Recommended

Building on research and analysis led by INCAE Business School

Summary

Facing the high—and rising—burden of antimicrobial resistance (AMR), Brazil has an opportunity to improve access, stewardship, and innovation for critical antimicrobials at the national, regional, and/or global level(s) by modifying procurement arrangements. Brazil is positioned for significant domestic benefit and further regional leadership in Latin America and the Caribbean (LAC) by leveraging a version of the existing Partnerships for Productive Development (PDP) model for antimicrobials: the annual fee PDP. Products manufactured through annual fee PDPs could be procured across LAC through the Pan American Health Organization’s (PAHO) Revolving Funds or through a global procurement platform.

Background

Almost 140,000 people die with a drug-resistant bacterial infection in Brazil every year. Antimicrobial sensitivity tests in Brazil in 2021 found that less than 14 percent of acinetobacter baumannii bacterias examined were susceptible to Carbapenems antibiotics—a resistance rate more than 17 percentage points higher than the worldwide rate estimated by the World Health Organization. Brazil is also the least prepared G20 country to combat AMR, according to a study conducted by the Global Coalition on Aging and the Infectious Diseases Society of America.

Despite this large AMR burden, many critical antimicrobials are not available through the publicly funded Unified Health System (SUS)—the main source of health care in the country, which provides a package of health products and services to all citizens. This reality is partly explained by a stringent market entry system with price caps designed to reward innovation and therapeutic benefit while keeping the cost of publicly funded medicines low. For example, Posaconazole—a drug used against fungal infections—is not sold through SUS, in large part due to the disputedly low assigned price cap.

Despite these challenges, Brazil has several assets in the fight against AMR: Brazil is the most populous country in the LAC region and the eighth largest economy in the world, making it one of the largest pharmaceutical markets in the world and the largest in LAC. Brazil’s network of official public laboratories has substantial manufacturing capacity to supply medicines and other health technologies to SUS and Brazil’s private market and, more broadly, to other countries in the region and the world. These public laboratories have also successfully received technology transfer from multinational pharmaceutical companies in the past through several mechanisms, including the PDP model.

Partnerships for Productive Development Model

The PDP model, launched in 2009, has a successful track record of bringing new medicines to Brazil, stimulating local production, and decreasing treatment costs, though results vary by partnership. Under a PDP, a Brazilian public laboratory enters an agreement with a pharmaceutical company, which gradually transfers the technology and production of a health product over the course of ten years. The Ministry of Health, which must approve the PDP, then purchases the product from the public laboratory on behalf of SUS at an agreed price and volume. At the end of the PDP, the public laboratory fully supplies the product to SUS, while the pharmaceutical company may still supply the private market.

As of December 2022, there were 66 active PDPs, mainly related to antivirals, anticancer, and immunosuppressant medicines. PDPs generated estimated savings for SUS of more than $500 million between 2011-2018, mostly due to a decline in price of over 50 percent charged for drugs subject to PDPs. The PDP model is a largely untapped opportunity for the antimicrobial market, as there is only one PDP for an antimicrobial—a tuberculosis treatment.

The Annual Fee PDP: Delinking Profit from Sales Volume in the PDP Model to serve LAC

Payment within the traditional PDP can be modified to secure steady, predictable revenue while disincentivizing overuse and inappropriate use of antimicrobials. This modified payment system would help make the market for these drugs financially viable while protecting the effectiveness of the drugs.

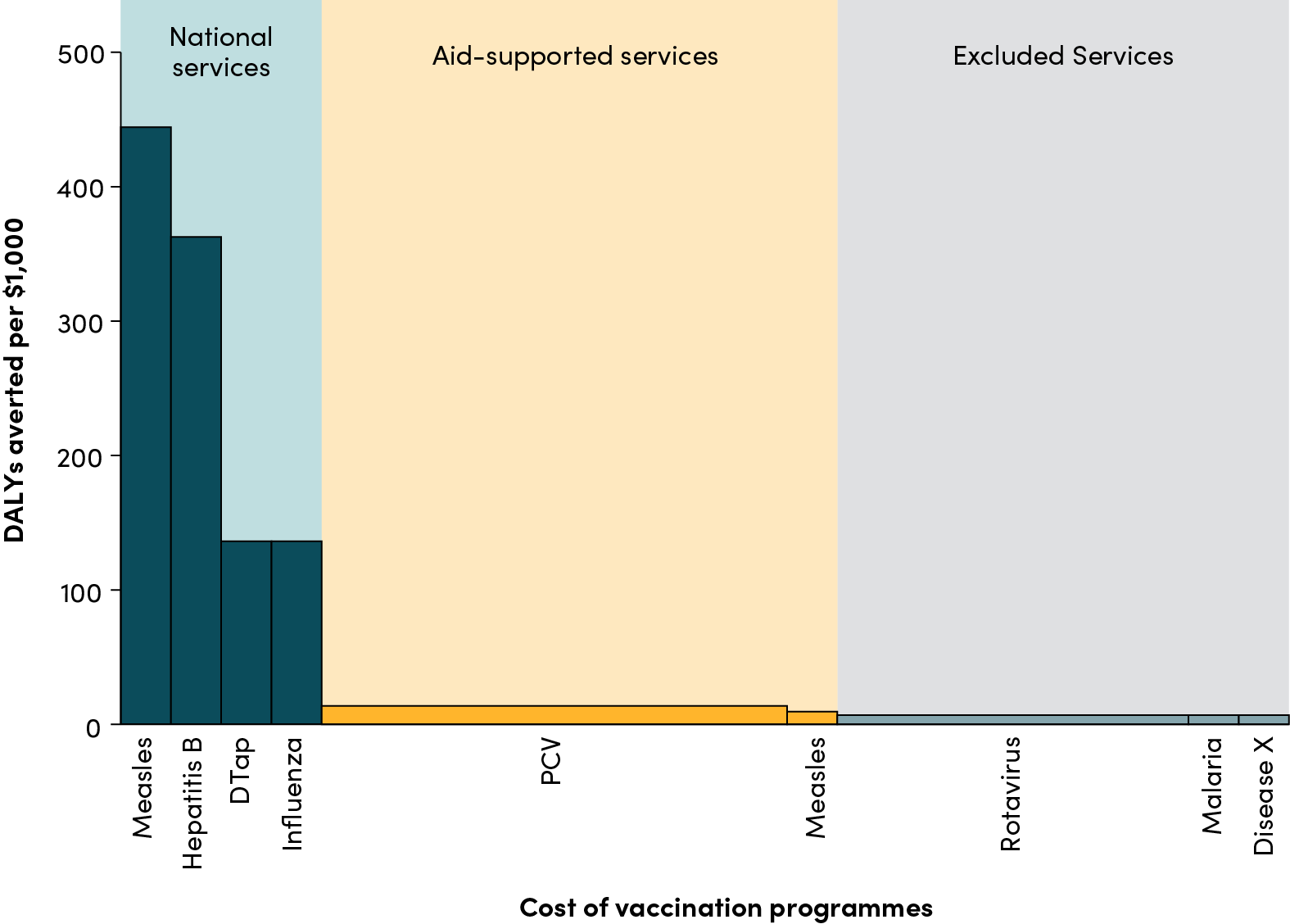

Traditional PDPs link the volume of sales to revenue—i.e., the procurement entity pays both pharmaceutical companies and public laboratories more for each additional unit. Annual fee models can help protect against incentives to oversell by setting a fixed payment independent of the volume purchased. Similar interventions have been piloted in settings like the UK and proposed in the US.

In the proposed model, the annual fee PDP, PAHO’s Revolving Funds would pay a fixed annual sum to the pharmaceutical company and the official lab, independent of the number of units purchased on behalf of LAC countries. Several elements would be factored into the calculation of the annual fee, including adherence to stewardship standards and countries’ ability to pay, to ensure equity among LAC countries, among others.

The annual fee PDP model would offer several benefits:

- Strengthen and expand domestic antimicrobial production capacity through technology transfer;

- Improve access to new high-cost antibiotics that might otherwise not be economically attractive to bring to LAC, while providing support to strengthen stewardship efforts; and

- Decrease incentives to oversell drugs through the annual fee-style payment.

Key Considerations and Options for Implementing the Annual Fee PDP in LAC

The first step to implement the annual fee PDP for antimicrobials in LAC will be to conduct horizon scanning to determine the molecules that should be considered for this PDP model. The annual fee PDP model could initially be applied to recently developed synthetic antimicrobials that are available in the private market, but not through public procurement channels in LAC, and/or high-cost antimicrobials or ones available from a single supplier.

Selected molecules must then be listed as “strategic products” within SUS. PDPs can only apply to products with this distinction, which typically indicates that the products are costly, mainly imported, technologically complex, and/or at risk of shortage.

PAHO’s Revolving Funds would also need to include the selected antimicrobials in their portfolio of services, and voluntary licenses would have to be granted for the LAC region, not just Brazil’s domestic market. Prior voluntary licensing deals, such as the licensing agreement signed between Shionogi, GARDP, and CHAI for cefiderocol that covered 135 countries, including all 33 from LAC, lay the groundwork for similar future deals and could be well suited to a regional manufacturer in LAC.

This regional hub, with Brazil as the supplier and PAHO’s Revolving Funds as the procurer, could be integrated into a global procurement framework, in line with the arrangement that a CGD working group is considering, to facilitate access to a portfolio of medically important antimicrobials and diagnostics facing access issues in low- and middle-income countries.

Selecting the antimicrobials to prioritize, advancing the conversation with the pharmaceutical industry on voluntary licensing, developing the methodology to calculate the annual fee payments, and garnering support among key stakeholders in the region are critical next steps in implementing the annual access fee model in LAC. CGD is conducting several briefings with regional institutions that could help advance this proposal, including PAHO and the Inter-American Development Bank.

Com base em pesquisas e análises realizadas na INCAE Business School

Resumo

Diante da alta e crescente carga de resistência antimicrobiana (AMR, antimicrobial resistance), o Brasil tem a oportunidade de melhorar o acesso, a gestão e a inovação para antimicrobianos críticos nos níveis nacional, regional e/ou global, modificando os acordos de aquisição. O Brasil tem condições de se beneficiar internamente e obter maior liderança na América Latina e Caribe (ALC) aproveitando uma versão do modelo de Parceria para o desenvolvimento produtivo (PDP) existente para antimicrobianos: as PDPs com pagamento anual. Produtos produzidos por meio das PDPs com pagamento anual podem ser adquiridos em toda a ALC através dos Fundos Rotatórios da Organização Pan-Americana da Saúde (OPAS) ou através de uma plataforma global de aquisição.

Contexto

No Brasil, a cada ano 140 mil pessoas morrem devido a alguma infecção bacteriana resistente a medicamentos. Testes de sensibilidade aos antibióticos feitos no Brasil em 2021 demonstraram que menos de 14% das bactérias Acinetobacter baumannii examinadas eram suscetíveis aos antibióticos carbapenêmicos, uma taxa de resistência mais de 17 pontos percentuais acima da taxa mundial estimada pela Organização Mundial da Saúde. O Brasil é também o país do G20 menos preparado para combater a AMR de acordo com um estudo conduzido pela Global Coalition on Aging em parceria com a Infectious Diseases Society of America.

Apesar desta grande carga de AMR, muitos antimicrobianos críticos não estão disponíveis com financiamento público no Sistema Único de Saúde (SUS), a principal fonte de cuidados de saúde no país e que oferece um pacote de produtos e serviços de saúde a todos os cidadãos. Essa realidade é parcialmente explicada por um sistema rigoroso de entrada no mercado com tetos de preços destinados a recompensar a inovação e o benefício terapêutico, mantendo baixo o custo dos medicamentos financiados por fundos públicos. Por exemplo, o Posaconazol, medicamento antifúngico, não é vendido por meio do SUS, em grande parte, devido ao baixo teto de preço atribuído.

Apesar desses desafios, o Brasil tem vários ativos na luta contra a AMR: o país é o mais populoso da região da ALC e a oitava maior economia do mundo, tornando-se um dos maiores mercados farmacêuticos do mundo e o maior da ALC. A rede brasileira de laboratórios públicos tem a capacidade de produzir uma quantidade significativa de medicamentos e outras tecnologias em saúde, tanto para o SUS quanto para o mercado privado e, de modo geral, para outros países da região e do mundo. No passado, esses laboratórios também receberam, com sucesso, transferências de tecnologia de empresas farmacêuticas multinacionais por meio de diversos mecanismos, incluindo o modelo de PDP.

Modelo de Parcerias para o desenvolvimento produtivo

O modelo de PDP lançado em 2009 tem um histórico de sucesso no que diz respeito a trazer medicamentos para o Brasil, estimular a produção local e reduzir os custos dos tratamentos. No entanto, os resultados variam de parceria para parceria. Sob uma PDP, um laboratório público brasileiro faz um acordo com uma empresa farmacêutica, que gradualmente transfere a tecnologia e a produção de um produto de saúde ao longo de um período de dez anos. Essa PDP tem que ser aprovada pelo Ministério da Saúde, que passa então a comprar o produto do laboratório público, em nome do SUS, a um preço e volume acordados. Ao fim da PDP, o laboratório público fornece o produto integralmente ao SUS, enquanto a empresa farmacêutica pode continuar abastecendo o mercado privado.

Em dezembro de 2022 havia 66 PDPs ativas, a maioria relacionada a medicamentos antivirais, anticâncer e imunossupressores. As PDPs geraram uma economia estimada de mais de 500 milhões de dólares para o SUS entre os anos de 2011 e 2018, principalmente pela redução do preço em mais de 50% cobrado por medicamentos sujeitos às PDPs. O modelo de PDP é uma oportunidade amplamente inexplorada para o mercado de antimicrobianos, uma vez que existe apenas uma PDP do tipo, para um tratamento de tuberculose.

A PDP com pagamento anual: desvinculando o lucro do volume de vendas no modelo de PDP para atender a ALC

O pagamento na PDP tradicional pode ser modificado para garantir uma receita estável e previsível, desincentivando o uso excessivo e inadequado de antimicrobianos. Esse sistema de pagamento modificado ajuda a tornar a comercialização desses medicamentos financeiramente viável ao mesmo tempo em que protege a eficácia dos medicamentos.

As PDPs tradicionais vinculam o volume de vendas à receita, ou seja, a entidade adjudicante paga mais por cada unidade adicional às empresas farmacêuticas e laboratórios públicos. Os modelos com pagamento anual podem ajudar a proteger contra incentivos para venda excessiva estabelecendo um pagamento fixo, independente do volume comprado. Intervenções semelhantes foram usadas como teste no Reino Unido e propostas nos EUA.

No modelo proposto, a PDP com pagamento anual, os Fundos Rotatórios da OPAS pagariam uma soma anual fixa à empresa farmacêutica e ao laboratório oficial, independentemente do número de unidades compradas em nome dos países da ALC. Diversos elementos seriam levados em conta no cálculo do pagamento anual, incluindo adesão aos padrões de gestão e a capacidade do país em pagar, para garantir a equidade entre os países da ALC, entre outros.

O modelo de PDP com pagamento anual ofereceria vários benefícios:

- Fortalecimento e expansão da capacidade de produção doméstica de antimicrobianos, por meio da transferência de tecnologia;

- Acesso melhorado a novos antibióticos de custo elevado que, de outro modo, não seriam economicamente atraentes para a ALC, ao mesmo tempo em que prestariam apoio para fortalecer os esforços de gestão; e

- Redução nos incentivos para venda excessiva de medicamentos, por meio do pagamento anual.

Considerações e opções importantes para a implementação das PDPs com pagamento anual na ALC

A primeira etapa para implementar o modelo de PDP com pagamento anual para antimicrobianos na ALC seria realizar uma varredura para determinar as moléculas que devem ser consideradas para esse modelo PDP. O modelo de PDP com pagamento anual poderia inicialmente ser aplicado a antimicrobianos sintéticos desenvolvidos recentemente e que estão disponíveis no mercado privado, mas não por meio dos canais de aquisição pública na ALC e/ou antimicrobianos de custo elevado ou aqueles disponíveis apenas via fornecedor único.

As moléculas selecionadas devem então ser listadas como “produtos estratégicos” pelo SUS. As PDPs só podem ser aplicadas a produtos com essa distinção, o que normalmente indica que os produtos são caros, geralmente importados, com complexidade tecnológica e/ou em risco de desabastecimento.

Os Fundos Rotatórios da OPAS também precisariam incluir os antimicrobianos selecionados em seus portfólios de serviços e licenças voluntárias teriam que ser concedidas para a região da ALC e não apenas para o mercado doméstico brasileiro. Acordos de licenciamento voluntários anteriores, como o acordo de licenciamento assinado entre Shionogi, GARDP e CHAI para o cefiderocol, que abrangeu 135 países, incluindo todos os 33 da ALC, estabeleceram as bases para acordos futuros semelhantes e poderiam ser bem adequados para um fabricante regional na ALC.

Este centro regional, com o Brasil como fornecedor e os Fundos Rotatórios da OPAS como provedor, poderia ser integrado em um quadro global de aquisições, em consonância com um arranjo que um grupo de trabalho do CGD está considerando, para facilitar o acesso a um portfólio de antimicrobianos e diagnósticos clinicamente importantes e que enfrentam problemas de acesso em países de baixa e média rendas.

Selecionar os antimicrobianos a serem priorizados, avançar na conversa com o setor farmacêutico sobre o licenciamento voluntário, desenvolver a metodologia para calcular os pagamentos anuais e conseguir suporte entre as principais partes interessadas na região são as próximas etapas essenciais na implementação do modelo de acesso com pagamento anual na ALC. O CGD está conduzindo diversos briefings com instituições regionais que podem ajudar no avanço dessa proposta, incluindo a OPAS e o Banco Interamericano de Desenvolvimento.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.