Recommended

Geopolitical tensions have risen with the war in Ukraine and the worsening of trade and political relations between China and the US. While it is too soon to assess the impact of the new geopolitical landscape on military spending, understanding how this spending has evolved since the Cold War can shed light on how military spending is likely to evolve going forward. The churning among the top 10 military spenders in the world—which countries have risen into the top spenders and which have fallen out—in the decades since 1990 can provide some pointers in this regard.

In this blog post, we examine the rise of several of today’s big military spenders. These risers were not in the top 10 spenders in 1990, but high rates of economic growth allowed them to allocate more dollars to the military, displacing countries higher in the list, including G7 nations. This suggests that countries that grow rapidly are likely to rank high in military spending in the future. We also see that revenues from the sale of natural resources contribute to enhancing military capabilities in some countries, although this consideration is likely to diminish as the world economy shifts away from fossil fuels.

Evolution of military spending since 1990

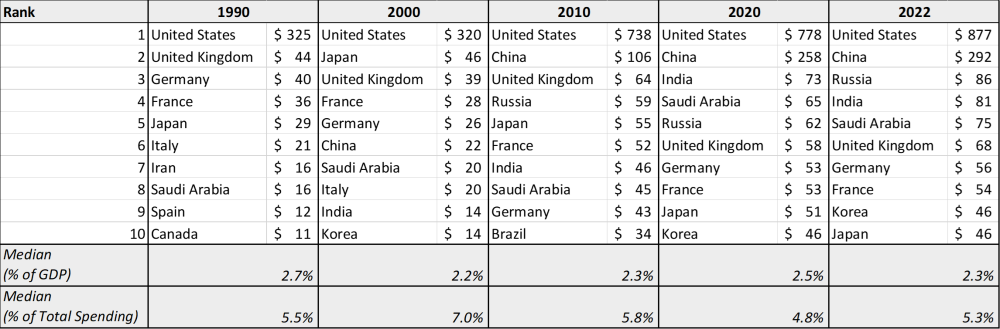

At the end of the Cold War in 1990, the top six military spenders were G7 countries, led by the US (Table 1). They were followed by Iran and Saudi Arabia. Military data on Russia was unavailable at the time of the breakup of the former Soviet Union but became available in 1994. Median spending as a share of GDP was 2.7 percent for the top 10 spenders, with the US spending more than twice that level. Saudi Arabia allocated 35 percent and Iran 14 percent of their national budget to the military, reflecting the high priority these countries assigned to military programs and the extent to which oil earnings influenced their ability to finance it.

Table 1. Top 10 military spenders in the world, 1990-2022 (in billions of US dollars)

Source: Stockholm International Peace Research Institute (SIPRI).

By 2000, the picture was beginning to change. Both China and India entered the top 10 club, with the former in sixth place. By then, the US—while towering in relation to dollars expended—had begun to shrink military spending by more than two percentage points of GDP, generating a peace dividend for other budgetary programs. Four countries allocated more than 10 percent of the budget to military outlays in that year: Saudi Arabia, followed by Korea, China, and India, despite relatively low per capita incomes in the latter two.

By 2010, it was clear that an important break from the past had occurred. China displaced the UK from the second position and Russia entered the category of top 10 military spenders for the first time, rising to the fourth position. By then, the Russian economy had stabilized after several years of economic transition from a socialist system and was earning considerable revenues from the export of oil and gas. Both Japan and Germany were spending just 1 percent of GDP on defense, less than many of the other top spenders, but still a considerable sum in absolute dollars given the size of their economies. Germany is a member of the North Atlantic Treaty Organization, whose target for defense spending by members is 2 percent of GDP.

By 2020, India had moved to the third position after the US and China, with Russia slipping to fifth place. The war in Ukraine in 2022 once again reordered the list of top military spenders, with Russia moving up to the third position. In terms of spending in proportion to GDP, the US stabilized its outlays at 3.5 percent, while Germany raised spending somewhat to 1.4 percent of GDP. In the aggregate, Europe increased defense spending by 13 percent in 2022 and Ukraine moved to the 11th place by spending $44 billion. Our previous analysis has shown that a country’s defense spending is influenced by military outlays by neighbors.

The churning of positions among the top military spenders over the past 30 years leads us to two conclusions. First, the size of the economy matters; and if a country’s economy grows rapidly, it can—and, as shown later, normally will—spend more on the military. Second, having a market for natural resources, such as oil and gas, helps sustain high levels of military spending.

Growth usually drives spending—but not always

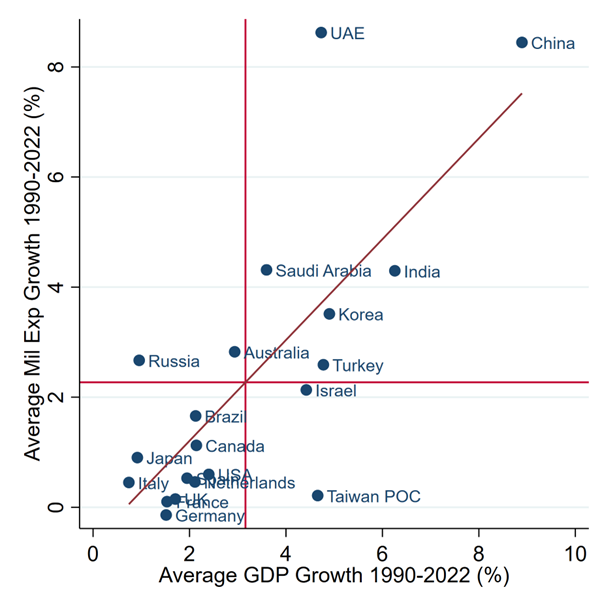

Figure 1. Military spending and growth, 1990-2022

Note: Correlation coefficient 0.75.

Source: Stockholm International Peace Research Institute (SIPRI).

The figure above shows the relationship between growth and military spending in constant dollars for the top 20 spenders. High growth in China has clearly given it the capacity to increase military spending more than other countries. In some sense, we can identify a “growth dividend” that allows countries to increase military spending in real terms without cutting other spending or raising budget deficits. Greater geopolitical tensions and conflict, however, can also impact military spending, as we have found in previous analysis. In the US, for example, the end of the Cold War led to a decline in the real growth of military spending. As is apparent in the figure, the growth of military spending is somewhat lower than predicted by its increase in GDP. And in Russia, military spending rose over the past year in real terms, despite a slowdown in economic activity.

Bottom line

If geopolitical tensions remain as they are today, it is safe to assume that military spending will grow faster over the next 10 years in countries with relatively high economic growth. This implies that China and India will continue to increase military spending at a faster clip than the United States and other G7 countries, with potentially important implications for the global balance of power. With debt-to-GDP ratios projected by the International Monetary Fund to rise in the next five years in China and the G7 countries, policymakers in these countries will face difficult choices regarding expenditure allocations going forward, including for overseas development assistance, even with a “growth dividend.”

Benedict Clements is a professor at the Universidad de las Américas in Ecuador.

Saida Khamidova is an independent researcher.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Adobe Stock