Recommended

Marginal abatement cost curves, which suggest the cheapest approaches to reducing carbon emissions, are out of favor in international climate finance discussions because they are not good tools to use when thinking about systemic and urgent change. On the other hand, international financing studies based on adding up the investment requirements linked to an emissions path to 1.5 degrees of warming produce historically implausible numbers and endanger existing development finance. To close the gap, we need to push the cost curve down (through technology advance) and lower the price of finance (through scalable multilateral development bank support) while protecting development finance and focusing it on where it is most needed: the poorest countries suffering the most from climate change.

Marginal cost curves illustrate the costs of getting to lower emissions. The McKinsey Cost Curve (Figure 1) lines up greenhouse gas abatement technologies by their cost per ton of emissions averted. Next to the y-axis are approaches that both reduce greenhouse gas emissions and save money –things like switching to LED lighting and improving building energy efficiency. In the middle are approaches that are cheap but still slightly more expensive than existing higher-emission approaches (think nuclear power over coal power). On the right are approaches that, with today’s technologies, are very expensive per ton of greenhouse gasses abated, like carbon capture and storage.

Figure 1. The McKinsey Cost Curve

Figure 2 presents a simplified cost curve and variations. The bit at bottom left is where it isn’t about money –these investments save cash. The bit top right is where it would be very inefficient to invest in ternms of dollars spent per ton of emission prevented. We’re most interested in getting the bit of the curve in the middle below the line so that zero or low carbon approaches are the cheapest way to produce goods and services. Simply, there are two ways to do that: raise the line (to O* in the second graph) or drop the curve (the third graph). What does that mean in practice? Raising the line involves making low-carbon solutions (relatively) cheaper by taxing emissions or subsidizing low-carbon approaches. Dropping the curve involves technological advance that makes abatement approaches relatively cheaper even absent subsidies or taxes.

Figure 2. Simplified cost curve and variations

But international climate finance discussions have largely abandoned marginal thinking on costs. Marginal approaches often don’t deliver the most rapid progress to net zero. For example, that hybrid cars are cheaper than full electric in terms of cost per ton abated doesn’t matter if you are trying to get to zero-carbon transport approaches. And in some cases it might make sense to prioritize more expensive abatement efforts where capital is longer-lived than less expensive efforts involving shorter-lived capital. Given the mindset of urgent, systemic change, it is more straightforward to just look at total costs of moving to low carbon infrastructure compatable with a given carbon budget, and then allocate those costs across sources to figure out financing needs. The Songwe-Stern-Bhattacharya Expert Group, for example, adds up the cost of needed infrastructure and related investments and suggests around $2 trillion in finance a year is needed for climate mitigation in developing countries excluding China if the world is to stabilize warming below 1.5 degrees centigrade.

That suggests climate finance discussions have embraced somewhat magical thinking on finance. $2 trillion a year is a lot of money. The Songwe et al study suggests that half of that can come from domestic sources in developing countries, and about $1 trillion a year will be required from international financing. Already by 2025, they suggest, we will need financing on climate investments (both mitigation and adaptation, but overwhelmingly mitigation) in developing countries provided by private sector investment to rise from $69 billion to $395 billion, non-concessional official finance from $31 billion to $161 billion, and climate ODA to rise from $12 billion to $96 billion. The numbers would rise considerably further after that point.

The trillion dollars or so of domestic financing is equal to about 3.25 percent of GDP in developing countries excluding China. It is worth comparing that to middle income country tax revenues that are only 11 percent of GDP, and government spending on education averages only about 4 percent of GDP worldwide. Developing countries excluding China are currently responsible for 35 percent of global annual CO2 emissions and a lesser share of the stock of emissions. Many of those countries may balk at taking on such a large and immediate burden with regard to fixing the climate problem when there are so many competing priorities and there is comparatively little sign of rich countries taking the lead toward aggressive emissions reduction strategies as they re-open coal pits and buy up global supplies of natural gas.

Compare the Inflation Reduction Act’s $400 billion spending over the course of a decade to Songwe et. al.’s ask. $40 billion a year is worth about 0.16 percent of US GDP, or about one twentieth of the domestic resource mobilization effort Songwe et al call for from the developing world. And consider the buy-America conditions attached to that finance and the extent to which it is focused on US industrial strategy rather than the most efficient ways to reduce global emissions. It seems a reasonable reaction for developing countries to wait on the rich world to better get its act together, in particular by rolling out technologies that make a zero-carbon transition more affordable, before investing so heavily themselves.

Turning to the near sixford rise in private finance for climate related investments by 2025, up to $395 billion, that is largely to be spent on infrastructure. The figure includes both sovereign lending and direct participation in project finance/ownership, but in that regard it is worth looking at the last thirty years of effort to increase private participation in infrastructure in developing countries. Total annual investment in PPI projects in those countries has never surpassed $158 billion, a level reached a decade ago. Investments haven’t topped $100 billion since 2015. Thirty percent of the investment for these deals comes from public sources, so the truly private financing component is closer to $70 billion. And in total, 83 percent of total infrastructure investment in developing countries is still publicly financed.

Even if more private infrastructure finance were forthcoming, private investors want very high returns. The challenge grows when the aim is to have the private sector finance (directly or indirectly) projects ever further from making a market return in an environment of higher interest rates. Songwe et al suggest want a 50 percent return for solar projects in countries with weak credit ratings. Of course there are tools to lower those rates, from project preparation support through guarantees to subsidies, but we have been using such approaches for decades with very little success and considerable cost. Recent IFC projects attempting to demonstrate that solar projects in lower income developing countries didn’t need subsidy instead demonstrated it took about $2 in subsidies to attract $1 in private finance.

And calibrating subsidies to be the right size to move something from above to just below the zero line on the cost curve (and so minimize subsidy requirements) is a significant challenge at which we have repeatedly failed. Because the marginal abatement cost curve actually looks different in different places, times, and economic situations, we don’t really know how much subsidy is required in a given situation to make projects happen. Absent competitive allocation mechanisms that would be provided by global carbon markets, we are left with the considerable cost and inefficiency of bespoke subsidy deals at the project level. For example, the ersatz carbon market of the Clean Development Mechanism under the Kyoto Protocol largely backed projects that would have happened anyway and may have increased global emissions overall. More recently, Ian Mitchell and Matt Juden find that aid-financed climate projects that claim to reduce emissions at reported costs of between $10 to $1,000 per tonne of CO2 equivalent averted –a hundredfold gap—and that is to say nothing of the additionality question of whether many of these projects would have gone ahead absent subsidy.

All of this suggests the need for a lot of heavily subsidized official finance to get anywhere near scale and sustainability for the non-concessional financing numbers, and in turn that the Songwe et al numbers for ODA financing are likely very optimistic even were it all simply dedicated to mobilizing related private finance and subsidizing official finance. But even assuming Songwe et al were right about mobilization potential, it is worth noting the ODA number is still very large. The $96 billion of required climate ODA for 2025 compares to current global country programmable aid (ODA that reaches the country to be spent on budget) worth only $65 billion. It is equal to more than fifty percent of all ODA, including rich country domestic spending and humanitarian relief.

This risks development finance if additional ODA isn’t forthcoming. Repeated studies from CGD and elsewhere have emphasized that the climate finance claimed by donor countries in their reporting to the OECD is in considerable part diverting, not adding to, development finance, and ODA in particular. Country programmable ODA was 0.25 percent of DAC donor GNI in 2009 and 0.25 percent of DAC donor GNI in 2021. DAC countries have come no closer to their commitment to providing 0.7 percent of their GNI to ODA, but they have claimed a lot more ODA was going to climate mitigation over that time.

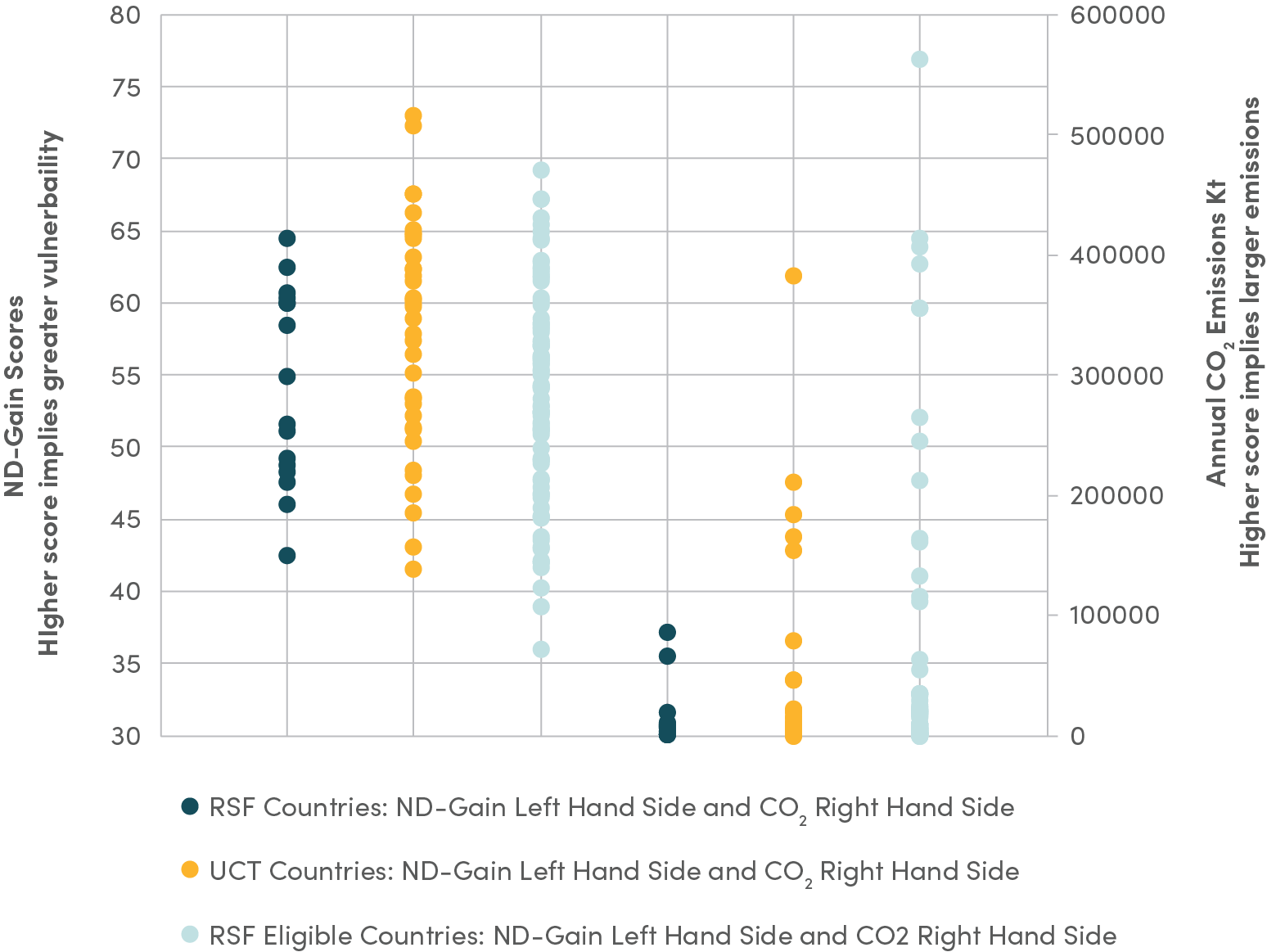

And mitigation spending in particular is more effectively utilized in upper middle income countries that account for considerable bulk of developing country emissions and where subsidy costs for zero-carbon approaches will be smaller (because finance in general is less expensive). It should be no surprise that only 33 percent of international climate finance tracked by the OECD went to low and lower middle income countries. That suggests ODA spent on mitigation comes at the price of the most effective ODA for development (indeed, the upper middle income share of ODA has climbed from below ten percent in in the mid-2000s closer to one quarter today).

This diversion is costly, because while we don’t know how to leverage grants efficiently to reduce emissions, we do know how to focus them on poverty reduction. Country of residence is a very strong predictor of personal consumption, so country-targeting is a powerful tool to focus grant assistance where it can be most effective. A one percentage point increase in the aid to GNI ratio raises annual real per capita GDP growth by about 0.35 percentage points in countries near the World Bank IDA income threshold. If all ODA was spent in low and lower middle income countries, that suggests it might raise annual growth by about 0.85 percentage points --or 18 percent of GDP if sustained over 20 years. And note that development is adaptation: richer countries are less reliant on agriculture, more able to afford cooling systems and the infrastructure of climate resilience.

There is very little sign the world as a whole is taking the steps required to reach the 1.5 degrees target at current (or even currently forecast) technology costs, and the above discussion suggests little hope the domestic resources or private finance will be forthcoming to support rapid mitigation progress in developing countries. Meanwhile, even if you diverted all development finance away from the poorest countries, those least responsible for climate change, already suffering the most from its effects, and most desperately in need of development as an adaptation response, what you would at best get in return is an extremely partial fix for less than half of the mitigation spending in a group of countries responsible for less than half of global emissions.

In other words, the world’s poorest countries would be considerably better off with development finance continuing and marginally more climate change in 2100 than no development finance and marginally less climate change. And, importantly, the worse you think the extent and impact of climate change is going to be, the worse it is to divert aid from poor countries that most need adaptation. That is why ‘new and additional’ matters, and that is why it is morally and economically obscene to divert existing development finance to mitigation.

The practical solution is to refocus on the cost curve. At least until we are in an environment where it is plausible to believe richer countries will make the required effort at home to meet their global commitment towards net zero, and until the cost curve has moved further down, and until the time when international financial flows considerably expand, focusing on the left hand of the marginal cost curve makes sense in developing countries and for development finance. That implies we should not hold developing countries to standards rich countries aren’t meeting around financing intermediate approaches like natural gas generation, for example. And even if it isn’t zero carbon, switching to liquid natural gas cooking would be better for the climate than using wood and dung and it would cut the 3.8 million annual death toll from indoor air pollution. Donors should support that.

To make more rapid global progress, the priority should be dropping the curve. McKinsey reports the first version of its cost curve, in 2007, “vastly underestimated” how fast technology costs would fall for renewable energy, and there is little reason to think that progress is going to halt. We’ve seen a 97 percent reduction in the price of both solar panels and batteries over three decades. Perhaps perovskite solar cells to replace silicon could reduce solar panel prices by a further 75 percent, while utility scale battery storage is also predicted to get considerably cheaper in the medium term. The more that the curve drops, the less need for subsidies and external finance to support rollout of zero-carbon technologies.

But this is largely an activity largely for countries excluded from the Songwe et al calculations. China, the US, Japan, the Republic of Korea and Germany between them accounted for 93 percent of resident patent applications worldwide. While there is an important role for innovations that adapt new technologies to low-income environments, and international finance can help support that, the greatest impact the rich world can have toward a low-carbon future for poorer countries is to further research, develop and scale low- and zero-carbon technologies at home.

MDB financing for reduced- and zero- carbon investments can still help raise the line at least somewhat. Unlike bespoke project-side interventions with individual private financiers which don’t scale, a blanket commitment to low-hassle MDB non-concessional financing for low and zero-carbon investment projects sponsored by developing countries is plausibly affordable and can scale. The (unweighted) average spread between IBRD loans and a basket of emerging market USD bonds was about 8 percent in late 2022. That spread will be considerably lower for many of the larger developing country emitters right now –closer to a one percent gap for Indonesia, for example. Still, and as a rule, MDB loans are usually notably cheaper than market rates for most client countries, especially lower middle income clients.

And as compared to the one-to-less-than-one mobilization on the downstream side of MDB operations, each dollar of new MDB equity can support $7 in direct MDB lending in perpetuity. For illustration, assuming a (long) twenty-year average maturity, MDBs could sustain an additional $350 billion a year in mitigation related lending in perpetuity with about $50 billion a year over twenty years in additional capital. DAC members account for around 60 percent of current World Bank shareholding. Assuming that number remains around the same and applies approximately across MDBs, it suggests that about $30 billion of (ODA-eligible) funding a year would be required from DAC members in order to ‘flood the zone’ for climate mitigation projects in the middle of the curve in middle income countries. This should, of course, be new and additional finance. If MDBs managed to mobilize (say) 45 cents of private finance for each dollar of this lending, potential total annual climate finance from this capital would top $500 billion.

That approach could help equalize the central part of the abatement cost line across countries for low carbon solutions —making them little more expensive (at least from a financing perspective) in developing countries than high income countries. It is a globally efficient approach –different solutions will be implemented because national circumstances change the shape of the cost curve rather than just because financing for all infrastructure is considerably more expensive in some countries. This makes the playing field a little more level, and helps ensure the most cost-efficient low and zero-carbon projects are carried out worldwide. In turn it will help scale markets for new technologies and bring prices further down.

If rich countries can't even manage this level of financing, it is a sign of how seriously they take overall climate financing commitments. But it will require shareholder support for process and bureaucracy change at the MDBs as well. That client countries weren’t rushing to borrow a lot more from the World Bank at a time of financial crisis and pandemic (in FY22 it lent $33.1 billion compared to a ceiling of $37.5 billion) suggests a considerable demand side problem. This is related to slow and bureaucratic approval and disbursement of financing –MDBs need to make their financing more attractive than last resort, especially given clients want Donors and MDBs to focus on development, not climate.

Developing countries want rich countries to lead on climate change. We should listen to them, both because they have a strong case based on all three of rights, utility and equity, as well as because pushing down on the abatement cost curve is largely about policy, research and development in rich countries.

Furthermore, with the international finance we have and the finance it seems plausible we will get in the near future, we can’t realistically move the line up very far in middle income countries, especially because of the practical complications of focusing finance where it would make a difference –on marginal investments. Pouring existing development finance, and in particular subsidy finance, into a very partial effort to roll out mitigation technologies in countries responsible for a third of emissions would do little to slow climate change but a lot to damage development prospects in the world’s poorest countries.

Given that, (i) global advocacy around climate change should pay considerably more attention to technology advance in rich countries, including both push and pull mechanisms for technology advance in those countries including R&D, subsidies and taxes; (ii) climate and development finance discussions should focus urgently and concretely on protecting core finance for development and better focusing it on the development and adaptation needs of the world’s poorest countries (iii) climate negotiators should agree new, additional, more attractive public non-concessional financing through MDB arms that will help level the global playing field in terms of the financing costs of delivering low or zero carbon investments in the middle of the cost curve.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.

Image credit for social media/web: Adobe Stock