Imagine you were a donor government trying to subsidize the private sector to invest in projects that would support climate mitigation or development around the world. You’d want your funding to go as far as possible, using efficient mechanisms to ensure the maximum impact for each scarce dollar spent.

If your goal was to maximize development, you’d want to focus on the world’s poorest countries, where each dollar goes furthest. You’d want to focus on the investments likely to have the most impact: working with host governments to develop a financially sustainable project pipeline that tackles the binding constraints to growth and where private provision makes sense. Of course, you’d want to use competitive or open approaches to award subsidies, to avoid waste and reduce the risk of corruption.

Or if your goal was to get the maximum reduction in emissions, you’d try to get as close as possible to a market allocation mechanism: auctioning subsidies to the firms that ask for the lowest dollar amount per ton of carbon dioxide saved to adopt zero-carbon technologies, as it might be. That could be hard to pull off absent a global market, so a fallback position could be open offers to provide set financing terms on a set percentage of total project costs to firms that construct zero-carbon power plants in particular countries or regions using particular technologies, for example.

In both cases, you’d want to crowd in lots of private capital—the more of the project cost paid for by the private sector, the more pro-development or low-carbon investment you get for your subsidy dollar.

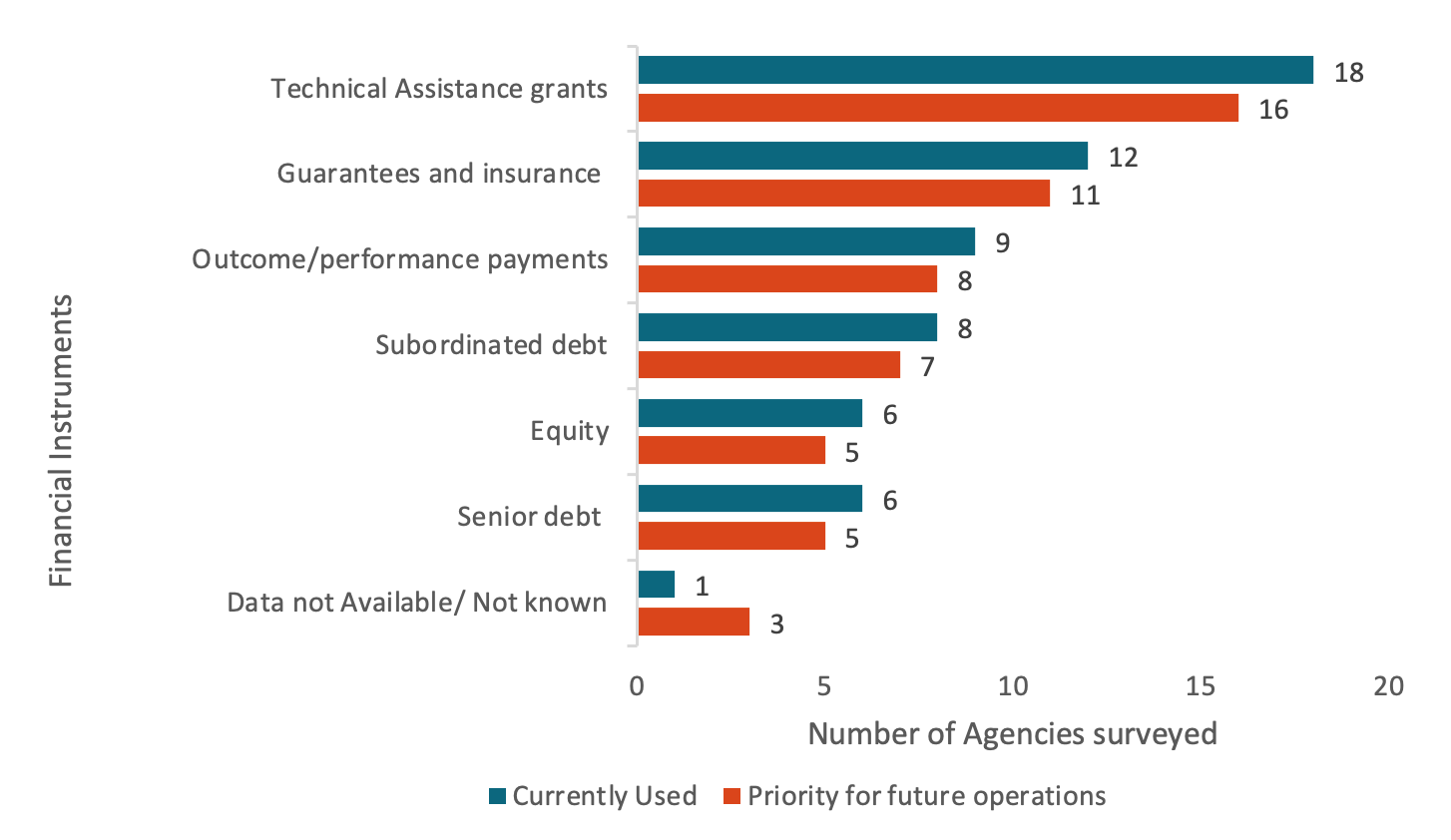

So: how do donor governments actually use their subsidies to the private sector to support mitigation and development projects around the world? The process usually starts with a private company (the project sponsor) asking a development finance institution (DFI) like the World Bank Group’s International Finance Corporation for financing. The DFI looks at the deal and decides it can’t support it on market terms: the cost of capital its internal modelling suggests is necessary to justify the project’s risk would make it financially unsustainable for the client. To bridge the gap, the DFI puts together a bespoke package of subsidized donor capital (grants, guarantees, low-cost senior debt, sub-debt, or cheap equity).

Of course, private financiers look at these deals and reach a similar conclusion to the DFI: without subsidized capital, these projects don’t make sense. And they aren’t getting the subsidy, so the only private investment involved in most subsidized deals is the project sponsor’s own contribution. That’s how we get to the result that donor-subsidized ‘private sector’ projects are financed two thirds by the public sector—nearly all DFIs and donors. Private finance—again, mostly sponsor investment—accounts for just $4.6 billion out of $13.4 billion of project finance involving a subsidy in 2021, with the rest provided by governments.

And the selection process is based on who walks in the door with a not-very-attractive project to finance. That’s utterly not based around maximizing development or mitigation impact per dollar spent, or using any kind of competitive mechanism, or thinking about constraints to development and working with governments to address them. And it is one reason for the lack of focus on countries that most need the support: low-income countries get just 13 percent of the concessional finance—that’s less than upper-middle-income countries (which get 20 percent).

To be fair, mitigation aid as a whole doesn’t appear to have much impact on emissions. And it isn’t like non-subsidized private finance through DFIs has demonstrated it can change sectoral development outcomes. But blended finance for climate and development almost seems perfectly designed to guarantee limited impact. It is time for root and branch reform.

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.