Ideas to action: independent research for global prosperity

Research

Innovative, independent, peer-reviewed. Explore the latest economic research and policy proposals from CGD’s global development experts.

POLICY PAPERS

April 15, 2024

WORKING PAPERS

April 15, 2024

CGD NOTES

April 11, 2024

WORKING PAPERS

April 11, 2024

All Research

Filters:

Experts

Facet Toggle

Topics

Facet Toggle

Publication Type

Facet Toggle

Time Frame

Facet Toggle

Research

WORKING PAPERS

October 12, 2020

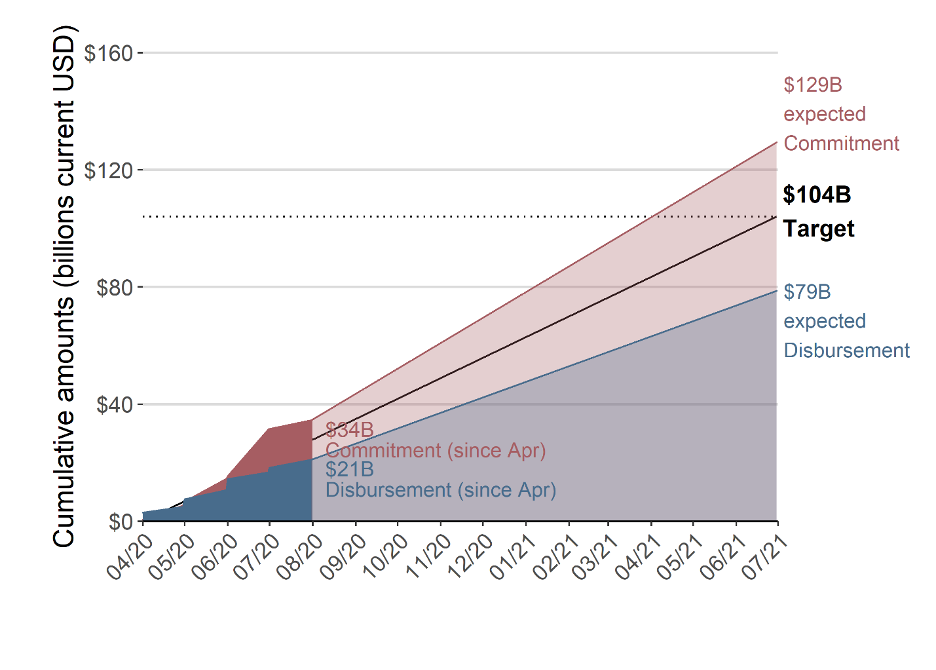

We compile a new data set, combining official sources with transaction-level records scraped from the World Bank website, spanning all commitments, disbursements, and payments on all World Bank loans from before the 2008-09 Global Financial Crisis through August 2020, allowing us to compare the...

WORKING PAPERS

October 07, 2020

The Development Assistance Committee (DAC) recently produced a long-awaited set of rules for how debt relief on loans should be scored as Official Development Assistance (ODA). Unfortunately, the rules suffer from a number of statistical problems and the DAC needs to take these rules back to th...

WORKING PAPERS

October 05, 2020

Our findings highlight the need to boost the knowledge of health care workers to achieve greater care readiness. Training programs have shown mixed results, so systems may need to adopt a combination of competency-based pre-service and in-service training for health care providers (with evaluation t...

WORKING PAPERS

September 30, 2020

One-quarter of married, fertile-age women in Sub-Saharan Africa report not wanting a pregnancy and yet do not use contraceptives. To study this issue, we collect detailed data on women’s subjective probabilistic beliefs and estimate a structural model of contraceptive choices

CGD NOTES

September 23, 2020

COVID-19 has raised the profile of violence against women and children (VAW/C) within the global discourse. Nine months after the emergence of COVID-19, global stakeholders continue to advocate for increased funding and action to mitigate against the risk of violence on vulnerable populations and su...