Recommended

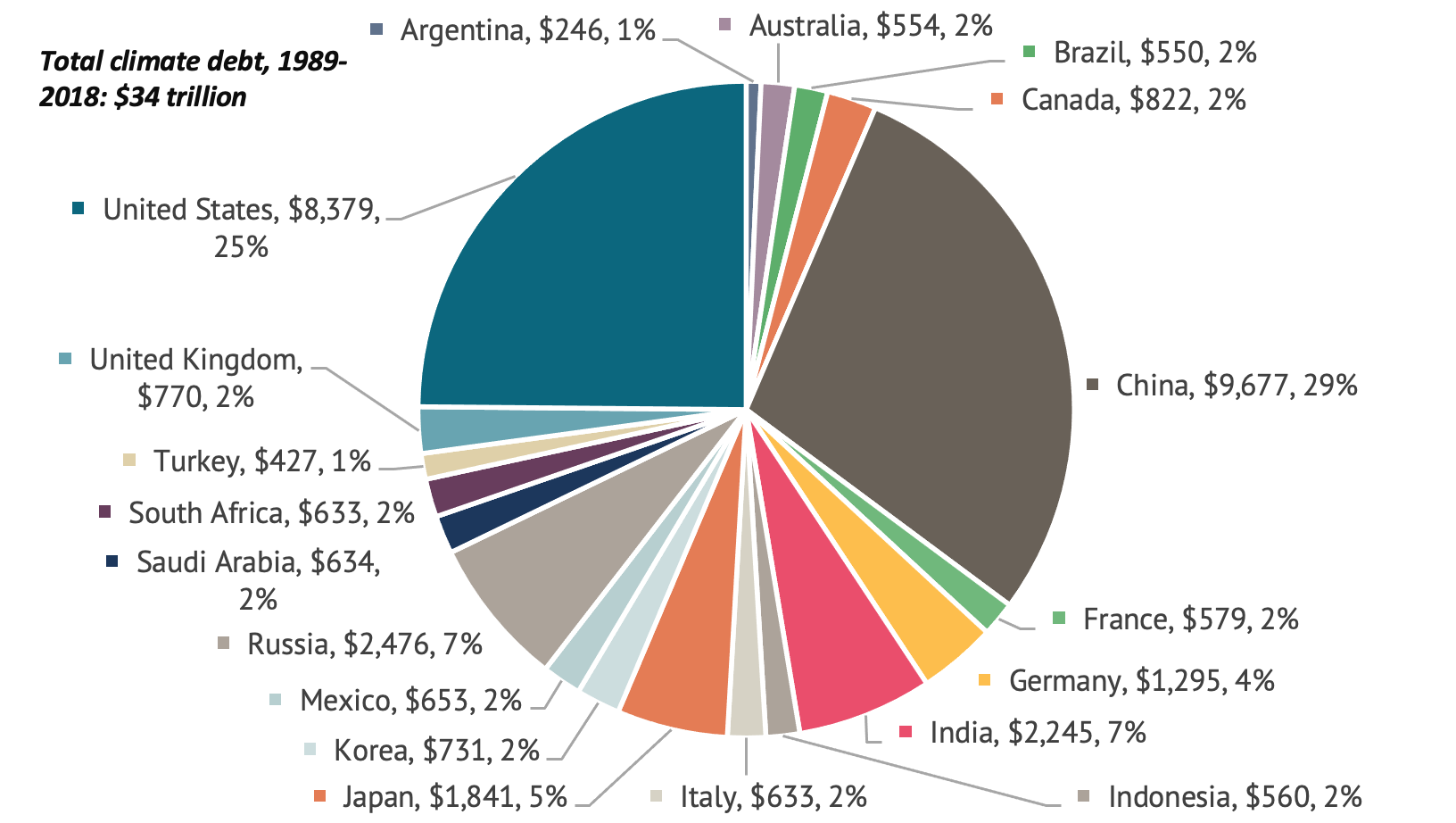

In an earlier blog post, we estimated G20 countries’ climate debt from 2019 to 2035 under business-as-usual and found it will rise by a staggering amount. Put simply, “climate debt” is the sum of the cumulative negative externalities from carbon emissions, whose costs are imposed on the globe without any compensation. We further argued that rising public debt as a result of the COVID pandemic and growing costs of pensions and health care will constrain policy choices in many countries and result in suboptimal social outcomes.

In this blog post, we discuss the implications for carbon emissions and climate debt if the G20 countries implemented the most recent pledges in their Nationally Determined Contributions (NDCs). Despite positive developments in the US on climate legislation, we find that the implementation of the G20 countries’ NDCs would reduce the accumulation of climate debt, but only by roughly one-fourth over 2022-30. The result would strike many as unfair, however, as climate debt per capita in the United States and other high-income economies would still greatly exceed that of developing economies of the G20.

Climate debt in the G20

We estimate the economic damages from emissions on the basis of the social cost of carbon (SCC). The SCC provides an estimate of the negative externality created by CO2 emissions, and they range widely in the literature. Stern and Stiglitz (2021) argue that an appropriate carbon price would be in the upper end of the range of $50- $100 per ton of CO2 emissions (at 2005 prices) for the year 2030. Our estimates of the SCC are based on a benchmark of $100 per ton of CO2 (at 2005 prices) for 2030. We assume that a country’s climate debt is determined by its share of cumulative global emissions, and not the timing of those emissions. This approach is fairer for developing countries; otherwise their future emissions would be viewed as more damaging to the environment than the past emissions of high-income economies.

We find that the projected rise in climate debt in absolute terms—some $80 trillion—far exceeds the climate debt accumulated in the past 60 years of $59 trillion (Figure 1).

Figure 1. Climate debt projection (billions), 2019-2035

Sources: Authors’ calculations using CO2 historical emission data from Ritchie and Roser (2017); emissions projections from the IMF’s Fiscal Affairs Department.

The climate debt is also very large relative to other government liabilities. Climate debt accumulated through 2018 equals about 81 percent of GDP (unweighted average) in the G20. Looking forward to 2035, cumulative climate debt will soar to 185 percent of GDP under the business-as-usual scenario—over double the G20 average of public debt of 88 percent of GDP in 2020.

Climate debt and full implementation of countries’ NDCs

We estimated the cumulative reduction in emissions over the period 2022-2030, assuming a gradual reduction in emissions for each country each year to meet their targets for 2030. In the aggregate, emissions would be lower by 19 percent by 2030 relative to business-as-usual. We also assume that the SCC is lower than in the baseline scenario by 19 percent by 2030. The net result is that implementation of country NDCs reduces the accumulation of climate debt by $9.6 trillion. This is a sizeable reduction (24 percent), but still not enough to stop the upward surge in climate debt from levels that are already very high. Notably, China and the United States would remain the greatest contributors to the accumulation of climate debt. It seems that implementation of NDCs is unlikely be seen as sufficient to arrive at a fair burden across countries in reducing climate debt.

Table 1. Impact of implementing reforms on emissions and climate debt (US$ billions)

| Country | Emission reduction, latest NDC, relative to 2030 BAU, % | Climate debt, 2022-2030, BAU | Climate debt under implementation of NDC's, 2022-2030 | Estimated reduction | % reduction |

|---|---|---|---|---|---|

| Argentina | 16 | 190 | 110 | 80 | 42 |

| Australia | 18 | 444 | 261 | 183 | 41 |

| Brazil | 20 | 464 | 253 | 212 | 46 |

| Canada | 50 | 555 | 342 | 213 | 38 |

| China | 11 | 12,904 | 10,720 | 2,184 | 17 |

| France | 47 | 375 | 223 | 153 | 41 |

| Germany | 49 | 791 | 508 | 283 | 36 |

| India | 0 | 3,674 | 3,245 | 429 | 12 |

| Indonesia | 3 | 697 | 323 | 374 | 54 |

| Italy | 31 | 330 | 241 | 89 | 27 |

| Japan | 37 | 1,149 | 759 | 390 | 34 |

| Korea | 44 | 702 | 374 | 328 | 47 |

| Mexico | 13 | 457 | 285 | 172 | 38 |

| Russia | 0 | 1,932 | 1,065 | 867 | 45 |

| Saudi Arabia | 21 | 632 | 333 | 299 | 47 |

| South Africa | 30 | 496 | 291 | 205 | 41 |

| Turkey | 0 | 538 | 248 | 289 | 54 |

| United Kingdom | 47 | 356 | 269 | 87 | 24 |

| United States | 48 | 5,217 | 3,316 | 1,901 | 36 |

| Rest of world | N/A | 7,654 | 6,790 | 863 | 11 |

| Global total | N/A | 39,556 | 29,956 | 9,600 | 24 |

Sources: Authors’ calculations using CO2 historical emission data from Ritchie and Roser (2017); emissions projections from the IMF’s Fiscal Affairs Department; and Black et al. (2021).

Note: BAU = business as usual

The way forward

The fiscal pressures G20 countries are currently facing may leave little room for new expenditures that could reduce the growth of climate debt, such as green infrastructure or subsidies for clean energy, or payments to those adversely affected by a transition to cleaner energy. The alternative is greater taxation of energy with carbon taxes (Clements et al., 2013). This would have the advantage of reducing emissions while also helping countries to fund additional spending; without these added revenues, even modest increases in spending could be difficult.

The potential revenues to countries through carbon taxation are sizeable. The amount will vary across countries, depending on their level of energy consumption and the mix of energy products (Black et al. 2021); in particular, countries that rely heavily on coal to produce electricity will have great potential to raise revenues from this tax. For the G20, Black et al. (2021) estimate that a $75 carbon price (on top of existing taxes)—which would be consistent with meeting emissions targets under the Paris Agreement—would raise revenues by an average of about 2 percent of GDP, with the amounts per country ranging from under 1 percent of GDP for high-income G20 economies to over 3 percent of GDP in Russia and South Africa. Carbon taxes will need to be accompanied by complementary fiscal policies to offset their adverse short-term effects on low-income households.

One way of achieving a fairer distribution of the burden between high-income and other G20 countries is for the former group of countries to ramp up their assistance to developing countries, including through climate finance. Current levels of climate finance, which have not yet reached the goal of $100 billion a year, are clearly inadequate considering the large size of climate debt accumulated by advanced economies.

Benedict Clements is a professor at the Universidad de las Américas in Ecuador.

Jianhong Liu is at the International Monetary Fund. This research was carried out when she was on the staff of the Center for Global Development.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.