Recommended

POLICY PAPERS

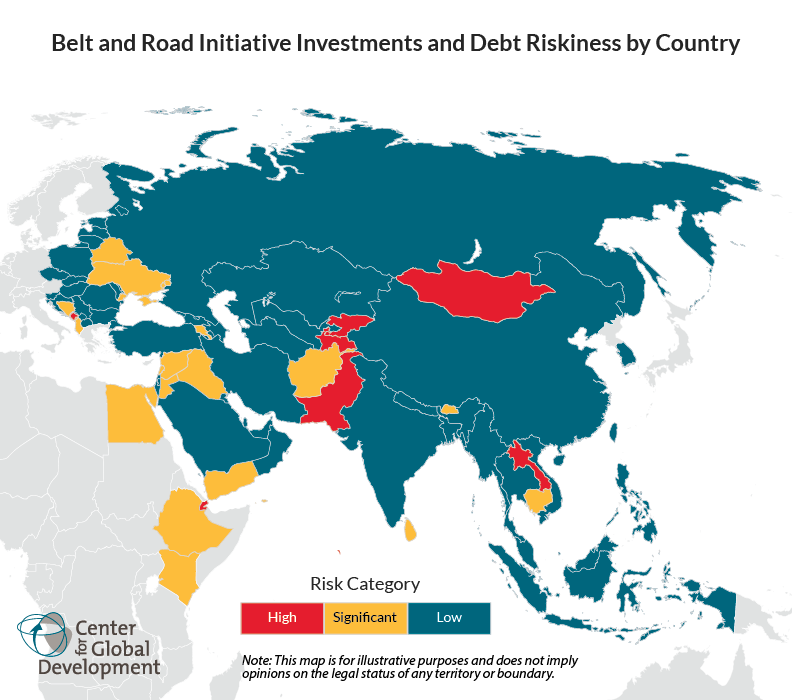

At the second Belt and Road Forum for International Cooperation April, China’s Ministry of Finance released a debt sustainability framework (DSF) for the Belt and Road initiative (BRI). This follows a shift in rhetoric from Chinese officials in the face of growing concerns highlighted by CGD’s research about debt vulnerabilities under the initiative: in recent months, Chinese policymakers have moved away from denying any problems with BRI lending to acknowledging the debt risks of large-scale lending and pointing to the need for more disciplined lending.

The announced DSF seems to be China’s answer to the problem. But is it up to the task?

The good news is that the new DSF is virtually identical to the World Bank-IMF DSF, which governs lending operations for the multilateral institutions and, to some degree, many bilateral lenders. It would seem then that China’s effort marks a significant step forward in guarding against debt problems associated with BRI.

The bad news is that, content aside, key questions remain about the role of a Belt and Road DSF in relation to the multilateral framework. Depending on how the new DSF is used, it could ultimately represent a step backward when it comes to achieving debt sustainability in low income countries.

What’s the same, what’s different?

The content of China’s DSF is virtually identical to the World Bank-IMF DSF—same weighting mechanisms, thresholds, and stress tests. Here are the differences we’ve identified:

-

The two IMF-WB fiscal realism tools are condensed into one in the Chinese version.

-

China has a stress test on “new borrowing” and includes reverse stress tests.

-

The World Bank-IMF guidance is much more detailed on how to implement the DSF, including comparisons to past DSFs and justification for changes.

China’s departures from the World Bank and IMF wouldn’t seem to bias the Chinese DSF, either in favor of easier or tighter lending standards. But the last difference may be telling in the additional flexibility it affords users on macro assumptions and inputs, a point we’ll come back to later.

Three problematic questions posed by China’s DSF

First, who is this “BRI” DSF for anyway?

The word from Chinese officials is that it is being made available on a voluntary basis to all BRI participants. Missing from that characterization is any firm commitment that it will be binding on Chinese official lending itself. Specifically, if analysts at the Ministry of Finance determine that a sub-Saharan African country is at the limit of its capacity to borrow, will that determination alone restrict lending decisions at China Development Bank or China Exim? No statements from Chinese officials to date suggest the DSF will be binding in this way.

As a separate input for BRI borrowers, the new DSF risks becoming a competitor to the World Bank-IMF framework, or at the very least, muddying the waters further in cases where the debt outlook is uncertain. Here, borrowing countries may simply choose to listen to whichever institution is offering the most money, which only further undermines the integrity of the analysis.

There may be a process difference too. The Bank-Fund DSF is discussed with the country authorities, and their comments are reflected in the final version. The DSF is then discussed by the World Bank and IMF boards and made publicly available on the institutions’ websites. It is unclear how the Chinese DSF will be formulated, discussed, or made available to the public.

Second, why does any of that matter if the two frameworks themselves are virtually identical? Shouldn’t we expect the same results from both?

Not necessarily. DSF outcomes are highly dependent on key assumptions about macroeconomic variables, with different assumptions yielding different outcomes under the same framework. In simple terms, future debt risks look much less severe if one assumes higher rates of economic growth over time.

It matters then who controls the framework and makes the assumptions. It certainly seems plausible that the Chinese government would prove susceptible to a bias toward forecasts that would be more permissive of lending. In fact, the multilateral institutions themselves have been charged with some bias toward growth optimism, despite a reputation for stringent lending. When the forecaster is also a lender with commercial and other bilateral interests in the lending relationship, there may be a pressure to lend that affects the integrity of the DSF analysis itself.

The very fact that the Chinese DSF hews so closely to the governing multilateral framework raises an important overarching third question:

Why create a new DSF? Why not just link BRI lending decisions to the World Bank-IMF framework?

Yet, these answers may not be as straightforward as they seem. In reality, the World Bank-IMF framework binds only the two institutions’ lending. It is not directly binding on bilateral lenders, though in practice, it does appear to inform the behavior of creditor countries, particularly those that participate in the Paris Club of creditors.

The club’s work to coordinate creditors when borrowing governments encounter debt problems also informs creditor behavior in guarding against these problems. But it is not evident that any bilateral creditor has made the multilateral DSF legally binding on its own lending decisions. In this sense, it may be holding China to an unreasonable to standard to expect that China’s official lenders would automatically adhere to the guidance of the multilateral institutions.

Yet, China is a special case. Chinese official lending to low income countries has surpassed all Paris Club creditors combined, and by some measures, China has become the leading creditor to the highest risk low income borrowers, surpassing the multilateral institutions themselves. From this standpoint, sustainable debt outcomes for a growing number of low-income countries depend on China’s behavior.

Perhaps the new Belt and Road DSF represents a path toward greater coordination with the multilateral institutions and other bilateral creditors. The Ministry of Finance deserves credit for publicly releasing the DSF (in Chinese and English, no less). But this same standard of transparency will be needed to assess whether the DSF is being used appropriately to coordinate, rather than compete, with these other actors.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.