European Bank for Reconstruction and Development

- Swedfund

- FMO

Sources

Bridge Ventures (2017). Shifting the Lens: A De-risking Toolkit for Impact Investment. Retrieved from https://www.bridgesfundmanagement.com/wp-content/uploads/2017/08/Shifting-the-Lens-A-De-risking-Toolkit-for-Impact-Investment.pdf

Convergence (2019). Blending with technical assistance. Data Brief, retrieved from https://assets.ctfassets.net/4cgqlwde6qy0/3RZClckJliqSyQVy5zkxaT/d3154bf0a55836bd3ec26fb07258a913/Technical_Assistance_Brief_vFinal.pdf

European Commission (2021). EFSD Operational Report 2020.

European Court of Auditors (2020). Special Report. The European Investment Advisory Hub — Launched to boost investment in the EU, the Hub’s impact remains limited.

European Investment Bank (2021). European Investment Advisory Hub - Annual Report 2020.

Lakmeeharan, K., Manji, Q., Nyairo, R., & Poeltner, H. (2020). Solving Africa’s infrastructure paradox. McKinsey & Company, 6. Retrieved from https://www.mckinsey.com/business-functions/operations/our-insights/solving-africas-infrastructure-paradox

Lawrence, D. & Gemanetti, E. (2020). DFI Partnerships Point to a New Way of Doing Business, IFC Insight. Retrieved from https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/insights/i13-dfi-partnerships

OECD/UNCDF (2019), Blended Finance in the Least Developed Countries 2019, OECD

Publishing, Paris, https://dx.doi.org/10.1787/1c142aae-en.

Proparco (2021). Technical Assistance: Opening Up New Horizons, Private Sector & Development nr. 36, Paris.

[1] https://www.mckinsey.com/business-functions/operations/our-insights/solving-africas-infrastructure-paradox

[3] https://www.bridgesfundmanagement.com/wp-content/uploads/2017/08/Shifting-the-Lens-A-De-risking-Toolkit-for-Impact-Investment.pdf

[4] https://assets.ctfassets.net/4cgqlwde6qy0/3RZClckJliqSyQVy5zkxaT/d3154bf0a55836bd3ec26fb07258a913/Technical_Assistance_Brief_vFinal.pdf

[5] The member institutions include the Belgian Investment Company For Developing Countries (Bio), British International Investment (formerly CDC), the Spanish Compañía Española de Financiación del Desarrollo (COFIDES), the German Deutsche Investitions- und Entwicklungsgesellschaft (DEG), the Finnish Fund for Industrial Cooperation (Finnfund), the Netherlands Development Finance Company (FMO), the Danish Investment Fund for Developing Countries (IFU), the Norwegian Investment Fund For Developing Countries (Nordfund), the Development Bank of Austria (OeEB), the French Société De Promotion Et De Participation Pour La Coopération Economique (Proparco), the Swiss Investment Fund For Emerging Markets (SIFEM), the Italian Società Italiana Per Le Imprese All'estero & CDP Development Finance (SIMEST/CDP), the Portuguese Sociedade Para O Financiamento Do Desenvolvimento (Sofid) and the Swedish Swedfund International.

[6] COFIDES plans to disburse TA financing in 2022 but did not disburse TA in previous years.

[8] https://www.proparco.fr/en/ressources/private-sector-and-development-ndeg36-technical-assistance-opening-new-horizons

[9] https://ec.europa.eu/eu-external-investment-plan/sites/default/files/documents/efsd_operational_report_en.pdf

[11] The Democratic Republic of the Congo, Haiti, Sierra Leone, Ethiopia, Lebanon, Madagascar, and Nepal.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.