Ideas to action: independent research for global prosperity

Poverty

More from the Series

Blog Post

November 23, 2021

CGD's Masood Ahmed speaks with Sida's Carin Jämtin and MCC's Alexia Latortue about their takeaways from the 2021 Development Leaders Conference, including the tensions between national and global challenges, how development agency leaders can address them, and what these decisions might mean for age...

Blog Post

April 08, 2021

The last eighteen months have shattered any pretense that global development can be taken as given. As ‘impatient optimist’ Bill Gates declared “The COVID-19 pandemic has not only stopped progress — it's pushed it backwards.” Beyond health, the COVID-19 crisis increased global poverty as well as nat...

CGD NOTES

February 09, 2021

The IMF’s concessional support for low-income countries (LICs) is provided primarily through the Poverty Reduction and Growth Trust (PRGT). Since the start of the pandemic, lending from the PRGT has risen very sharply in response to the unprecedented and urgent needs of LICs; total PRGT credit outst...

Blog Post

October 21, 2020

It is to be expected that this accumulation of negative shocks will translate into an increase in poverty and inequality, but what order of magnitude are we talking about? Which income group is being most affected? To what extent have mitigation measures been able to contain the impact?

WORKING PAPERS

October 21, 2020

Based on the economic sector in which household members work, we use microsimulation to estimate the distributional consequences of COVID-19-induced lockdown policies in Argentina, Brazil, Colombia and Mexico. Our estimates of the poverty consequences are worse than many others’ projections because ...

Blog Post

October 16, 2020

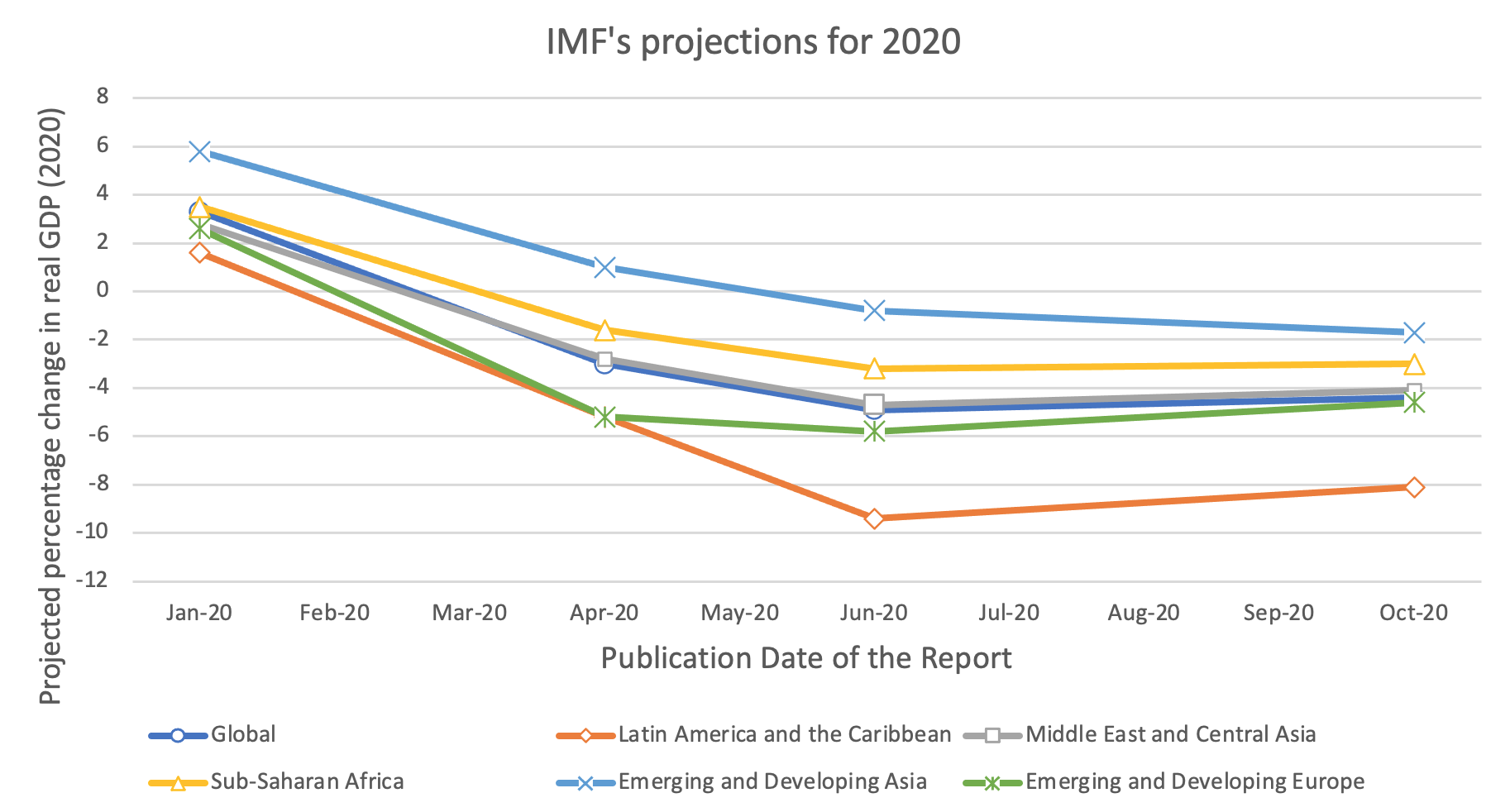

This week the IMF released new global economic growth projections in the face of COVID-19, updating their earlier projections from June and from April before that. In recent weeks, the World Bank has also released new projections for various regions. Here are six takeaways that we gleaned from revie...

Blog Post

September 28, 2020

When a society goes from broadly shared growth to a state of malaise or decline, the ensuing pain is not just economic but psychological. Now that tens of millions of people in developing countries are suffering precisely such a reversal of fortune, the political fallout is sure to be tumultuous.