Recommended

WORKING PAPERS

This blog was first published by the International Food Policy Research Institute.

Following the initial COVID-19 outbreak in Hubei Province in late 2019, starting in late Jan. 2020 the Chinese government imposed draconian lockdown measures across the country to control the spread of the disease (Fang, Wang and Yang, 2020). Most small and medium-sized enterprises (SMEs) suspended operations. Then, as the pandemic eased in April, China began lifting the restrictions.

To understand the impact of the lockdown on China’s SMEs and the extent of their recovery, the Enterprise Survey for Innovation and Entrepreneurship in China (ESIEC) project team led by Peking University conducted two rounds of telephone interviews in February and May 2020 with enterprises surveyed over the past three years.

In general, the survey shows that the vast majority of SMEs were able to reopen and rehire workers once restrictions were lifted, exhibiting a V-shaped recovery. Yet a substantial number of mostly smaller enterprises closed permanently, leaving many unemployed, particularly in rural areas.

The survey probed SMEs’ work resumption and production situation, the main difficulties they faced, their efforts to adapt, demands for appropriate assistance policies, and the reach of lockdown-related business assistance programs. Below are four major findings.

1. SMEs experienced a V-shaped recovery

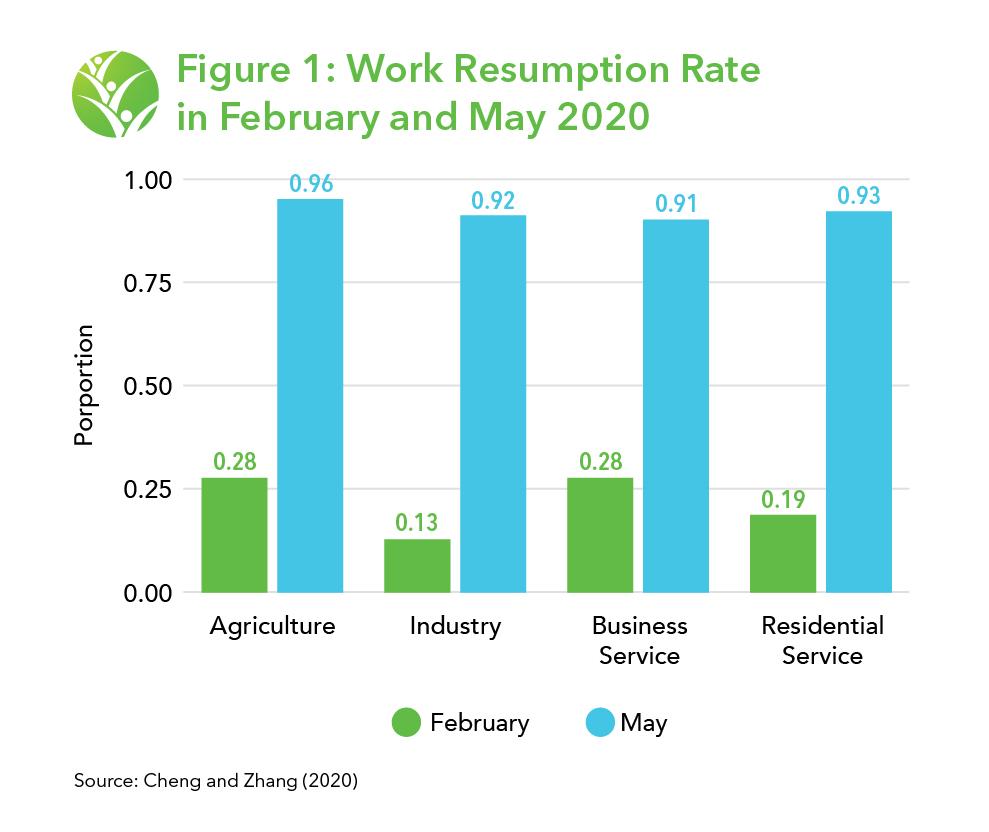

China’s February lockdowns to stop the spread of COVID-19 initially hit SMEs hard, as I examined in an earlier post. By May, economic conditions had greatly improved. As shown in Figure 1, most businesses had reopened. Among those firms, employment reached an average of 86.4% of its pre-shock level. This is clearly a V-shaped recovery. Overall, smaller firms reopened at a lower rate in May across all sectors.

The V-shaped pattern can also be seen in firm entry data. As shown in Dai et al. (2020b), the number of firm entries plummeted to a nadir in the first week after the Chinese New Year week (the first week of lockdown). By the eighth week after the New Year, the number of entries rebounded to the level of previous years. Thanks to greater demand, agricultural SMEs experienced more rapid recovery in production capacity than did SMEs in other sectors (Cheng and Zhang, 2020[1]).

Thanks in large part to the rapid recovery, entrepreneurs said they felt much less anxious and were significantly more optimistic in May than in February. Still, some SMEs were hit harder than others, and serious challenges remain for most SMEs.

2. COVID-19 restrictions took a heavy toll on SMEs and rural residents.

Our analysis shows that around 18% of SMEs closed for good between the two surveys. Given that SMEs generate 80% of employment in China, an 18% failure rate would send a shockwave through the labor market, chopping the national employment rate by about 14%. Because most employees of SMEs are from rural areas, which account for 57% of the country’s population, the rural job loss rate may be as high as 25%. According to another recent survey, of more than 700 villages (Wang et al., 2020[2]), 26% of rural households reported to have at least one family member who lost a job due to the pandemic and one out of six self-employed businesses were closed. Thus, the two different surveys yield consistent results. Clearly, it is rural people who suffered the most from China’s COVID-19 restrictions. Heavy job losses undoubtedly would lower rural residents’ consumption. 42% of rural households reported to have cut food expenditure, while 9% have reduced education expenditure.

Residential service firms suffered the highest exit rate. Among the manufacturing enterprises, the failure rate for smaller firms (fewer than eight workers) is 2.5 percentage points higher than larger firms (eight workers or more). Among export firms, smaller ones exited at a rate 4 percentage points higher than relatively larger firms.

3. Major challenges have shifted from the supply side to the demand side

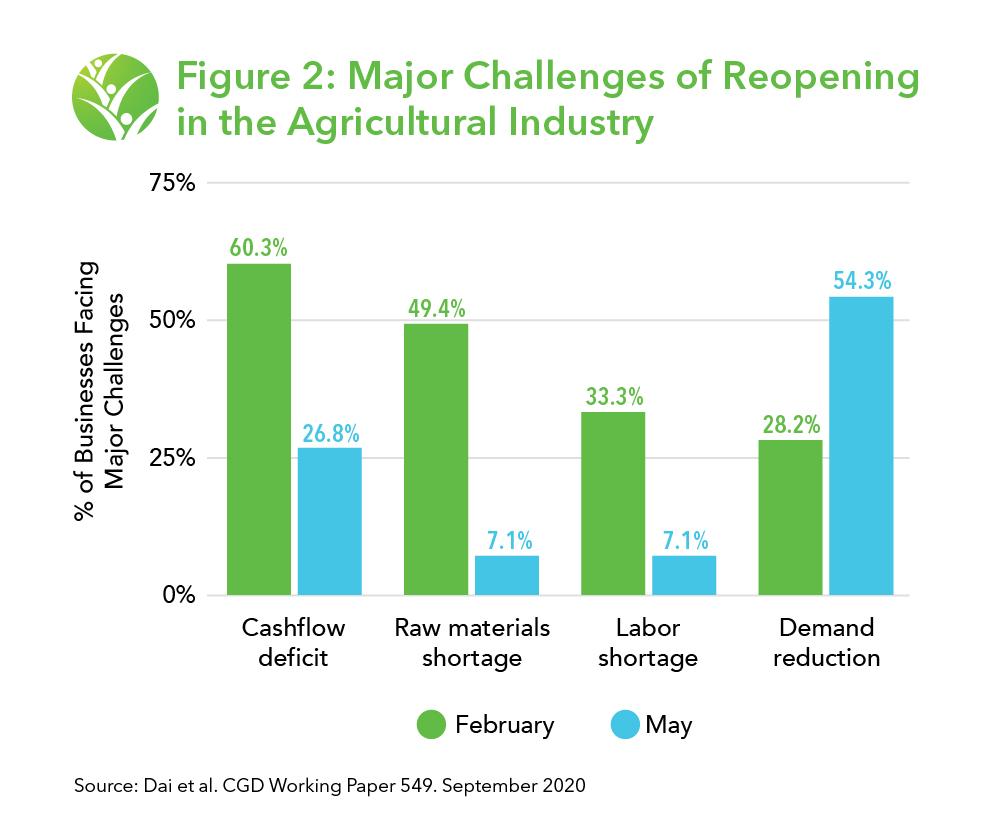

In the recovery, the survey shows, SMEs’ major challenges facing SMEs have been mostly on the demand side rather than the supply side. In February, logistics breakdowns and labor shortages ranked among the top challenges, in particular for industrial enterprises. In May, more than 70% of firms listed the lack of demand as the top challenge, while most supply-side problems, such as raw material shortages and labor shortages, had faded away. Except for agricultural enterprises, smaller firms reported more problems with lack of demand than their bigger counterparts.

In general, agricultural enterprises recovered more rapidly (Figure 2) than the manufacturing, business service, and residential service sectors, which encountered more serious demand problems. Given there are 550 million rural residents (not including migrant workers who transit to urban areas), heavy job losses in rural areas likely explain the reduced demand for consumer goods and residential services: Those affected may have cut back on non-essential spending while trying to maintain their food budgets.

In addition, export firms were 10 percentage points more likely to report inadequate demand as their most critical challenge, largely thanks to shrinking international demand as COVID-19 spread to other countries. Despite the high reopening rate, low demand meant that many firms, particularly export firms, were still running at partial capacity.

4. Support policies did not reach a vast number of SMEs.

After the lockdown was imposed, the Chinese government launched various policies to help affected SMEs, including rent relief, tax reductions, postponing social security payments for employees, and direct financial support. Yet these programs often did not reach smaller firms. Most relief measures did not even apply to self-employed businesses, which, for instance, do not pay much in taxes and or social security for workers. Despite a commitment of 1.5 trillion yuan ($223 billion) in financial support for SMEs, on average only 15% of SMEs reported accessing some form of government assistance—only two percentage points higher than in 2018, when we did our baseline survey. Among self-employed businesses, the coverage rate was as low as 9%.

More than 60% of SMEs wished to receive reductions in rent and other fees, yet the penetration rate for this form of assistance was below 30%. This is because most landlords are private firms or individuals also struggling amid the pandemic. Unemployment insurance, meanwhile, is only provided for workers at big corporations, and most SME workers do not have it. The survey also shows that small firms received less policy support than larger ones. In general, then, SMEs largely relied on themselves through the lockdown.

According to Wang et al. (2020), 98% of rural residents had never heard about unemployment insurance. Once SMEs went bankrupt, most of their workers had to return to their home villages, largely unaccounted for in official unemployment statistics.

China’s initial COVID-19 lockdowns dealt a heavy blow to SMEs, driving up unemployment in rural areas. But once restrictions were eased, many businesses quickly rebounded—showing the resilience of SMEs and offering some hope for how recovery can play out in other parts of the world once outbreaks are brought under control. (Reardon and Swinnen, 2020). But China’s SMEs still faced ongoing post-lockdown problems, with government assistance largely failing to reach a vast number of them, particularly the very small ones, and low demand persisting. Our survey suggests that policies that stimulate domestic demand by targeting consumers, particularly those with low incomes and the vulnerable in rural areas, would indirectly help SMEs and have broader economic benefits.

Xiaobo Zhang is a Senior Research Fellow with IFPRI’s Development Strategy and Governance Division. He is also a Chair Professor of Economics at Peking University and a Visiting Fellow with the Center for Global Development and European Institute for Chinese Studies. The analysis and opinions expressed in this piece are solely those of the author. This paper draws from Dai et al. (2020a)[3] and Cheng and Zhang (2020).

[1] Cheng, Zijun and Xiaobo Zhang, 2020. “V-shaped Recovery of Agricultural SMEs in China from Covid-19 Restrictions.” Working paper. Revised and resubmitted to Agricultural Economics.

[2] Wang, Huan, Markus Zhang, Robin Li, Oliver Zhong, Hannah Johnstone, Huan Zhou, Hao Xue, Sean Sylvia, Matthew Boswell, Prashant Loyalka, and Scott Rozelle. 2020. “Tracking the Impact of COVID-19 in Rural China over Time.” Working Paper. Stanford University.

[3] Dai, Ruochen, Dilip Mookherjee, Yingyue Quan, and Xiaobo Zhang, 2020a. EDI Policy Note.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.